Exam 10: Partnerships: Formation, Operation, and Basis

Exam 1: Understanding and Working With the Federal Tax Law74 Questions

Exam 2: Corporations: Introduction and Operating Rules113 Questions

Exam 3: Corporations: Special Situations111 Questions

Exam 4: Corporations: Organization and Capital Structure93 Questions

Exam 5: Corporations: Earnings Profits and Dividend Distributions89 Questions

Exam 6: Corporations: Redemptions and Liquidations112 Questions

Exam 7: Corporations: Reorganizations121 Questions

Exam 8: Consolidated Tax Returns145 Questions

Exam 9: Taxation of International Transactions159 Questions

Exam 10: Partnerships: Formation, Operation, and Basis100 Questions

Exam 11: Partnerships: Distributions, Transfer of Interests, and Terminations97 Questions

Exam 12: S: Corporations157 Questions

Exam 13: Comparative Forms of Doing Business143 Questions

Exam 14: Taxes on the Financial Statements87 Questions

Exam 15: Exempt Entities151 Questions

Exam 16: Multistate Corporate Taxation160 Questions

Exam 17: Tax Practice and Ethics153 Questions

Exam 18: The Federal Gift and Estate Taxes173 Questions

Exam 19: Family Tax Planning145 Questions

Exam 20: Income Taxation of Trusts and Estates156 Questions

Select questions type

Which of the following partnership owners is personally liable for the entity's debts to general creditors?

(Multiple Choice)

4.9/5  (36)

(36)

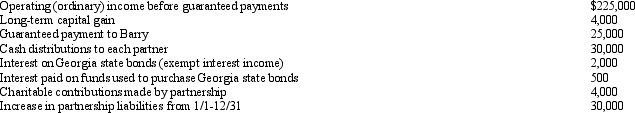

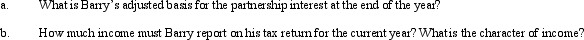

An examination of the RB Partnership's tax books provides the following information for the current year:

Barry is a 30% partner in partnership capital, profits, and losses. Assume the adjusted basis of his partnership interest is $50,000 at the beginning of the year, and he shares in 30% of the partnership liabilities for basis purposes.

Barry is a 30% partner in partnership capital, profits, and losses. Assume the adjusted basis of his partnership interest is $50,000 at the beginning of the year, and he shares in 30% of the partnership liabilities for basis purposes.

(Essay)

4.8/5  (38)

(38)

Kaylyn is a 40% partner in the KKM Partnership. During the current year, KKM reported gross receipts of $160,000 and a charitable contribution of $10,000. The partnership paid office expenses of $100,000. In addition, KKM distributed $10,000 each to partners Kaylyn and Kristie, and the partnership paid partner Megan $20,000 for administrative services. Kaylyn reports the following income from KKM during the current tax year:

(Multiple Choice)

4.8/5  (37)

(37)

Shane made a contribution of property to the newly formed QRST Partnership. The property had a $80,000 adjusted basis to Shane and a $150,000 fair market value on the contribution date. The property was also encumbered by a $90,000 nonrecourse debt, which was transferred to the partnership on that date. Another partner, Rachel, shares 20% of the partnership income, gain, loss, deduction, and credit. Under IRS regulations, Rachel's share of the nonrecourse debt for basis purposes is:

(Multiple Choice)

4.8/5  (48)

(48)

Hardy's basis in his partnership interest was $5,000 at the beginning of the tax year. For the year, his share of the partnership's loss was $6,000, and he also received a distribution of $3,000. Hardy can deduct a $2,000 loss, and the remaining $4,000 loss is suspended until a year in which he has adequate basis.

(True/False)

4.9/5  (35)

(35)

When property is contributed to a partnership for a capital and profits interest, the holding period of the contributing partner's interest:

(Multiple Choice)

4.7/5  (32)

(32)

Katherine invested $80,000 this year to purchase a 30% interest in the KLM Partnership. The partnership reported $200,000 of net income from operations, a $2,000 short-term capital loss, and a $10,000 charitable contribution. In addition, the partnership distributed $20,000 to Katherine and $10,000 each to partners Lauren and Missy. Assuming the partnership has no beginning or ending liabilities, what is Katherine's basis in her partnership interest at the end of the year?

(Essay)

4.8/5  (39)

(39)

A limited liability limited partnership (LLLP) is a limited partnership (LP) in which all partners, including the general partners, are protected from debts of the partnership.

(True/False)

4.8/5  (42)

(42)

Emma's basis in her BBDE LLC interest is $60,000 at the beginning of the tax year. Her allocable share of LLC items are as follows: $20,000 of ordinary income, $2,000 tax-exempt interest income, and a $6,000 long-term capital gain. In addition, the LLC distributed $12,000 of cash to Emma during the year. Assuming the LLC had no liabilities at the beginning or the end of the year, Emma's ending basis in her LLC interest is $88,000.

(True/False)

4.9/5  (46)

(46)

Fern, Inc., Ivy Inc., and Jason formed a general partnership. Fern owns a 50% interest and Ivy and Jason each own 25% interests. Fern, Inc. files its tax return on a July 1 - June 30 fiscal year; Ivy Inc. files on a September 1 - August 31 fiscal year; and Jason is a calendar year taxpayer. Which of the following statements is true regarding the taxable year the partnership can choose?

