Exam 6: Inventories

Exam 1: Accounting and Business248 Questions

Exam 2: Double-Entry Accounting219 Questions

Exam 3: Adjustments: Accruals and Deferrals205 Questions

Exam 4: The Accounting Cycle213 Questions

Exam 5: Accounting for Retail Businesses276 Questions

Exam 6: Inventories210 Questions

Exam 7: Internal Control and Cash201 Questions

Exam 8: Receivables186 Questions

Exam 9: Long-Term Assets: Fixed and Intangible248 Questions

Exam 10: Liabilities: Current, Installment Notes, and Contingencies182 Questions

Exam 11: Liabilities: Bonds Payable174 Questions

Exam 12: Corporations: Organization, Stock Transactions, and Dividends194 Questions

Exam 13: Statement of Cash Flows195 Questions

Exam 14: Financial Statement Analysis208 Questions

Exam 15:Investments121 Questions

Select questions type

During periods of increasing costs, an advantage of the LIFO inventory cost method is that it matches more recent costs against current revenues.

(True/False)

4.8/5  (38)

(38)

If a company mistakenly counts less items during a physical inventory than actually exist, how will the error affect the cost of goods sold?

(Multiple Choice)

4.7/5  (35)

(35)

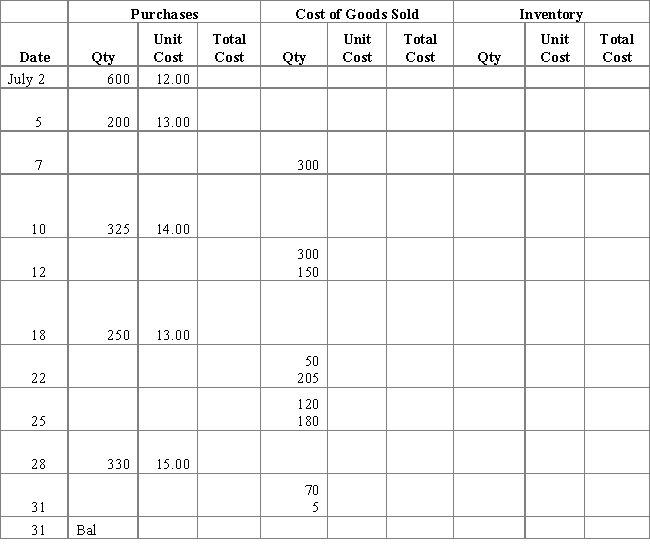

Complete the following table using the perpetual FIFO method of inventory flow.

(Essay)

4.9/5  (36)

(36)

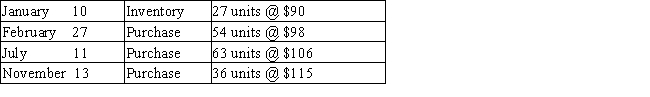

The units of an item available for sale during the year were as follows:

There are 50 units of the item in the physical inventory at December 31. The periodic inventory system is used. Determine the ending inventory cost by (a) the first-in, first-out method, (b) the last-in, first-out method, and (c) the average cost method. Show your work.

There are 50 units of the item in the physical inventory at December 31. The periodic inventory system is used. Determine the ending inventory cost by (a) the first-in, first-out method, (b) the last-in, first-out method, and (c) the average cost method. Show your work.

(Essay)

4.9/5  (36)

(36)

If a company mistakenly counts more items during a physical inventory than actually exist, how will the error affect their bottom line?

(Multiple Choice)

4.7/5  (44)

(44)

The units of Manganese Plus available for sale during the year were as follows:

There are 15 units of the product in the physical inventory at November 30. The periodic inventory system is used. Determine the difference in gross profit between the LIFO and FIFO inventory cost systems.

There are 15 units of the product in the physical inventory at November 30. The periodic inventory system is used. Determine the difference in gross profit between the LIFO and FIFO inventory cost systems.

