Exam 6: Inventories

Exam 1: Accounting and Business248 Questions

Exam 2: Double-Entry Accounting219 Questions

Exam 3: Adjustments: Accruals and Deferrals205 Questions

Exam 4: The Accounting Cycle213 Questions

Exam 5: Accounting for Retail Businesses276 Questions

Exam 6: Inventories210 Questions

Exam 7: Internal Control and Cash201 Questions

Exam 8: Receivables186 Questions

Exam 9: Long-Term Assets: Fixed and Intangible248 Questions

Exam 10: Liabilities: Current, Installment Notes, and Contingencies182 Questions

Exam 11: Liabilities: Bonds Payable174 Questions

Exam 12: Corporations: Organization, Stock Transactions, and Dividends194 Questions

Exam 13: Statement of Cash Flows195 Questions

Exam 14: Financial Statement Analysis208 Questions

Exam 15:Investments121 Questions

Select questions type

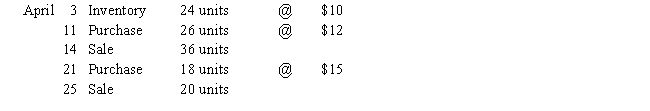

Beginning inventory, purchases and sales data for T-shirts are as follows:

Assuming the business maintains a periodic inventory system, calculate the cost of goods sold and ending inventory under the following assumptions:

a. FIFO

b. LIFO

c. Average cost (round cost of goods sold and ending inventory to the nearest dollar)

Assuming the business maintains a periodic inventory system, calculate the cost of goods sold and ending inventory under the following assumptions:

a. FIFO

b. LIFO

c. Average cost (round cost of goods sold and ending inventory to the nearest dollar)

(Essay)

4.7/5  (32)

(32)

While taking a physical inventory, a company counts its inventory as less than the actual amount on hand. How will this error affect the income statement?

(Short Answer)

4.8/5  (33)

(33)

The inventory method that assigns the most recent costs to cost of goods sold is

(Multiple Choice)

4.7/5  (35)

(35)

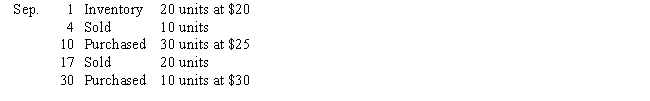

Addison, Inc. uses a perpetual inventory system. Below is information about one inventory item for the month of September.

-Use the information in the table to answer this question. If Addison uses FIFO, the September 17 entry for cost of goods sold would be: ?

-Use the information in the table to answer this question. If Addison uses FIFO, the September 17 entry for cost of goods sold would be: ?

(Multiple Choice)

4.9/5  (35)

(35)

Inventory turnover measures the length of time it takes to acquire, sell, and replace the inventory.

(True/False)

4.9/5  (37)

(37)

The specific identification inventory method should be used when the inventory consists of identical, low-cost units that are purchased and sold frequently.

(True/False)

4.9/5  (29)

(29)

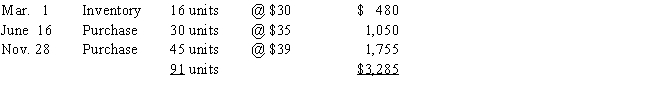

The units of Manganese Plus available for sale during the year were as follows:

There are 15 units of the product in the physical inventory at November 30. The periodic inventory system is used. Determine the inventory cost by (a) FIFO, (b) LIFO, and (c) average cost methods.

There are 15 units of the product in the physical inventory at November 30. The periodic inventory system is used. Determine the inventory cost by (a) FIFO, (b) LIFO, and (c) average cost methods.

(Essay)

4.8/5  (36)

(36)

Based upon the following data, estimate the cost of ending inventory using the gross profit method.

