Exam 23: Flexible Budgets and Standard Cost Systems

Exam 1: Accounting and the Business Environment263 Questions

Exam 2: Recording Business Transactions219 Questions

Exam 3: The Adjusting Process225 Questions

Exam 4: Completing the Accounting Cycle208 Questions

Exam 5: Merchandising Operations277 Questions

Exam 6: Merchandise Inventory199 Questions

Exam 7: Internal Control and Cash258 Questions

Exam 8: Receivables234 Questions

Exam 9: Plant Assets, Natural Resources, and Intangibles212 Questions

Exam 10: Investments192 Questions

Exam 11: Current Liabilities and Payroll225 Questions

Exam 12: Long-Term Liabilities207 Questions

Exam 13: Stockholders Equity277 Questions

Exam 14: The Statement of Cash Flows183 Questions

Exam 15: Financial Statement Analysis161 Questions

Exam 16: Introduction to Managerial Accounting245 Questions

Exam 17: Job Order Costing191 Questions

Exam 18: Process Costing173 Questions

Exam 19: Cost Management Systems: Activity-Based Just-In-Time 189 Questions

Exam 20: Cost Volume Profit Analysis196 Questions

Exam 21: Variable Costing148 Questions

Exam 22: Master Budgets181 Questions

Exam 23: Flexible Budgets and Standard Cost Systems223 Questions

Exam 24: Responsibility Accounting and Performance Evaluation188 Questions

Exam 25: Short-Term Business Decisions200 Questions

Exam 26: Capital Investment Decisions152 Questions

Exam 27: Understanding Accounting Information Systems and their Components164 Questions

Select questions type

A favorable variance has a debit balance and is a contra revenue.

(True/False)

4.8/5  (42)

(42)

A new factory manager was hired for a company that was experiencing slow production rates and lower production volumes than demanded by management. Upon investigation, the manager found that the workers were poorly motivated and not closely supervised. Midway through the quarter, an incentive program was initiated, and cash bonuses were given when workers hit their production targets. Within a short time, production output increased, but the bonuses had to be charged to the direct labor budget. This could produce a(n) ________.

(Multiple Choice)

4.9/5  (38)

(38)

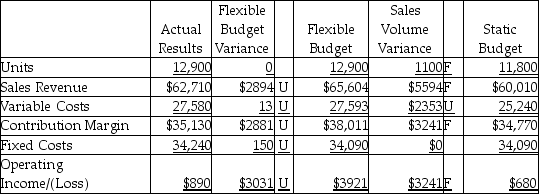

The Crockery Pottery Company completed the flexible budget analysis for the second quarter, which is given below.  Which of the following would be a correct factor to explain the sales volume variance for sales revenue?

Which of the following would be a correct factor to explain the sales volume variance for sales revenue?

(Multiple Choice)

4.8/5  (41)

(41)

A favorable flexible budget variance in sales revenue suggests a(n) ________.

(Multiple Choice)

4.8/5  (46)

(46)

When using management by exception, which of the following variances would NOT affect the production manager?

(Multiple Choice)

4.8/5  (41)

(41)

Palmer Productions uses a standard cost system. On December 31, the account balances include the following:

Sales Revenues: $750,000

Cost of Goods Sold (standard costing): $400,500

Selling & Administrative expenses: $150,000

Variances:

Sales revenue variance \ 6,000 F Direct materials cost variance 400 U Direct materials efficiency variance 375 F Direct labor cost variance 675 U Direct labor efficiency variance 150 F Variable overhead cost variance 250 U Variable overhead efficiency variance 800 F Fixed overhead cost variance 420 U Fixed overhead volume variance 100 F Prepare a multi-step, standard cost income statement.

(Essay)

4.8/5  (38)

(38)

A favorable direct materials cost variance occurs when the actual direct materials cost incurred is less than the standard direct materials cost.

(True/False)

4.8/5  (35)

(35)

When using management by exception, managers investigate only those variances that are unfavorable.

