Exam 6: Inventories

Exam 1: Accounting and Business248 Questions

Exam 2: Double-Entry Accounting219 Questions

Exam 3: Adjustments: Accruals and Deferrals205 Questions

Exam 4: The Accounting Cycle213 Questions

Exam 5: Accounting for Retail Businesses276 Questions

Exam 6: Inventories210 Questions

Exam 7: Internal Control and Cash201 Questions

Exam 8: Receivables186 Questions

Exam 9: Long-Term Assets: Fixed and Intangible248 Questions

Exam 10: Liabilities: Current, Installment Notes, and Contingencies182 Questions

Exam 11: Liabilities: Bonds Payable174 Questions

Exam 12: Corporations: Organization, Stock Transactions, and Dividends194 Questions

Exam 13: Statement of Cash Flows195 Questions

Exam 14: Financial Statement Analysis208 Questions

Exam 15:Investments121 Questions

Select questions type

The inventory costing method that reports the most current prices in ending inventory is

(Multiple Choice)

5.0/5  (28)

(28)

Determine the total value of the merchandise using net realizable value. Item Quantity Selling Price Commission Doll 10 \ 7 \ 2 Horse 5 9 3

(Multiple Choice)

4.8/5  (38)

(38)

If inventory is being valued at cost and the purchase price is steadily falling, which method of costing will yield the largest net income?

(Multiple Choice)

4.7/5  (38)

(38)

Match each description to the appropriate inventory system.

Correct Answer:

Premises:

Responses:

(Matching)

4.8/5  (46)

(46)

If Beginning Inventory (BI) + Purchases (P) - Ending Inventory (EI) = Cost of Goods Sold (COGS), an equivalent equation can be written as

(Multiple Choice)

4.8/5  (35)

(35)

During periods of decreasing costs, the use of the LIFO method of costing inventory will result in a lower amount of net income than would result from the use of the FIFO method.

(True/False)

4.8/5  (32)

(32)

The choice of an inventory costing method has no significant impact on the financial statements.

(True/False)

4.7/5  (30)

(30)

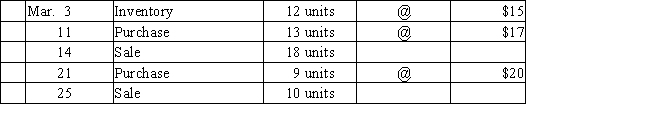

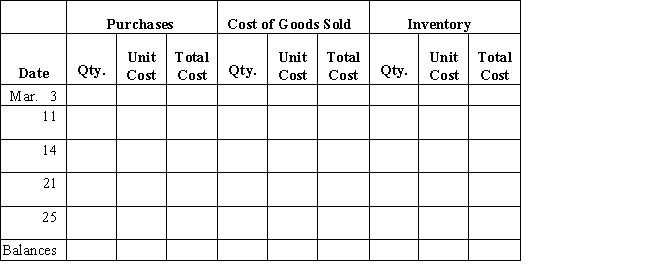

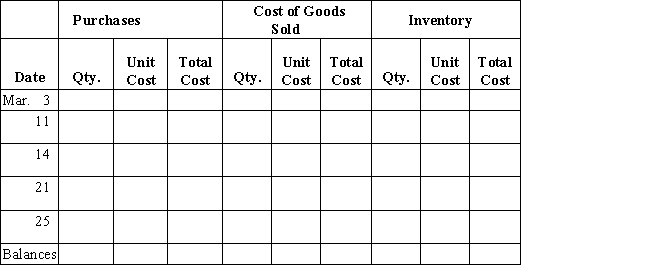

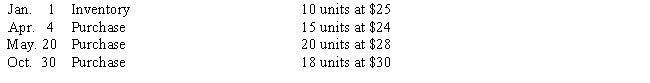

Beginning inventory, purchases, and sales data for hammers are as follows:

Assuming the business maintains a perpetual inventory system, complete the inventory cards and calculate the cost of goods sold and ending inventory under the following assumptions:

(a) First-in, first-out

Assuming the business maintains a perpetual inventory system, complete the inventory cards and calculate the cost of goods sold and ending inventory under the following assumptions:

(a) First-in, first-out

(b) Last-in, first-out

(b) Last-in, first-out

(Essay)

4.8/5  (37)

(37)

If the perpetual inventory system is used, the inventory account is debited for purchases of merchandise.

