Exam 2: Corporations: Introduction and Operating Rules

Exam 1: Understanding and Working With the Federal Tax Law74 Questions

Exam 2: Corporations: Introduction and Operating Rules113 Questions

Exam 3: Corporations: Special Situations111 Questions

Exam 4: Corporations: Organization and Capital Structure93 Questions

Exam 5: Corporations: Earnings Profits and Dividend Distributions89 Questions

Exam 6: Corporations: Redemptions and Liquidations112 Questions

Exam 7: Corporations: Reorganizations121 Questions

Exam 8: Consolidated Tax Returns145 Questions

Exam 9: Taxation of International Transactions159 Questions

Exam 10: Partnerships: Formation, Operation, and Basis100 Questions

Exam 11: Partnerships: Distributions, Transfer of Interests, and Terminations97 Questions

Exam 12: S: Corporations157 Questions

Exam 13: Comparative Forms of Doing Business143 Questions

Exam 14: Taxes on the Financial Statements87 Questions

Exam 15: Exempt Entities151 Questions

Exam 16: Multistate Corporate Taxation160 Questions

Exam 17: Tax Practice and Ethics153 Questions

Exam 18: The Federal Gift and Estate Taxes173 Questions

Exam 19: Family Tax Planning145 Questions

Exam 20: Income Taxation of Trusts and Estates156 Questions

Select questions type

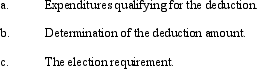

In connection with the deduction of organizational expenditures under § 248, comment on the following:

Free

(Essay)

4.8/5  (46)

(46)

Correct Answer:

Sage, Inc., a closely held corporation that is not a PSC, has a $110,000 passive loss, $90,000 of active income, and $25,000 of portfolio income during the year. How much of the passive loss can Sage deduct in the current year?

Free

(Multiple Choice)

4.9/5  (40)

(40)

Correct Answer:

C

Explain the rules regarding the accounting periods available to corporate taxpayers.

Free

(Essay)

5.0/5  (40)

(40)

Correct Answer:

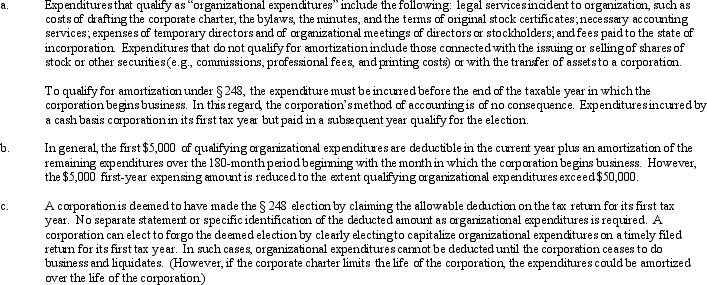

In general, a corporate taxpayer may select a calendar year or a fiscal year for tax return reporting purposes. A newly formed corporation generally can select it's initial reporting period without having to obtain IRS consent. However, certain types of corporate taxpayers are subject to restrictions on their reporting period. In general, personal service corporations (PSCs) and S corporations are required to use the calendar year for tax reporting. Exceptions to this rule apply, and a fiscal year can be elected by a PSC (or S corporation), under any of the following conditions:

Jessica, a cash basis individual, is a 60% shareholder of Crow Corporation, a regular corporation. On January 1, 2011, Jessica loaned Crow $300,000, with the principal due in 5 years and 6% interest due each January 1. Crow, an accrual method, calendar year taxpayer, accrued $18,000 of interest expense on the loan on December 31, 2011, and paid the $18,000 to Jessica on January 1, 2012. How much is Crow's deduction for interest on this loan for 2011? Would your answer change if Jessica was a 25% shareholder of Crow?

(Essay)

4.9/5  (42)

(42)

Schedule M-2 is used to reconcile unappropriated retained earnings at the beginning of the year with unappropriated retained earnings at the end of the year.

(True/False)

4.8/5  (39)

(39)

Describe the Federal tax treatment of entities formed as limited liability companies.