(True/False)

4.7/5  (33)

(33)

Andrea, a production manager for Akim Manufacturing, is investigating variances that are greater than 10% of the budgeted amounts. Andrea is engaging in ________.

(Multiple Choice)

4.9/5  (42)

(42)

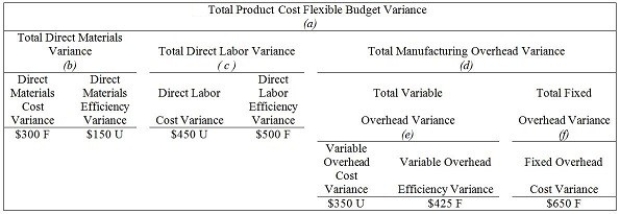

Based on the following, what is the total fixed overhead variance for the total product cost flexible budget variance?

(Multiple Choice)

4.9/5  (29)

(29)

The sales volume variance is the difference between the ________.

(Multiple Choice)

4.9/5  (38)

(38)

Home Decor Company manufactures special metallic materials for luxury homes that require highly skilled labor. Home Decor uses standard costs to prepare its flexible budget. For the first quarter of the year, direct materials and direct labor standards for one of their popular products were as follows: Direct materials: 3 pounds per unit; $3 per pound

Direct labor: 4 hours per unit; $16 per hour

Home Decor produced 4000 units during the quarter. At the end of the quarter, an examination of the labor costs records showed that the company used 25,000 direct labor hours and actual total direct labor costs were $372,000. What is the direct labor cost variance? (Round any intermediate calculations to the nearest cent, and your final answer to the nearest dollar.)

(Multiple Choice)

4.7/5  (40)

(40)

The following information relates to Tablerock Manufacturing's overhead costs for the month:

Static budget variable overhead \ 14,200 Static budget fixed overhead \ 5,600 Static budget direct labor hours 1,000 hours Static budget number of units 5,000 units Tablerock allocates variable manufacturing overhead to production based on standard direct labor hours.

Tablerock reported the following actual results for last month: actual variable overhead, $14,500; actual fixed overhead, $5,400; actual production of 4,700 units at 0.22 direct labor hours per unit. The standard direct labor time is 0.20 direct labor hours per unit.

Compute the variable overhead cost variance. (Round intermediate calculations to two decimal places and the answer to the nearest dollar.)

(Essay)

4.7/5  (39)

(39)

Seaworthy Designs manufactures special metallic materials and decorative fittings for luxury yachts that require highly skilled labor. Seaworthy uses standard costs to prepare its flexible budget. For the first quarter of the year, direct materials and direct labor standards for one of their popular products were as follows: Direct materials: 4 pounds per unit; $6 per pound

Direct labor: 2 hours per unit; $19 per hour

During the first quarter, Seaworthy produced 2000 units of this product. Actual direct materials and direct labor costs were $66,000 and $326,000, respectively.

For the purpose of preparing the flexible budget, what is the total standard direct labor cost at a production volume of 2000 units?

(Multiple Choice)

4.8/5  (51)

(51)

Marshall Company uses a standard cost system. Variable overhead costs are allocated based on direct labor hours. In the first quarter, Marshall had a favorable efficiency variance for variable overhead costs. Which of the following scenarios is a reasonable explanation for this variance?

(Multiple Choice)

4.7/5  (38)

(38)

The static budget is used to compute flexible budget variances as well as cost and efficiency variances for direct materials and direct labor.

(True/False)

4.9/5  (39)

(39)

Unfavorable variances are subtracted from each other to arrive at a favorable variance.

(True/False)

4.8/5  (31)

(31)

A company's production department was experiencing a high defect rate on the assembly line, which was slowing down production and causing a higher waste of valuable direct materials. The production manager decided to recruit some highly skilled production workers from another company to bring down the defect rate. This would produce a(n) ________.

(Multiple Choice)

4.9/5  (36)

(36)

The variable overhead cost variance measures how well the business ________.

(Multiple Choice)

4.9/5  (42)

(42)

Showing 201 - 220 of 223

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)