(Multiple Choice)

4.8/5  (38)

(38)

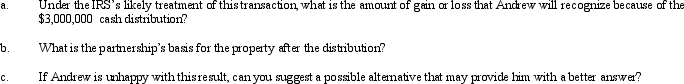

Andrew contributes property with a fair market value of $6,000,000 and an adjusted basis of $2,000,000 to AP Partnership. Andrew shares in $3,000,000 of partnership debt under the liability sharing rules, giving him an initial adjusted basis for his partnership interest of $5,000,000. One month after the contribution, Andrew receives a cash distribution from the partnership of $3,000,000. Andrew would not have contributed the property if the partnership had not contractually obligated itself to make the distribution. Assume Andrew's share of partnership liabilities will not change as a result of this distribution.

(Essay)

4.8/5  (48)

(48)

Partner Tom transferred property (basis of $20,000; fair market value of $50,000) to the TUV Partnership in exchange for a partnership interest. At a later date, when Tom's outside basis for his partnership interest was $70,000, Tom received a $50,000 cash distribution from the partnership. Which one of the following statements is not true?

(Multiple Choice)

4.8/5  (32)

(32)

Crystal contributes land to the newly formed CD Partnership in exchange for a 40% interest. The land has an adjusted basis and fair market value of $200,000 and is subject to a liability of $50,000, which the partnership assumes. None of this liability is repaid at year-end. At the end of the year, the partnership has trade accounts payable of $60,000. Assume all liabilities are allocated proportionately to the partners. Total partnership income for the year is $300,000. What is Crystal's basis in her partnership interest at the end of the year?

(Essay)

4.8/5  (38)

(38)

Marissa is a 50% partner in the BAM Partnership. At the beginning of the tax year, Marissa's basis in the partnership interest was $200,000, including her share of partnership liabilities. During the current year, BAM reported an ordinary loss of $100,000. In addition, BAM distributed $10,000 to Marissa and paid partner Brian a $20,000 consulting fee (neither of these amounts was deducted in determining the $100,000 loss from operations). At the end of the year, Marissa's share of partnership liabilities decreased by $30,000. Assuming loss limitation rules do not apply, Marissa's basis in the partnership interest at the end of the year is:

(Multiple Choice)

4.7/5  (37)

(37)

Tom and William are equal partners in the TW Partnership. Just before TW liquidated, Tom's capital account balance was $50,000 and William's capital account balance was $30,000. To meet the substantial economic effect requirements, any liquidating cash distribution must be allocated equally between the partners.

(True/False)

4.7/5  (36)

(36)

At the beginning of the year, Heather's "tax basis" capital account balance in the HEP Partnership was $60,000. During the tax year, Heather contributed property with a basis of $10,000 and a fair market value of $30,000. Her share of the partnership's ordinary income and separately stated income and deduction items was $26,000. At the end of the year, the partnership distributed $10,000 of cash to Heather. Also, the partnership allocated $15,000 of recourse debt and $25,000 of nonrecourse debt to Heather. What is Heather's ending capital account balance determined using the "tax basis" method?

(Multiple Choice)

4.8/5  (35)

(35)

Nicholas, a 1/3 partner with a basis in the interest of $80,000 at the beginning of the year, received a guaranteed payment in the current year of $50,000. Partnership income before consideration of the guaranteed payment was $20,000. Nicholas must report a $10,000 ordinary loss from partnership operations, and the $50,000 guaranteed payment as ordinary income.

(True/False)

4.8/5  (37)

(37)

Cassandra is a 10% limited partner in C&C, Ltd. Her basis in the interest is $60,000 before loss allocations, including her $30,000 share of the partnership's nonrecourse debt. (This debt is not qualified nonrecourse financing.) Cassandra is also a 10% limited partner in RSTU, in which her basis is $30,000. Cassandra is allocated an $80,000 loss from C&C, and $20,000 of income from RSTU. How much of the loss from C&C may Cassandra deduct? Under what Code provisions are the remaining losses suspended?

(Essay)

4.8/5  (35)

(35)

The MNO Partnership, a calendar year taxpayer, was formed on July 1 of the current year and started business on October 1. MNO incurred $30,000 in startup costs. MNO may deduct $5,000 and amortize the remaining $25,000 over 120 months starting in July.

(True/False)

4.8/5  (46)

(46)

During the current tax year, Jordan and Whitney each contributed $50,000 to form the J&W LLC. Each member has a 50% interest in LLC capital, profits, and losses, except that depreciation expense is allocated 40% to Jordan and 60% to Whitney. During the first year, the LLC reported income (before depreciation expense) of $20,000 and had depreciation expense of $10,000. The LLC incurred recourse debt (that was personally guaranteed by both of the LLC members) of $60,000. Partnership assets are $170,000 at the end of the year. Under the constructive liquidation scenario, how is the recourse debt allocated to Jordan and Whitney?

(Multiple Choice)

4.9/5  (33)

(33)

Showing 41 - 60 of 100

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)