Exam 2: Corporations: Introduction and Operating Rules

Exam 1: Understanding and Working With the Federal Tax Law74 Questions

Exam 2: Corporations: Introduction and Operating Rules113 Questions

Exam 3: Corporations: Special Situations111 Questions

Exam 4: Corporations: Organization and Capital Structure93 Questions

Exam 5: Corporations: Earnings Profits and Dividend Distributions89 Questions

Exam 6: Corporations: Redemptions and Liquidations112 Questions

Exam 7: Corporations: Reorganizations121 Questions

Exam 8: Consolidated Tax Returns145 Questions

Exam 9: Taxation of International Transactions159 Questions

Exam 10: Partnerships: Formation, Operation, and Basis100 Questions

Exam 11: Partnerships: Distributions, Transfer of Interests, and Terminations97 Questions

Exam 12: S: Corporations157 Questions

Exam 13: Comparative Forms of Doing Business143 Questions

Exam 14: Taxes on the Financial Statements87 Questions

Exam 15: Exempt Entities151 Questions

Exam 16: Multistate Corporate Taxation160 Questions

Exam 17: Tax Practice and Ethics153 Questions

Exam 18: The Federal Gift and Estate Taxes173 Questions

Exam 19: Family Tax Planning145 Questions

Exam 20: Income Taxation of Trusts and Estates156 Questions

Select questions type

On December 20, 2011, the directors of Quail Corporation (an accrual basis, calendar year taxpayer) authorized a cash donation of $5,000 to the American Cancer Society, a qualified charity. The payment, which is made on March 15, 2012, may be claimed as a deduction for tax year 2011.

(True/False)

5.0/5  (43)

(43)

Jade Corporation, a C corporation, had $100,000 operating income and $40,000 operating expenses during the year. In addition, Jade had a $2,000 long-term capital gain and a $10,000 short-term capital loss. Compute Jade's taxable income for the year.

(Multiple Choice)

4.8/5  (40)

(40)

During 2011, Sparrow Corporation, a calendar year C corporation, had operating income of $510,000, operating expenses of $370,000, a short-term capital loss of $25,000, and a long-term capital gain of $80,000. How much is Sparrow's tax liability for 2011?

(Multiple Choice)

4.9/5  (39)

(39)

Almond Corporation, a calendar year C corporation, had taxable income of $900,000, $1.1 million, and $790,000 for 2008, 2009, and 2010, respectively. Almond's taxable income is $1.5 million for 2011. Compute the minimum estimated tax payments for 2011 for Almond Corporation.

(Essay)

5.0/5  (41)

(41)

Generally, corporations with no taxable income must file a Form 1120.

(True/False)

4.8/5  (36)

(36)

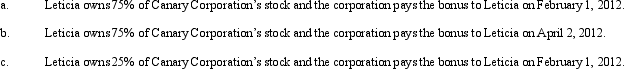

Canary Corporation, an accrual method C corporation, uses the calendar year for tax purposes. Leticia, a cash method taxpayer, is both a shareholder of Canary and the corporation's CFO. On December 31, 2011, Canary has accrued a $100,000 bonus to Leticia. Describe the tax consequences of the bonus to Canary and to Leticia under the following independent situations.

Under § 267(a)(2), an accrual method taxpayer must defer a deduction for an expenditure attributable to a cash method related party until such time the related party reports the amount as income. For purposes of this limitation, a more-than-50% shareholder of the corporation is a related party.

Under § 267(a)(2), an accrual method taxpayer must defer a deduction for an expenditure attributable to a cash method related party until such time the related party reports the amount as income. For purposes of this limitation, a more-than-50% shareholder of the corporation is a related party.

(Essay)

4.7/5  (39)

(39)

Ivory Corporation, a calendar year, accrual method C corporation, has two cash method, calendar year shareholders who are unrelated to each other. Craig owns 55% of the stock, and Oscar owns the remaining 45%. During 2011, Ivory paid a salary of $200,000 to each shareholder. On December 31, 2011, Ivory accrued a bonus of $50,000 to each shareholder. Assuming that the bonuses are paid to the shareholders on February 1, 2012, compute Ivory Corporation's 2011 deduction for the above amounts.

(Multiple Choice)

4.8/5  (42)

(42)

Canary Corporation, which sustained a $5,000 net capital loss during the year, will enter $5,000 as a addition item on Schedule M-1.