(True/False)

4.9/5  (39)

(39)

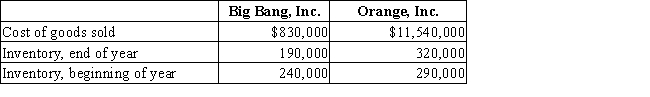

The following data were taken from the annual reports of Big Bang Inc., a manufacturer of fireworks, and Orange Inc., a manufacturer of computers.

(a) Determine the (1) inventory turnover and (2) number of days' sales in inventory for Big Bang and Orange.

Round your answers to two decimal places.

(b) How would you expect these measures to compare between the companies? Why?

(a) Determine the (1) inventory turnover and (2) number of days' sales in inventory for Big Bang and Orange.

Round your answers to two decimal places.

(b) How would you expect these measures to compare between the companies? Why?

(Essay)

4.9/5  (41)

(41)

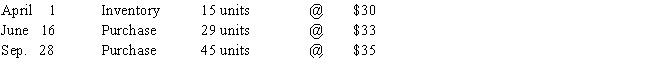

The following lots of a Commodity P were available for sale during the year. Use this information to answer the questions that follow.

The firm uses the periodic system, and there are 20 units of the commodity on hand at the end of the year.

-What is the year-end inventory balance using the average cost method? Use the information provided in the table to answer this question

The firm uses the periodic system, and there are 20 units of the commodity on hand at the end of the year.

-What is the year-end inventory balance using the average cost method? Use the information provided in the table to answer this question

(Multiple Choice)

4.9/5  (43)

(43)

Safeguarding inventory and proper reporting of the inventory in the financial statements are the reasons for controlling the inventory.

(True/False)

4.8/5  (40)

(40)

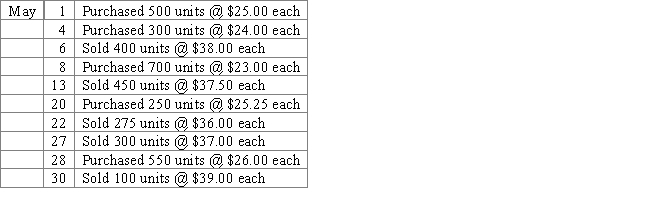

Brutus Corporation, a newly formed corporation, has the following transactions during May, its first month of operations.

-Using the table provided, calculate total sales, cost of goods sold, gross profit, and ending inventory using each of the FIFO perpetual inventory method.

-Using the table provided, calculate total sales, cost of goods sold, gross profit, and ending inventory using each of the FIFO perpetual inventory method.

(Multiple Choice)

4.8/5  (31)

(31)

The units of Product Green-2 available for sale during the year were as follows:

There are 17 units of the product in the physical inventory at September 30. The periodic inventory system is used. Determine the cost of goods sold by (a) FIFO, (b) LIFO, and (c) average cost methods.

There are 17 units of the product in the physical inventory at September 30. The periodic inventory system is used. Determine the cost of goods sold by (a) FIFO, (b) LIFO, and (c) average cost methods.

(Essay)

4.7/5  (43)

(43)

The inventory costing method that reports the earliest costs in ending inventory is

(Multiple Choice)

4.9/5  (38)

(38)

Use the information below to answer the following questions.

The Boxwood Company sells blankets for $60 each. The following was taken from the inventory records during May. The company had no beginning inventory on May 1.

-Assuming that the company uses the perpetual inventory system, determine the gross profit for the sale of May 23 using the FIFO inventory cost method.

-Assuming that the company uses the perpetual inventory system, determine the gross profit for the sale of May 23 using the FIFO inventory cost method.

(Multiple Choice)

4.7/5  (37)

(37)

During periods of increasing costs, the use of the FIFO method of costing inventory will yield an inventory amount for the balance sheet that is higher than LIFO would produce.

(True/False)

4.7/5  (34)

(34)

The units of an item available for sale during the year were as follows:

There are 19 units of the item in the physical inventory at December 31. The periodic inventory system is used. Determine the ending inventory cost using LIFO.

There are 19 units of the item in the physical inventory at December 31. The periodic inventory system is used. Determine the ending inventory cost using LIFO.

(Short Answer)

4.7/5  (32)

(32)

Use the information below to answer the following questions.

The Boxwood Company sells blankets for $60 each. The following was taken from the inventory records during May. The company had no beginning inventory on May 1.

-Assuming that the company uses the perpetual inventory system, determine the cost of goods sold for the sale of May 20 using the FIFO inventory cost method.

-Assuming that the company uses the perpetual inventory system, determine the cost of goods sold for the sale of May 20 using the FIFO inventory cost method.

(Multiple Choice)

4.9/5  (41)

(41)

Showing 81 - 100 of 210

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)