Exam 2: An Introduction to Cost Terms and Purposes

Exam 1: The Accountants Vital Role in Decision Making141 Questions

Exam 2: An Introduction to Cost Terms and Purposes165 Questions

Exam 3: Cost-Volume-Profit Analysis139 Questions

Exam 4: Job Costing138 Questions

Exam 5: Activity-Based Costing and Management133 Questions

Exam 6: Master Budget and Responsibility Accounting150 Questions

Exam 7: Flexible Budgets, Variances, and Management Control: I146 Questions

Exam 8: Flexible Budgets, Variances, and Management Control: II137 Questions

Exam 9: Income Effects of Denominator Level on Inventory Valuation154 Questions

Exam 10: Quantitative Analyses of Cost Functions114 Questions

Exam 11: Decision Making and Relevant Information146 Questions

Exam 12: Pricing Decisions, Product Profitability Decisions, and Cost Management135 Questions

Exam 13: Strategy, Balanced Scorecard, and Profitability Analysis140 Questions

Exam 14: Period Cost Allocation153 Questions

Exam 15: Cost Allocation: Joint Products and Byproducts149 Questions

Exam 16: Revenue and Customer Profitability Analysis137 Questions

Exam 17: Process Costing128 Questions

Exam 18: Spoilage, Rework, and Scrap121 Questions

Exam 19: Cost Management: Quality, Time, and the Theory of Constraints158 Questions

Exam 20: Inventory Cost Management Strategies136 Questions

Exam 21: Capital Budgeting: Methods of Investment Analysis128 Questions

Exam 22: Capital Budgeting: a Closer Look120 Questions

Exam 23: Transfer Pricing and Multinational Management Control Systems141 Questions

Exam 24: Multinational Performance Measurement and Compensation139 Questions

Select questions type

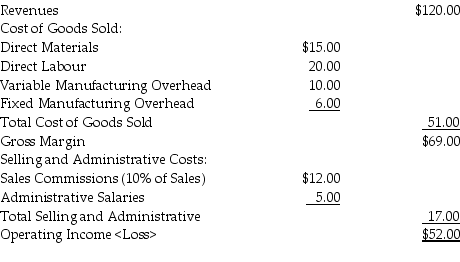

Macadamia Co. produced and sold 40,000 units last year. Per unit revenue and costs were as follows:

The Fixed Manufacturing Overhead provides a capacity of 50,000 units. The Production Manager has proposed leasing a new machine at a cost of $80,000 per year. This will reduce Direct Labour by 30% and improve quality so the the selling price per unit can be increased by $10. Production and sales are expected to remain the same as last year.

Required:

Prepare a statement of operating income assuming the leasing proposal is accepted.

The Fixed Manufacturing Overhead provides a capacity of 50,000 units. The Production Manager has proposed leasing a new machine at a cost of $80,000 per year. This will reduce Direct Labour by 30% and improve quality so the the selling price per unit can be increased by $10. Production and sales are expected to remain the same as last year.

Required:

Prepare a statement of operating income assuming the leasing proposal is accepted.

(Essay)

4.8/5  (39)

(39)

Answer the following question(s) using the information below.

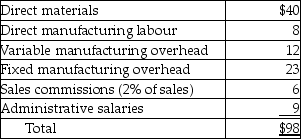

The West Company manufactures several different products. Unit costs associated with Product ORD203 are as follows:

-What are the fixed costs per unit associated with Product ORD203?

-What are the fixed costs per unit associated with Product ORD203?

(Multiple Choice)

4.7/5  (40)

(40)

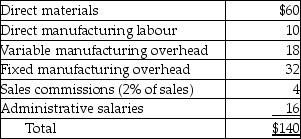

Answer the following question(s) using the information below.

The Singer Company manufactures several different products. Unit costs associated with Product ICT101 are as follows:

-What are the variable costs per unit associated with Product ICT101?

-What are the variable costs per unit associated with Product ICT101?

(Multiple Choice)

4.9/5  (36)

(36)

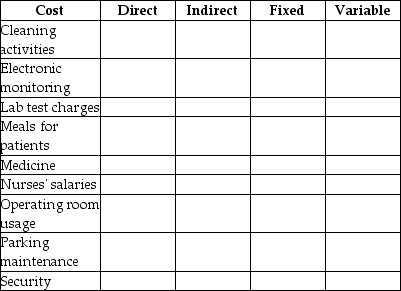

Boone Hospital wants to determine, to the extent possible, the actual cost for each patient stay. It is a general health care facility with all basic services but does not perform specialized services such as organ transplants.

Required:

Complete the following table by

a. Classifying each cost as a direct or indirect cost with respect to each patient.

b. Classifying each item as fixed or variable with respect to the number of patient days (sum of days each patient was in hospital) the hospital incurs.

