Exam 23: Transfer Pricing and Multinational Management Control Systems

Exam 1: The Accountants Vital Role in Decision Making141 Questions

Exam 2: An Introduction to Cost Terms and Purposes165 Questions

Exam 3: Cost-Volume-Profit Analysis139 Questions

Exam 4: Job Costing138 Questions

Exam 5: Activity-Based Costing and Management133 Questions

Exam 6: Master Budget and Responsibility Accounting150 Questions

Exam 7: Flexible Budgets, Variances, and Management Control: I146 Questions

Exam 8: Flexible Budgets, Variances, and Management Control: II137 Questions

Exam 9: Income Effects of Denominator Level on Inventory Valuation154 Questions

Exam 10: Quantitative Analyses of Cost Functions114 Questions

Exam 11: Decision Making and Relevant Information146 Questions

Exam 12: Pricing Decisions, Product Profitability Decisions, and Cost Management135 Questions

Exam 13: Strategy, Balanced Scorecard, and Profitability Analysis140 Questions

Exam 14: Period Cost Allocation153 Questions

Exam 15: Cost Allocation: Joint Products and Byproducts149 Questions

Exam 16: Revenue and Customer Profitability Analysis137 Questions

Exam 17: Process Costing128 Questions

Exam 18: Spoilage, Rework, and Scrap121 Questions

Exam 19: Cost Management: Quality, Time, and the Theory of Constraints158 Questions

Exam 20: Inventory Cost Management Strategies136 Questions

Exam 21: Capital Budgeting: Methods of Investment Analysis128 Questions

Exam 22: Capital Budgeting: a Closer Look120 Questions

Exam 23: Transfer Pricing and Multinational Management Control Systems141 Questions

Exam 24: Multinational Performance Measurement and Compensation139 Questions

Select questions type

Alsation Ltd. has two divisions: Machining and Assembly. The Machining Division prepares the raw materials into component parts and the Assembly Division assembles the components into finished product. No inventories exist in either division at the beginning of the year. During the year the Machining Division prepared 80,000 square metres of sheet metal at a cost of $480,000. All production was transferred to the Assembly Division where the metal was converted into 800,000 units of finished product at an additional costs of $5 per unit. The 800,000 units were sold for $2,000,000.

Required:

a. Determine the operating income for each division if the transfer price from Machining to Assembly is at cost, $6/square metre.

b. Determine the operating income for each division if the transfer price is $5/square metre.

c. Since the Machining Division has all of its sales internally to the Assembly Division, does the manager care what price is selected? Why? Should the Machining Division be a cost centre or a profit centre under the circumstances?

(Essay)

4.8/5  (38)

(38)

The Surrey Division of Columbia Ltd. has approached the Burnaby Division and requested that it supply 25,000 units of the component at a transfer price of $150. The Burnaby Division will save $3 per unit of direct materials costs for the components manufactured for the Surrey Division. Assuming Burnaby Division has no idle capacity, what is the minimum transfer price the Burnaby Division should agree to accept?

(Multiple Choice)

4.9/5  (37)

(37)

Crush Company makes internal transfers at 180% of full cost. The Soda Refining division purchases 30,000 containers of carbonated water per day, on average, from a local supplier, who delivers the water for $30 per container via an external shipper. In order to reduce costs the company located an independent producer in Manitoba who is willing to sell 30,000 containers at $20 each, delivered to Crush Company's shipping division in Manitoba. The company's Shipping Division in Manitoba has excess capacity and can ship the 30,000 containers at a variable cost of $2.50 per container. What is the total cost of purchasing the water from the Manitoba supplier and shipping it to the Soda Division?

(Multiple Choice)

4.7/5  (41)

(41)

Sportswear Ltd. manufactures socks. The Athletic Division sells its socks for $6 a pair to outsiders.

Socks have manufacturing costs of $2.50 each for variable and $1.50 for fixed. The division's total fixed

manufacturing costs are $105,000 at the normal volume of 70,000 units.

The European Division has offered to buy 15,000 socks at the full cost of $4. The Athletic Division

has excess capacity and the 15,000 units can be produced without interfering with the current outside

sales of 70,000. The 85,000 volume is within the division's relevant operating range.

Explain whether the Athletic Division should accept the offer.

