Exam 9: Indirect and Mutual Holdings

Exam 1: Business Combinations36 Questions

Exam 2: Stock Investments - Investor Accounting and Reporting41 Questions

Exam 3: An Introduction to Consolidated Financial Statements39 Questions

Exam 4: Consolidated Techniques and Procedures38 Questions

Exam 5: Intercompany Profit Transactions Inventories40 Questions

Exam 6: Intercompany Profit Transactions Plant Assets39 Questions

Exam 7: Intercompany Profit Transactions Bonds40 Questions

Exam 8: Consolidations - Changes in Ownership Interests37 Questions

Exam 9: Indirect and Mutual Holdings37 Questions

Exam 11: Consolidation Theories, Push-Down Accounting, and Corporate Joint Ventures41 Questions

Exam 12: Derivatives and Foreign Currency: Concepts and Common Transactions40 Questions

Exam 13: Accounting for Derivatives and Hedging Activities40 Questions

Exam 14: Foreign Currency Financial Statements39 Questions

Exam 15: Segment and Interim Financial Reporting40 Questions

Exam 16: Partnerships - Formation, Operations, and Changes in Ownership Interests40 Questions

Exam 17: Partnership Liquidation40 Questions

Exam 18: Corporate Liquidations and Reorganizations40 Questions

Exam 19: An Introduction to Accounting for State and Local Governmental Units38 Questions

Exam 20: Accounting for State and Local Governmental Units - Governmental Funds37 Questions

Exam 21: Accounting for State and Local Governmental Units - Proprietary and Fiduciary Funds39 Questions

Exam 22: Accounting for Not-For-Profit Organizations39 Questions

Exam 23: Estates and Trusts38 Questions

Select questions type

Pallet Corporation owns 80% of Adelt Corporation and Adelt owns 60% of Bajo Inc. Which of the following is correct?

(Multiple Choice)

4.9/5  (33)

(33)

Controlling interest share of consolidated net income for Paint Corporation and Subsidiaries is:

(Multiple Choice)

4.9/5  (40)

(40)

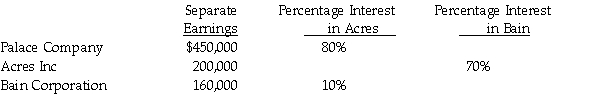

Paice Corporation owns 80% of the voting common stock of Accardi Corporation. Paice owns 60% of the voting common stock of Badger Corporation. Accardi owns 20% of the voting common stock of Badger. There are no cost/book value/fair value differentials to consider. The separate net incomes (excluding investment income) of these affiliated companies for 2014 are:

Required:

Calculate controlling interest share of consolidated net income and noncontrolling interest shares for Paice Corporation and Subsidiaries for 2014.

Required:

Calculate controlling interest share of consolidated net income and noncontrolling interest shares for Paice Corporation and Subsidiaries for 2014.

(Essay)

4.8/5  (33)

(33)

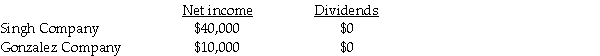

On January 1, 2014, Singh Company acquired an 80 percent interest in Gonzalez Company for $300,000. On January 1, 2014, Gonzalez's total stockholders' equity was $375,000. The fair value and book value of Gonzalez's individual assets and liabilities were equal.

On January 2, 2014, Gonzalez Company acquired a 10 percent interest in Singh Company for $50,000. On January 2, 2014, Singh's total stockholders' equity was $500,000. The fair value and book value of Singh's individual assets and liabilities were equal.

For the year ending December 31, 2014, the following data is available:

The treasury stock method is used to account for the mutual stock holdings between Singh and Gonzalez. The separate net incomes do not include investment income. A partial consolidating worksheet is below.

The treasury stock method is used to account for the mutual stock holdings between Singh and Gonzalez. The separate net incomes do not include investment income. A partial consolidating worksheet is below.

Required:

Prepare the elimination entries for the year ending December 31, 2014.

Do not enter them onto the worksheet. Instead, list them below.

Required:

Prepare the elimination entries for the year ending December 31, 2014.

Do not enter them onto the worksheet. Instead, list them below.

