Exam 4: Completing the Accounting Cycle

Exam 1: Accounting in Business298 Questions

Exam 2: Analyzing and Recording Transactions253 Questions

Exam 3: Adjusting Accounts and Preparing Financial Statements247 Questions

Exam 4: Completing the Accounting Cycle186 Questions

Exam 5: Accounting for Merchandising Operations258 Questions

Exam 6: Inventories and Cost of Sales232 Questions

Exam 7: Accounting Information Systems177 Questions

Exam 8: Cash and Internal Controls220 Questions

Exam 9: Accounting for Receivables217 Questions

Exam 10: Plant Assets Natural Resoures and Intangibles245 Questions

Exam 11: Current Liabilities and Payroll Accounting210 Questions

Exam 12: Accounting for Partnerships172 Questions

Exam 13: Accounting for Corporations228 Questions

Exam 14: Long-Term Liabilities234 Questions

Exam 15: Investments220 Questions

Exam 16: Reporting the Statement of Cash Flows237 Questions

Exam 17: Analysis of Financial Statements235 Questions

Exam 18: Managerial Accounting Concepts and Principles246 Questions

Exam 19: Job Order Costing213 Questions

Exam 20: Process Costing230 Questions

Exam 21: Cost-Volume-Profit Analysis244 Questions

Exam 22: Master Budgets and Planning216 Questions

Exam 23: Flexible Budgets and Standard Costs223 Questions

Exam 24: Performance Measurement and Responsibility Accounting208 Questions

Exam 25: Capital Budgeting and Managerial Decisions190 Questions

Exam 26: Present and Future Values in Accounting84 Questions

Exam 27: Activity-Based Costing70 Questions

Select questions type

A current ratio of 2.1 suggests that a company has ________ current assets to cover current liabilities.

Free

(Short Answer)

4.8/5  (41)

(41)

Correct Answer:

sufficient

Income Summary is a temporary account only used for the closing process.

Free

(True/False)

4.9/5  (37)

(37)

Correct Answer:

True

After preparing and posting the closing entries for revenues and expenses, the income summary account has a debit balance of $33,000. The entry to close the income summary account will be:

Free

(Multiple Choice)

4.8/5  (40)

(40)

Correct Answer:

B

The following information is available for Zephyr Company before closing the accounts. After all of the closing entries are made, what will be the balance in the Zephyr, Capital account? Net income \ 115,000 Zephyr, Capital 110,000 Zephyr, Withdrawals 39,000

(Multiple Choice)

4.7/5  (32)

(32)

Tara Westmont, the proprietor of Tiptoe Shoes, had annual revenues of $185,000, expenses of $103,700, and withdrew $18,000 from the business during the current year. The owner's capital account before closing had a balance of $297,000.

- The entry to close the Income Summary account at the end of the year, after revenue and expense accounts have been closed, is:

(Multiple Choice)

4.9/5  (32)

(32)

Current liabilities include accounts receivable, unearned revenues, and salaries payable.

(True/False)

4.9/5  (36)

(36)

Closing the temporary accounts at the end of each accounting period does all of the following except:

(Multiple Choice)

4.9/5  (34)

(34)

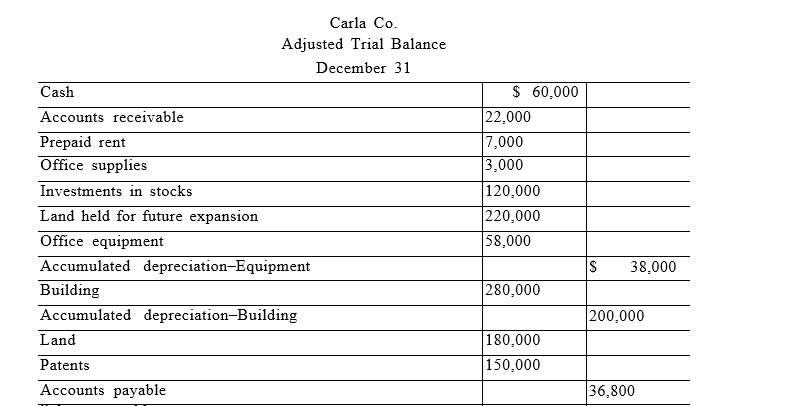

The following adjusted trial balance is for Carla Co. at year-end December 31. The credit balance in Carla West, Capital at the beginning of the year, January 1, was $320,000. The owner, Carla West, invested an additional $100,000 during the current year. The land held for future expansion was also purchased during the current year.