(Essay)

4.9/5  (40)

(40)

Market based transfer prices are generally accepted by tax authorities because they represent arm's length prices.

(True/False)

4.9/5  (32)

(32)

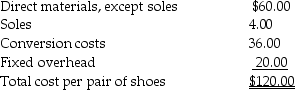

The Brownshoe Company has three specialized divisions. The Casual Shoe Division has asked the Sole Division to supply it with a large quantity of soles. The Sole Division is currently at capacity. The Sole Division sells soles outside for $5.00 each. The Casual Shoe Division, which is operating at 50 percent capacity, has offered to pay $4.00 per sole. The Sole Division has a variable cost of $3.60 per sole. The Casual Shoe Division has the following cost structure:

The manager of Casual Shoe believes that the $4 price from Sole is necessary if the division is to compete in the market for casual shoes.

Required:

a. As manager of Sole Division, would you recommend that your division supply the soles to Casual Shoe? Why?

b. Would it be desirable for the division to supply Casual Shoe with the soles for $4 assuming the Sole Division had excess capacity? Why?

c. What would be the corporate position assuming the Sole Division has excess capacity?

The manager of Casual Shoe believes that the $4 price from Sole is necessary if the division is to compete in the market for casual shoes.

Required:

a. As manager of Sole Division, would you recommend that your division supply the soles to Casual Shoe? Why?

b. Would it be desirable for the division to supply Casual Shoe with the soles for $4 assuming the Sole Division had excess capacity? Why?

c. What would be the corporate position assuming the Sole Division has excess capacity?

(Essay)

4.7/5  (36)

(36)

Use the information below to answer the following question(s).

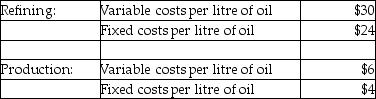

Blackoil Corp. has two divisions, Refining and Production. The company's primary product is Clean Oil. Each division's costs are provided below:

The Production Division is able to sell the oil to other areas for $24 per litre. The Refining Division has been operating at a capacity of 80,000 litres a day, using oil from the Production Division and oil purchased from other suppliers. The Refining Division usually purchases 50,000 litres of oil, on average, from the Production Division and 30,000 litres, on average, from other suppliers at $40/litre.

-What is the Refining Division's operating income if 150 litres of oil are sold at $110 /litre and 200 litres are transferred in? Assume the transfer price is based on 175% of variable costs.

The Production Division is able to sell the oil to other areas for $24 per litre. The Refining Division has been operating at a capacity of 80,000 litres a day, using oil from the Production Division and oil purchased from other suppliers. The Refining Division usually purchases 50,000 litres of oil, on average, from the Production Division and 30,000 litres, on average, from other suppliers at $40/litre.

-What is the Refining Division's operating income if 150 litres of oil are sold at $110 /litre and 200 litres are transferred in? Assume the transfer price is based on 175% of variable costs.

(Multiple Choice)

4.9/5  (30)

(30)

Negotiated transfer prices are always transacted at the top management levels.

(True/False)

4.7/5  (32)

(32)

Which of the following is False concerning profit centres and cost centres?

(Multiple Choice)

4.9/5  (33)

(33)

Examples of market-based transfer prices include variable manufacturing costs, full manufacturing costs, and full product costs.

(True/False)

4.8/5  (38)

(38)

When industry has excess capacity, market prices may drop sizably below their historical average. If this drop is temporary, it is called

(Multiple Choice)

4.9/5  (40)

(40)

Which of the following is False concerning Canada Revenue Agency's published position on transfer pricing?

(Multiple Choice)

4.9/5  (34)

(34)

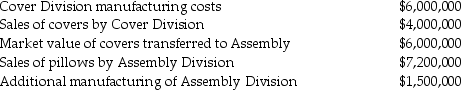

Bedtime Bedding Ltd. manufactures pillows. The Cover Division makes covers and the Assembly Division makes the finished products. The covers can be sold separately for $5.00. The pillows sell for $6.00. The information related to manufacturing for the most recent year is as follows:

Required:

Compute the operating income for each division and the company as a whole. Use market value as the transfer price. Are all managers happy with this concept? Explain.

Required:

Compute the operating income for each division and the company as a whole. Use market value as the transfer price. Are all managers happy with this concept? Explain.