(Essay)

4.8/5  (38)

(38)

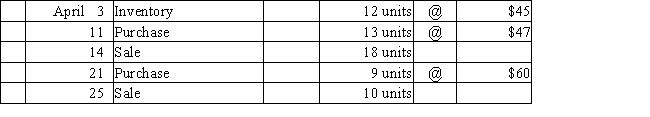

Beginning inventory, purchases, and sales data for tennis rackets are as follows:

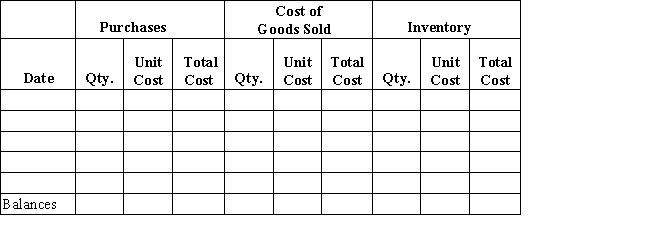

Complete the inventory cost card assuming the business maintains a perpetual inventory system and determine the cost of goods sold and ending inventory using LIFO.

Complete the inventory cost card assuming the business maintains a perpetual inventory system and determine the cost of goods sold and ending inventory using LIFO.

(Essay)

4.9/5  (40)

(40)

If inventory is being valued at cost and the price level is steadily rising, the method of costing that will yield the highest net income is

(Multiple Choice)

4.9/5  (42)

(42)

The three inventory costing methods will normally each yield different amounts of net income.

(True/False)

4.8/5  (32)

(32)

Of the three widely used inventory costing methods (FIFO, LIFO, and average cost), the LIFO method of costing inventory assumes costs are charged based on the most recent purchases first.

(True/False)

4.7/5  (33)

(33)

Based on the following data, calculate the estimated cost of the inventory on March 31 using the retail method.

(Essay)

4.9/5  (34)

(34)

Under the _____ inventory method, accounting records maintain a continuously updated inventory value.

(Multiple Choice)

4.8/5  (35)

(35)

1. Explain the effect of the following on the financial statements:

Goods held on consignment were included in the ending inventory count.

Goods purchased FOB shipping point were in transit on the last day of the year.

The goods were not counted as part of ending inventory.

Goods sold FOB shipping point were in transit on the last day of the year.

These goods were not counted as part of ending inventory.

2. What happens if inventory errors are not found and corrected?

(Essay)

4.8/5  (36)

(36)

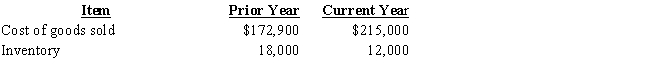

Based on the following information: compute (a) inventory turnover; (b) average daily cost of goods sold; and (c) number of days' sales in inventory for the current year. Use a 365-day year. (d) If an inventory turnover of 12 is average for the industry, how is this company doing?

(Essay)

5.0/5  (34)

(34)

Use the information below to answer the following questions.

The Boxwood Company sells blankets for $60 each. The following was taken from the inventory records during May. The company had no beginning inventory on May 1.

-Assuming that the company uses the perpetual inventory system, determine the cost of goods sold for the sale of May 20 using the LIFO inventory cost method.

-Assuming that the company uses the perpetual inventory system, determine the cost of goods sold for the sale of May 20 using the LIFO inventory cost method.

(Multiple Choice)

4.9/5  (37)

(37)

Which of the following measures the length of time it takes to acquire, sell, and replace inventory?

(Multiple Choice)

4.8/5  (35)

(35)

The following lots of Commodity Z were available for sale during the year. Use this information to answer the questions that follow.

Beginning inventory 10 units at \ 30 First purchase 25 units at \ 32 Second purchase 30 units at \ 34 Third purchase 10 units at \ 35

-The firm uses the periodic system, and there are 20 units of the commodity on hand at the end of the year. What is the ending inventory balance at the end of the year rounded to nearest dollar according to the average cost method?

(Multiple Choice)

4.7/5  (36)

(36)

Showing 21 - 40 of 210

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)