(Essay)

4.8/5  (31)

(31)

Which of the following methods is appropriate for a business whose inventory consists of a relatively small number of unique, high-cost items?

(Multiple Choice)

4.7/5  (41)

(41)

If the estimated rate of gross profit is 30%, what is the estimated cost of the inventory on September 30, based on the following data? Sep. 1 Inventory (at cost) \ 125,000 Sep. 1-30 Purchases, net (at cost) 300,000 Sep. 1-30 Sales 150,000

(Multiple Choice)

4.7/5  (30)

(30)

The inventory data for an item for November are: Nov. 1 Inventory 20 units at \ 19 4 Sold 10 units 10 Purchased 30 units at \ 20 17 Sold 20 units 30 Purchased 10 units at \ 21 Using a perpetual system, what is the cost of the goods sold for November if the company uses FIFO?

(Multiple Choice)

4.9/5  (37)

(37)

During a period of consistently rising prices, the method of inventory that will result in reporting the greatest cost of goods sold is

(Multiple Choice)

4.9/5  (40)

(40)

Brutus Corporation, a newly formed corporation, has the following transactions during May, its first month of operations.

May 1 Purchased 500 units @ $25.00 each

4 Purchased 300 units @ $24.00 each

6 Sold 400 units @ $38.00 each

8 Purchased 700 units @ $23.00 each

13 Sold 450 units @ $37.50 each

20 Purchased 250 units @ $25.25 each

22 Sold 275 units @ $36.00 each

27 Sold 300 units @ $37.00 each

28 Purchased 550 units @ $26.00 each

30 Sold 100 units @ $39.00 each

Calculate total sales, cost of goods sold, gross profit, and ending inventory using each of the following inventory methods:

1. FIFO perpetual

2. FIFO periodic

3. LIFO perpetual

4. LIFO periodic

5. Average cost periodic (round average to nearest cent)

(Essay)

4.7/5  (30)

(30)

When using a perpetual inventory system, the journal entry to record the cost of goods sold is:

(Multiple Choice)

4.8/5  (30)

(30)

If Addison uses LIFO, the September 30 inventory balance is

(Multiple Choice)

4.7/5  (35)

(35)

During periods of rapidly rising costs, the use of the LIFO method results in illusory or inventory profits.

(True/False)

4.9/5  (37)

(37)

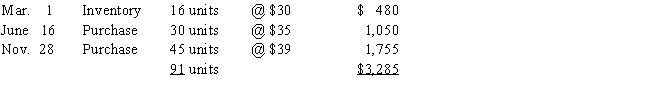

The following lots of a Commodity P were available for sale during the year. Use this information to answer the questions that follow.

The firm uses the periodic system, and there are 20 units of the commodity on hand at the end of the year.

-What is the year-end inventory balance using the FIFO method? Use the information provided in the table to answer this question

The firm uses the periodic system, and there are 20 units of the commodity on hand at the end of the year.

-What is the year-end inventory balance using the FIFO method? Use the information provided in the table to answer this question

(Multiple Choice)

4.8/5  (37)

(37)

A perpetual inventory system is an effective means of control over inventory.

(True/False)

4.8/5  (38)

(38)

The following units of an inventory item were available for sale during the year. Use this information to answer the following questions.

Beginning inventory 10 units at \ 55 First purchase 25 units at \ 60 Second purchase 30 units at \ 65 Third purchase 15 units at \ 70 The firm uses the periodic inventory system. During the year, 60 units of the item were sold.

-The ending inventory cost using FIFO is

(Multiple Choice)

4.9/5  (37)

(37)

When using the FIFO inventory costing method, the most recent costs are assigned to the cost of goods sold.

(True/False)

4.7/5  (31)

(31)

Which of the following measures the relationship between cost of goods sold and the amount of inventory carried during the period?

(Multiple Choice)

4.8/5  (35)

(35)

Showing 141 - 160 of 210

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)