Sal aries payable 10,500 Interest payable 7,900 Long-term note payable 252,000 C. West, Capital 420,000 C. West, Withdrawals 60,000 Service fees earned 470,800 Sal aries expense 195,000 Insurance expense 18,000 Rent expense 36,000 Depreciation expense-Equipment 12,000 Depreciation expense-Building 15,000 Totals \ 1,436,000 \ 1,436,000

Required: Prepare a classified balance sheet as of December 31. (Note: A $21,000 installment on the long-term note payable is due within one year.)

Sal aries payable 10,500 Interest payable 7,900 Long-term note payable 252,000 C. West, Capital 420,000 C. West, Withdrawals 60,000 Service fees earned 470,800 Sal aries expense 195,000 Insurance expense 18,000 Rent expense 36,000 Depreciation expense-Equipment 12,000 Depreciation expense-Building 15,000 Totals \ 1,436,000 \ 1,436,000

Required: Prepare a classified balance sheet as of December 31. (Note: A $21,000 installment on the long-term note payable is due within one year.)

(Essay)

4.9/5  (35)

(35)

Two common subgroups for liabilities on a classified balance sheet are:

(Multiple Choice)

4.7/5  (31)

(31)

Reversing entries are recorded in response to external transactions that were created in error during the prior accounting period.

(True/False)

5.0/5  (33)

(33)

The following information is available for the Noir Detective Agency. After closing entries are posted, what will be the balance in the G. Noir, Capital account?

Net Loss \ 17,600 G. Noir, Capital 289,000 G. Noir, Withdrawals 32,000

(Multiple Choice)

4.8/5  (33)

(33)

All necessary amounts needed to prepare the income statement can be taken from the income statement columns of the work sheet, including the net income or net loss.

(True/False)

4.9/5  (32)

(32)

At the beginning of the year, Sigma Company's balance sheet reported Total Assets of $195,000 and Total Liabilities of $75,000. During the year, the company reported total revenues of $226,000 and expenses of $175,000. Also, owner withdrawals during the year totaled $48,000. Assuming no other changes to owner's capital, the balance in the owner's capital account at the end of the year would be:

(Multiple Choice)

4.9/5  (24)

(24)

Which of the following statements regarding reporting under GAAP and IFRS is not true:

(Multiple Choice)

4.9/5  (27)

(27)

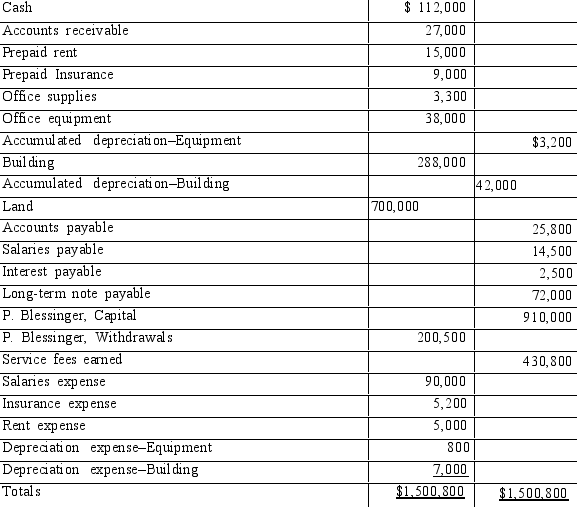

The calendar year-end adjusted trial balance for Blessinger Co. follows:

Required:

(a) Prepare a classified year-end balance sheet. (Note: A $9,000 installment on the long-term note payable is due within one year.)

(b) Prepare the required closing entries.

Required:

(a) Prepare a classified year-end balance sheet. (Note: A $9,000 installment on the long-term note payable is due within one year.)

(b) Prepare the required closing entries.

(Essay)

4.9/5  (34)

(34)

Accumulated Depreciation and Service Fees Earned would be sorted to which respective columns in completing a work sheet?

(Multiple Choice)

4.9/5  (35)

(35)

For the year ended December 31, a company has revenues of $317,000 and expenses of $196,000. The owner withdrew $50,000 during the year. The balance in the owner's capital account before closing is $81,000. Which of the following entries would be used to close the withdrawal account?

(Multiple Choice)

4.7/5  (45)

(45)

Showing 1 - 20 of 186

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)