(Essay)

4.8/5  (40)

(40)

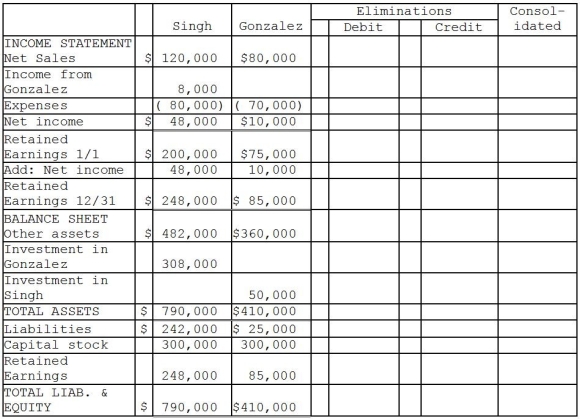

On January 1, 2014, Peabody Corporation acquired a 90% interest in Salisbury Company for $270,000 when Salisbury's stockholders' equity was $300,000; with Common stock $200,000 and Retained earnings $100,000.

On January 1, 2014, Salisbury purchased a 10% interest in Peabody for $70,000 when Peabody's total stockholders' equity was $700,000; with Common stock $500,000 and Retained earnings $200,000.

The following data was available for the year ending December 31, 2014:

Use the conventional approach to account for the mutually-held stock. Assume there were no book value/fair value differentials for each investment. The separate net incomes do not include investment income.

Required:

1. Prepare the journal entry for Peabody on January 1, 2014.

2. Prepare the journal entry for Salisbury on January 1, 2014.

3. Prepare the journal entry to record the constructive retirement of 10% of Peabody's outstanding stock due to Salisbury's purchase of Peabody's stock.

4. Determine the incomes of Peabody and Salisbury on a consolidated basis with mutual income for 2014 using simultaneous equations.

5. What is controlling interest share of consolidated net income and noncontrolling interest shares for 2014?

Use the conventional approach to account for the mutually-held stock. Assume there were no book value/fair value differentials for each investment. The separate net incomes do not include investment income.

Required:

1. Prepare the journal entry for Peabody on January 1, 2014.

2. Prepare the journal entry for Salisbury on January 1, 2014.

3. Prepare the journal entry to record the constructive retirement of 10% of Peabody's outstanding stock due to Salisbury's purchase of Peabody's stock.

4. Determine the incomes of Peabody and Salisbury on a consolidated basis with mutual income for 2014 using simultaneous equations.

5. What is controlling interest share of consolidated net income and noncontrolling interest shares for 2014?

(Essay)

4.8/5  (42)

(42)

When mutually-held stock involves subsidiaries holding the stock of each other, the ________ method is not used.

(Multiple Choice)

4.8/5  (34)

(34)

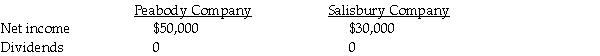

On January 1, 2014, Wrobel Company acquired a 90 percent interest in Sally Company for $270,000. On January 1, 2014, Sally's total stockholders' equity was $300,000. The fair value and book value of Sally's individual assets and liabilities were equal.

On January 2, 2014, Sally Company acquired a 10 percent interest in Wrobel Company for $70,000. On January 2, 2014, Wrobel's total stockholders' equity was $700,000. The fair value and book value of Wrobel's individual assets and liabilities were equal.

For the year ending December 31, 2014, the following data is available:

The treasury stock method is used to account for the mutual stock holdings between Wrobel and Sally. The separate net incomes do not include investment income.

Required:

1. What is Sally's income from Wrobel for 2014?

2. What is Wrobel's income from Sally for 2014?

3. What is the noncontrolling interest share associated with Sally Company for 2014?

4. Prepare the elimination entry for Sally's Investment in Wrobel Company.

The treasury stock method is used to account for the mutual stock holdings between Wrobel and Sally. The separate net incomes do not include investment income.

Required:

1. What is Sally's income from Wrobel for 2014?

2. What is Wrobel's income from Sally for 2014?

3. What is the noncontrolling interest share associated with Sally Company for 2014?

4. Prepare the elimination entry for Sally's Investment in Wrobel Company.

(Essay)

4.9/5  (39)

(39)

Separate earnings and investment percentages for three affiliates for 2014 are as follows:

Assume the investments were acquired at a cost equal to the book value of each investment, which also equals the fair value. Separate earnings do not include investment income.

Required:

1. Calculate revised net incomes for Palace, Acres, and Bain by using the conventional method.

2. Determine the controlling interest share of consolidated net income and the noncontrolling interest shares.

Assume the investments were acquired at a cost equal to the book value of each investment, which also equals the fair value. Separate earnings do not include investment income.

