Exam 3: Adjusting Accounts and Preparing Financial Statements

Exam 1: Accounting in Business298 Questions

Exam 2: Analyzing and Recording Transactions253 Questions

Exam 3: Adjusting Accounts and Preparing Financial Statements247 Questions

Exam 4: Completing the Accounting Cycle186 Questions

Exam 5: Accounting for Merchandising Operations258 Questions

Exam 6: Inventories and Cost of Sales232 Questions

Exam 7: Accounting Information Systems177 Questions

Exam 8: Cash and Internal Controls220 Questions

Exam 9: Accounting for Receivables217 Questions

Exam 10: Plant Assets Natural Resoures and Intangibles245 Questions

Exam 11: Current Liabilities and Payroll Accounting210 Questions

Exam 12: Accounting for Partnerships172 Questions

Exam 13: Accounting for Corporations228 Questions

Exam 14: Long-Term Liabilities234 Questions

Exam 15: Investments220 Questions

Exam 16: Reporting the Statement of Cash Flows237 Questions

Exam 17: Analysis of Financial Statements235 Questions

Exam 18: Managerial Accounting Concepts and Principles246 Questions

Exam 19: Job Order Costing213 Questions

Exam 20: Process Costing230 Questions

Exam 21: Cost-Volume-Profit Analysis244 Questions

Exam 22: Master Budgets and Planning216 Questions

Exam 23: Flexible Budgets and Standard Costs223 Questions

Exam 24: Performance Measurement and Responsibility Accounting208 Questions

Exam 25: Capital Budgeting and Managerial Decisions190 Questions

Exam 26: Present and Future Values in Accounting84 Questions

Exam 27: Activity-Based Costing70 Questions

Select questions type

Abdulla, Co. collected 6-months' rent in advance from a tenant on October 1 of the current year. When it collected the cash, it recorded the following entry:

Oct. 01 Cash 15,000 Rent Revenue Earned 15,000

Assuming Abdulla only prepares adjustments at year-end, prepare the required adjusting entry at December 31 of the current year.

(Essay)

4.9/5  (42)

(42)

A company purchased new furniture at a cost of $14,000 on September 30. The furniture is estimated to have a useful life of 8 years and a salvage value of $2,000. The company uses the straight-line method of depreciation.

- How much depreciation expense will be recorded for the furniture for the first year ended December 31?

(Multiple Choice)

4.9/5  (36)

(36)

An____________ is a listing of all of the accounts in the ledger with their account balances before

adjustments are made.

(Short Answer)

4.9/5  (35)

(35)

Under the cash basis of accounting, no adjustments are made for prepaid, unearned, and accrued items.

(True/False)

4.7/5  (27)

(27)

On April 1, a company paid the $1,350 premium on a three-year insurance policy with benefits beginning on that date. What amount of the insurance expense will be reported on the annual income statement for the year ended December 31?

(Multiple Choice)

4.8/5  (43)

(43)

Explain how accounting adjustments affect financial statements and provide an example of an adjustment that would impact the statements if not recorded.

(Essay)

4.7/5  (41)

(41)

Match the following definitions with the appropriate term

Correct Answer:

Premises:

Responses:

(Matching)

4.9/5  (34)

(34)

A company paid $9,000 for a twelve-month insurance policy on February 1. The policy coverage began on February 1. On February 28, $750 of insurance expense must be recorded.

(True/False)

4.8/5  (38)

(38)

Explain how the owner of a company uses the accrual basis of accounting.

(Essay)

4.8/5  (38)

(38)

A balance sheet that places the liabilities and equity to the right of the assets is a(n):

(Multiple Choice)

4.9/5  (35)

(35)

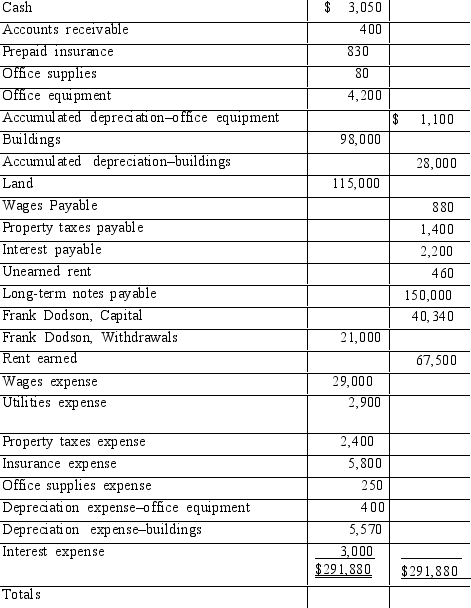

Using the information presented below, prepare an income statement from the adjusted trial balance of Dodson Containers.

DODSON CONTAINERS

Adjusted Trial Balance December 31

(Essay)

5.0/5  (38)

(38)

It is acceptable to record prepayment of expenses as debits to expense accounts if an adjusting entry is made at the end of the period to bring the asset account balance to the correct unused or unexpired amount.

(True/False)

4.7/5  (39)

(39)

If a company records prepayment of expenses in an asset account, the adjusting entry when all or part of the prepaid asset is used or expired would:

(Multiple Choice)

4.8/5  (32)

(32)

The total amount of depreciation recorded against an asset over the entire time the asset has been owned:

(Multiple Choice)

4.9/5  (36)

(36)

Using the information given below, prepare an income statement and owner's equity statement for Rapid Car Services from the adjusted trial balance. Owner Stella Grafton did not make any additional investments in the company during the year.

Rapid Car Services Adjusted Trial Balance

For the year ended December 31

Cash \ 33,000 Accounts receivable 14,200 Office supplies 1,700 Vehides 100,000 Accumulated depreciation - Vehicles 45,000 Accounts payable 11,500 Stella Grafton, Capital 71,900 Stella Grafton, Withdrawals 40,000 Fees earned 155,000 Rent expense 13,000 Office supplies expense 2,000 Utilities expense 2,500 Depreciation Expense — Vehicles 15,000 Salary expense 50,000 Fuel expense Totals \2 83,400

(Essay)

4.8/5  (28)

(28)

Which of the following does not require an adjusting entry at year-end?

(Multiple Choice)

4.9/5  (32)

(32)

During the current year ended December 31, clients paid fees in advance for accounting services amounting to $15,000. These fees were recorded in an account called Unearned Accounting Fees. If $3,500 of these fees remains unearned on December 31 of this year, prepare the required December 31 adjusting entry to bring the accounts up to date.

(Essay)

4.8/5  (34)

(34)

Fragmental Co. leased a portion of its store to another company for eight months beginning on October 1, at a monthly rate of $800. Fragmental collected the entire $6,400 cash on October 1 and recorded it as unearned revenue. Assuming adjusting entries are only made at year-end, the adjusting entry made by Fragmental Co. on December 31 would be:

(Multiple Choice)

4.7/5  (30)

(30)

Under the alternative method for accounting for unearned revenue, which of the following pairs of journal entry formats is correct?

(Multiple Choice)

4.9/5  (42)

(42)

Showing 221 - 240 of 247

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)