(Essay)

4.8/5  (30)

(30)

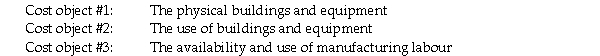

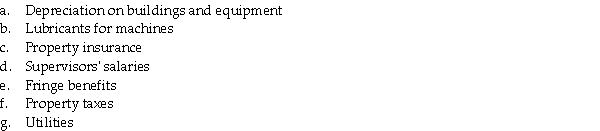

Lucas Manufacturing has three cost objects that it uses to accumulate costs for its manufacturing plants. They are:

The following manufacturing overhead cost categories are found in the accounting records:

The following manufacturing overhead cost categories are found in the accounting records:

Required:

Assign each of the above costs to the most appropriate cost object.

Required:

Assign each of the above costs to the most appropriate cost object.

(Essay)

4.9/5  (32)

(32)

Factors affecting direct/indirect cost classifications are the materiality of the cost in question, the information-gathering technology used, and the operations.

(True/False)

4.7/5  (40)

(40)

A value proposition is a distinct benefit for which customers will pay.

(True/False)

4.8/5  (32)

(32)

Which statement about conversion costs is correct, using the three-part classification of costs?

(Multiple Choice)

4.8/5  (30)

(30)

A cost is classified as a direct or indirect cost based on the applicable cost object.

(True/False)

4.7/5  (33)

(33)

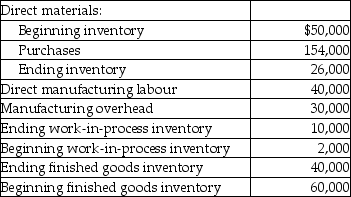

Use the information below to answer the following question(s).

Montreal Industries Inc. had the following activities during the year::

-Which of the following statements would be correct in a manufacturing business?

-Which of the following statements would be correct in a manufacturing business?

(Multiple Choice)

4.8/5  (30)

(30)

The following information pertains to Tom's Country Wood Shop:  What is the cost of goods manufactured for 20X4?

What is the cost of goods manufactured for 20X4?

(Multiple Choice)

4.8/5  (40)

(40)

Overtime premium consists of the wages paid to all workers (for both direct labour and indirect labour) in excess of their straight-time wage rates.

(True/False)

4.8/5  (38)

(38)

Things are not going well for the widget industry this year. The well-known cyclical nature of widget sales is in a downturn and your plant has been ordered to cut costs by its American parent corporation. The plant manager explains that he has shown the lead by negotiating a $1.50 hourly wage decrease with the production workers, based on a formula that pegs a $1.50 per hour wage increase/decrease to sales volume, and since sales are down this year, so are hourly wage costs. In the quarterly management meeting, the sales manager complained that sales could have been higher, but that somehow costs had increased, at least that's what the reports out of your office in management accounting, indicated. The Purchasing manager assured everyone that she was able to obtain raw materials at the same price as last year, and unfortunately, you as the management accountant, were not in attendance at the meeting. Your assistant, a new employee attended in your place, and promised at the meeting to redo the reports and find the errors. Your assistant has come to you as he cannot find any errors in the reports. Consequently, the plant manager wants you to redo the reports, find the error reports produced by your department for the last quarter and to explain to your boss, the plant manager, why average costs have increased.

Required:

Assuming there are no errors in the cost reports, explain to the plant manager how direct labour costs could be decreased and direct materials costs could be the same as last year, and yet the selling price cannot be lowered without sacrificing net income for the plant.

(Essay)

4.9/5  (36)

(36)

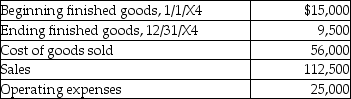

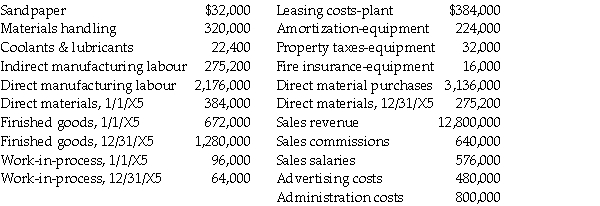

Helmer Sporting Goods Company manufactured 100,000 units in 20X5 and reported the following costs:

Required:

a. What is the cost of direct materials used during 20X5?

b. What manufacturing costs were added to WIP during 20X5?

c. What is cost of goods manufactured for 20X5?

d. What is cost of goods sold for 20X5?

Required:

a. What is the cost of direct materials used during 20X5?

b. What manufacturing costs were added to WIP during 20X5?

c. What is cost of goods manufactured for 20X5?

d. What is cost of goods sold for 20X5?

(Essay)

4.9/5  (28)

(28)

When defining variable and fixed costs, it is assumed that there is only one cost driver.

(True/False)

4.9/5  (38)

(38)

Showing 81 - 100 of 165

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)