(Essay)

4.9/5  (36)

(36)

What is the monthly operating advantage (disadvantage) of purchasing the goods internally assuming the Production Division is able to utilize the facilities for other operations resulting in monthly cash-operating savings of $40,000?

(Multiple Choice)

4.9/5  (31)

(31)

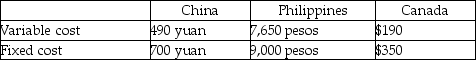

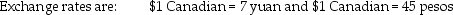

Hendricks Ltd. of Calgary manufactures and sells computers. The Manufacturing Division is located in China and transfers 75% of its output to the Assembly Division in the Philippines. The balance of the product is sold in the local market at 2,100 yuan/unit. The Philippines division sells 20% of its output in the local market at 31,500 pesos/unit, with the balance shipped to Calgary. The Calgary operation packages the units and sells the final product at $1,900 Canadian per unit.

The following budget data are available:

Tax rates are 45% in China, 20% in the Philippines and 40% in Canada. Income taxes are not included in the calculation of cost-based transfer prices. Assume that Hendricks does not pay Canadian tax on amounts already taxed in foreign jurisdictions. Take each calculation to 2 decimal places.

Required:

The company has determined that it may transfer units at 250% of variable cost or at market and comply with all existing tax legislation. Which transfer pricing method should the company pursue? Support your recommendation with appropriate calculations.

Tax rates are 45% in China, 20% in the Philippines and 40% in Canada. Income taxes are not included in the calculation of cost-based transfer prices. Assume that Hendricks does not pay Canadian tax on amounts already taxed in foreign jurisdictions. Take each calculation to 2 decimal places.

Required:

The company has determined that it may transfer units at 250% of variable cost or at market and comply with all existing tax legislation. Which transfer pricing method should the company pursue? Support your recommendation with appropriate calculations.

(Essay)

4.8/5  (28)

(28)

What is the purpose of the internal control system within an organization?

(Essay)

4.7/5  (44)

(44)

Answer the following question(s) using the information below:

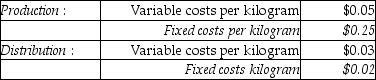

Greenlawn Ltd. has two divisions, Distribution and Production. The company's primary product is fertilizer. Each division's costs are provided below:

The Distribution Division has been operating at a capacity of 4,000,000 kilograms a week and usually purchases 2,000,000 kilograms from the Production Division and 2,000,000 kilograms from other suppliers at $0.45 per kilogram.

-What is the transfer price per kilogram from the Production Division to the Distribution Division, assuming the method used to place a value on each kilogram of fertilizer is 120% of full costs?

The Distribution Division has been operating at a capacity of 4,000,000 kilograms a week and usually purchases 2,000,000 kilograms from the Production Division and 2,000,000 kilograms from other suppliers at $0.45 per kilogram.

-What is the transfer price per kilogram from the Production Division to the Distribution Division, assuming the method used to place a value on each kilogram of fertilizer is 120% of full costs?

(Multiple Choice)

4.7/5  (38)

(38)

Briefly describe the arm's length principle and how it applies to transfers among international divisions.

(Essay)

4.8/5  (36)

(36)

The Mill Flow Company has two divisions. The Cutting Division prepares timber at its sawmills. The Assembly Division prepares the cut lumber into finished wood for the furniture industry. No inventories exist in either division at the beginning of the year. During the year, the Cutting Division prepared 60,000 cords of wood at a cost of $660,000. All the lumber was transferred to the Assembly Division, where additional operating costs of $6 per cord were incurred. The 600,000 boardfeet of finished wood were sold for $2,500,000.

Required:

a. Determine the operating income for each division if the transfer price from Cutting to Assembly is at cost - $11 a cord.

b. Determine the operating income for each division if the transfer price is $9 per cord.

c. Since the Cutting Division sells all of its wood internally to the Assembly Division, does the manager care what price is selected? Why? Should the Cutting Division be a cost centre or a profit centre under the circumstances?

(Essay)

4.8/5  (30)

(30)

Additional factors that arise in multinational transfer pricing include tariffs and customs duties levied on imports of products into a country.

(True/False)

4.8/5  (29)

(29)

Showing 81 - 100 of 141

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)