(Essay)

4.8/5  (41)

(41)

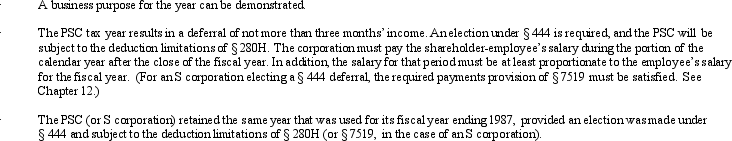

During the current year, Waterthrush Company had operating income of $510,000 and operating expenses of $400,000. In addition, Waterthrush had a long-term capital gain of $30,000. How does Lucinda, the sole owner of Waterthrush Company, report this information on her individual income tax return under following assumptions?

(Essay)

4.8/5  (30)

(30)

The passive loss rules apply to closely held C corporations and to personal service corporations but not to S corporations.

(True/False)

4.7/5  (34)

(34)

Which of the following statements is incorrect regarding the dividends received deduction?

(Multiple Choice)

4.7/5  (39)

(39)

In the current year, Amber, Inc., a calendar C corporation, has income from operations of $200,000 and operating deductions of $225,000. Amber also had $30,000 of dividends from a 25% stock ownership in a domestic corporation. Which of the following statements is incorrect with respect to Amber's net operating loss deduction?

(Multiple Choice)

4.9/5  (35)

(35)

Donald owns a 60% interest in a partnership that earned $230,000 in the current year. He also owns 60% of the stock in a C corporation that earned $230,000 during the year. Donald received $50,000 in distributions from each of the two entities during the year. With respect to this information, Donald must report $188,000 of income on his individual income tax return for the year.

(True/False)

4.8/5  (36)

(36)

A calendar year C corporation with average annual gross receipts of $5 million or less must use the cash method of accounting.

(True/False)

4.9/5  (34)

(34)

Patrick, an attorney, is the sole shareholder of Gander Corporation. Gander is a personal service corporation with a fiscal year ending September 30. The corporation paid Patrick a salary of $294,000 during its fiscal year ending September 30, 2011. How much salary must Gander pay Patrick during the period October 1 through December 31, 2011, to permit the corporation to continue to use its fiscal year without negative tax effects?

(Multiple Choice)

4.9/5  (46)

(46)

Owl Corporation, a C corporation, recognizes a gain on the sale of a § 1250 asset in the current year. Owl had used the straight-line method for depreciating the realty. Some of Owl's gain on the sale of the realty will be treated as depreciation recapture (ordinary income).

(True/False)

4.8/5  (36)

(36)

Discuss the purpose of Schedule M-1. Give two examples of an addition and two examples of a subtraction that could be reported on Schedule M-1.

(Essay)

4.8/5  (36)

(36)

A corporation with $10 million or more in assets must file Schedule M-3 (instead of Schedule M-1).

(True/False)

4.8/5  (48)

(48)

Unlike individual taxpayers, corporate taxpayers do not receive a preferential tax rate with respect to long-term capital gains.

(True/False)

4.7/5  (31)

(31)

In the current year, Plum Corporation, a computer manufacturer, donated 100 laptop computers to a local school district (a qualified educational organization). The computers were constructed by Plum earlier this year, and the school district allocated the computers among its various schools where they will be used for educational purposes. Plum's basis in the computers is $50,000, and their fair market value is $120,000. What is Plum's deduction for the contribution of the computers (ignoring the taxable income limitation)?

(Multiple Choice)

4.9/5  (31)

(31)

Olga's proprietorship earned a net profit of $95,000 during the year and she withdrew $70,000 of this profit. Olga must report $70,000 net income from the proprietorship on her individual income tax return (Form 1040).

(True/False)

4.9/5  (31)

(31)

Quail Corporation is a C corporation with net income of $300,000 during 2011. If Quail paid dividends of $50,000 to its shareholders, the corporation must pay tax on $300,000 of net income. Shareholders must report the $50,000 of dividends as income.

(True/False)

4.8/5  (37)

(37)

Showing 1 - 20 of 113

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)