Required:

1. Calculate revised net incomes for Palace, Acres, and Bain by using the conventional method.

2. Determine the controlling interest share of consolidated net income and the noncontrolling interest shares.

(Essay)

4.8/5  (30)

(30)

The amount of noncontrolling interest share for the current year is

(Multiple Choice)

4.8/5  (32)

(32)

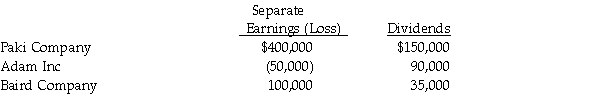

On January 1, 2014 Paki Inc. bought 75% interest in Adam Corporation. At the time of purchase, Adam owned 80% of Baird Company. In all acquisitions, the book value equals the fair value, which equals the acquisition cost. Separate earnings (loss) (excluding investment income) for the three affiliates for 2014 are as follows:

Required:

Compute controlling interest share of consolidated net income and noncontrolling interest shares for Paki and affiliates for 2014.

Required:

Compute controlling interest share of consolidated net income and noncontrolling interest shares for Paki and affiliates for 2014.

(Essay)

4.8/5  (44)

(44)

Paglia Corporation owns 80% of Aburn Corporation and has separate net income of $200,000 for 2013. Aburn Corporation has separate net income of $100,000 and owns 70% of the outstanding stock of Badley Corporation. Badley Corporation has separate net income of $80,000. (Separate net incomes exclude investment income.) The cost of each investment was equal to book value and fair value. The controlling interest share of consolidated net income for 2013 is

(Multiple Choice)

4.7/5  (30)

(30)

Packer Corporation owns 100% of Abel Corporation, Abel Corporation owns 95% of Bacon Corporation and Bacon Corporation owns 80% of Cab Corporation. The separate net incomes (excluding investment income) of Packer, Abel, Bacon, and Cab are $300,000, $100,000, $200,000, and $300,000, respectively. All of the investments were made at times when the investee's book values were equal to their fair values. There were no cost/book value differentials for each investment.

Required:

Determine the controlling interest share of consolidated net income and noncontrolling interest shares for Packer Corporation and Subsidiaries for the current year.

(Essay)

4.8/5  (43)

(43)

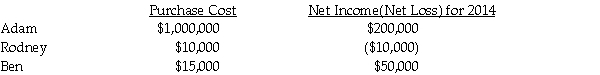

On January 1, 2014, Adam Corporation purchased a 90% interest in Rodney Corporation. On January 1, 2014, Rodney Corporation purchased an 80% interest in Ben Corporation.

In all investment acquisitions, the cost of the interest was equal to the book value of the interest and the fair value of the interest. The following information is available for 2014:

The separate net incomes do not include investment income.

Required:

1. What is controlling interest share of consolidated net income for 2014?

2. What is noncontrolling interest shares of consolidated net income for 2014?

The separate net incomes do not include investment income.

Required:

1. What is controlling interest share of consolidated net income for 2014?

2. What is noncontrolling interest shares of consolidated net income for 2014?

(Essay)

4.8/5  (32)

(32)

The amount of income for the current year assigned to the noncontrolling shareholders of Abussi Corporation is

(Multiple Choice)

4.9/5  (34)

(34)

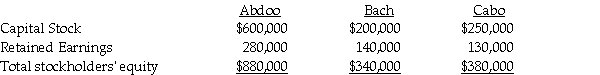

Pacini Corporation owns an 80% interest in Abdoo Corporation, acquired on January 1, 2013 for $700,000 when Abdoo's stockholders' equity consisted of $600,000 of Capital Stock and $200,000 of Retained Earnings.

Abdoo Corporation acquired a 60% interest in Bach Corporation on July 1, 2013 for $180,000 when Bach had Capital Stock of $200,000 and Retained Earnings of $50,000. On January 1, 2014, Abdoo acquired a 70% interest in Cabo Corporation for $270,000 when Cabo had Capital Stock of $250,000 and Retained Earnings of $100,000.

No change in outstanding stock of any of the affiliated companies has occurred since the investments were made. All cost-book value differentials are goodwill. There are no fair value/book value differentials. The stockholders' equity section of the separate balance sheets of Abdoo, Bach, and Cabo at December 31, 2014 are as follows:

Required:

1. Compute the amount at which goodwill should be shown in the consolidated balance sheet of Pacini Corporation and Subsidiaries at December 31, 2014.

2. Pacini and Abdoo have applied the equity method correctly. Determine the balances of the three investment accounts at December 31, 2014.

Required:

1. Compute the amount at which goodwill should be shown in the consolidated balance sheet of Pacini Corporation and Subsidiaries at December 31, 2014.

2. Pacini and Abdoo have applied the equity method correctly. Determine the balances of the three investment accounts at December 31, 2014.

(Essay)

4.8/5  (31)

(31)

Showing 21 - 37 of 37

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)