(True/False)

4.9/5  (33)

(33)

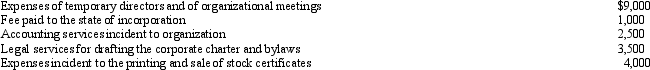

Emerald Corporation, a calendar year C corporation, was formed and began operations on July 1, 2011. The following expenses were incurred during the first tax year (July 1 through December 31, 2011) of operations:  Assuming a § 248 election, what is the Emerald's deduction for organizational expenditures for 2011?

Assuming a § 248 election, what is the Emerald's deduction for organizational expenditures for 2011?

(Multiple Choice)

4.9/5  (34)

(34)

In 2011, Bluebird Corporation had net income from operations of $75,000. Further, Bluebird recognized a long-term capital loss of $30,000, and a short-term capital gain of $10,000. Which of the following statements is correct?

(Multiple Choice)

4.8/5  (43)

(43)

Norma formed Hyacinth Enterprises, a proprietorship, in 2011. In its first year, Hyacinth had operating income of $400,000 and operating expenses of $240,000. In addition, Hyacinth had a long-term capital loss of $10,000. Norma, the proprietor of Hyacinth Enterprises, withdrew $75,000 from Hyacinth during the year. Assuming Norma has no other capital gains or losses, how does this information affect her taxable income for 2011?

(Multiple Choice)

4.8/5  (33)

(33)

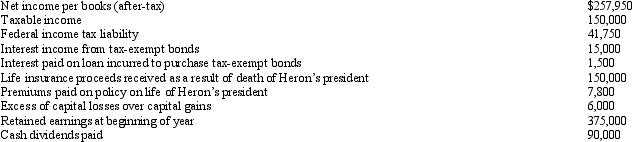

Heron Corporation, a calendar year, accrual basis taxpayer, provides the following information for this year and asks you to prepare Schedule M-1:

(Essay)

4.8/5  (38)

(38)

During the current year, Violet, Inc., a closely held corporation (not a PSC), has $130,000 of passive loss, $90,000 of active business income, and $70,000 of portfolio income. How much is Violet's taxable income for the current year?

(Multiple Choice)

4.8/5  (40)

(40)

On December 31, 2011, Flamingo, Inc., a calendar year, accrual method C corporation, accrues a bonus of $50,000 to its president (a cash basis taxpayer), who owns 75% of the corporation's outstanding stock. The $50,000 bonus is paid to the president on February 1, 2012. For Flamingo's 2011 Form 1120, the $50,000 bonus will be a subtraction item on Schedule M-1.

(True/False)

4.9/5  (43)

(43)

Azul Corporation, a personal service corporation, had $300,000 of active income, $40,000 of portfolio income, and a $190,000 passive loss during the year. How much is Azul's taxable income?

(Multiple Choice)

4.9/5  (37)

(37)

For purposes of the estimated tax payment rules, a "large corporation" is defined as a corporation that had an average taxable income of $1 million or more over the preceding three-year period.

(True/False)

4.7/5  (31)

(31)

Hippo, Inc., a calendar year C corporation, manufactures golf gloves. For 2011, Hippo had taxable income (before DPAD) of $800,000, qualified domestic production activities income of $950,000, and W-2 wages related to qualified production activities income of $130,000. Hippo's domestic production activities deduction for 2011 is:

(Multiple Choice)

4.9/5  (41)

(41)

Eagle Company, a partnership, had a short-term capital loss of $10,000 during the year. Aaron, who owns 25% of Eagle, will report $2,500 of Eagle's short-term capital loss on his individual tax return.

(True/False)

4.8/5  (34)

(34)

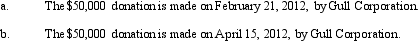

On December 30, 2011, the board of directors of Gull Corporation, a calendar year, accrual method C corporation, authorized a contribution of $50,000 to a qualified charitable organization. For purposes of the taxable income limitation applicable to charitable deductions, Gull has taxable income of $420,000 and $370,000 for 2011 and 2012, respectively. Describe the tax consequences to Gull Corporation under the following independent situations.

(Essay)

4.7/5  (40)

(40)

Katherine, the sole shareholder of Purple Corporation, a calendar year C corporation, has the corporation pay her a salary of $450,000 in the current year. The Tax Court has held that $150,000 represents unreasonable compensation. Purple Corporation's taxable income is unaffected by the Tax Court's determination.

(True/False)

4.8/5  (39)

(39)

Showing 61 - 80 of 113

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)