Exam 23: Flexible Budgets and Standard Cost Systems

Exam 1: Accounting and the Business Environment263 Questions

Exam 2: Recording Business Transactions219 Questions

Exam 3: The Adjusting Process225 Questions

Exam 4: Completing the Accounting Cycle208 Questions

Exam 5: Merchandising Operations277 Questions

Exam 6: Merchandise Inventory199 Questions

Exam 7: Internal Control and Cash258 Questions

Exam 8: Receivables234 Questions

Exam 9: Plant Assets, Natural Resources, and Intangibles212 Questions

Exam 10: Investments192 Questions

Exam 11: Current Liabilities and Payroll225 Questions

Exam 12: Long-Term Liabilities207 Questions

Exam 13: Stockholders Equity277 Questions

Exam 14: The Statement of Cash Flows183 Questions

Exam 15: Financial Statement Analysis161 Questions

Exam 16: Introduction to Managerial Accounting245 Questions

Exam 17: Job Order Costing191 Questions

Exam 18: Process Costing173 Questions

Exam 19: Cost Management Systems: Activity-Based Just-In-Time 189 Questions

Exam 20: Cost Volume Profit Analysis196 Questions

Exam 21: Variable Costing148 Questions

Exam 22: Master Budgets181 Questions

Exam 23: Flexible Budgets and Standard Cost Systems223 Questions

Exam 24: Responsibility Accounting and Performance Evaluation188 Questions

Exam 25: Short-Term Business Decisions200 Questions

Exam 26: Capital Investment Decisions152 Questions

Exam 27: Understanding Accounting Information Systems and their Components164 Questions

Select questions type

Myers Manufacturing uses a standard cost system. The allocation base for overhead costs is direct labor hours. Standard and actual data for manufacturing overhead are as follows:

Variable overhead allocation rate: $30 per direct labor hour

Fixed overhead allocation rate: $10 per direct labor hour

Actual overhead incurred (variable and fixed): $45,600

Standards for direct labor are as follows:

Hours per unit 0.5, Direct labor cost per hour $18.00

Actual direct labor for the month: 1,200 hours for a total cost of $24,000

Actual and planned production for the month: 3,000 units

Prepare the journal entry to allocate overhead cost (both variable and fixed) to production.

(Essay)

4.8/5  (26)

(26)

Marlin Manufacturing uses a standard cost system. Data on standard costs and actual costs are as follows:

Direct materials: Standard Actual Direct materials units per unit of output 2.0 3.3 Cost per unit of direct materials \ 5.00 \ 4.80 Direct materials cost per unit \ 10.00 \ 16.00 Number of units 3,000 3,000 Direct materials cost \ 30.000 \ 48.000

Direct labor: Standard Actual Hours per unit 0.5 0.4 Cost per hour \ 18.00 \ 20.00 Labor cost per unit \ 9.00 \ 8.00 Number of units 3,000 3,000 Direct labor cost \ 27.000 \ 24.000

Variable overhead Standard Actual Hours per unit 0.5 0.4 Cost per hour \ 30.00 \ 29.00 Variable overhead cost per unit \ 15.00 \ 11.60 Number of units 3,000 3,000 Variable overhead cost \ 45.000 \ 34.800

*allocated based on direct labor hours

Fixed overhead* Standard Actual Hours per unit 0.5 0.4 Cost per hour \ 10.00 \ 9.00 Fixed overhead cost per unit \ 5.00 \ 3.60 Number of units 3,000 3,000 Fixed overhead cost \ 15.000 \ 10.800

*allocated on the basis of direct labor hours

Give the journal entry to transfer the cost of units from Work-in-Process Inventory to Finished Goods Inventory. Omit explanation.

(Essay)

4.8/5  (44)

(44)

For each of the following variances, state which manager is most likely to be responsible for the variance.

Variance Responsible Manager Direct Materials Efficiency Direct Labor Cost Variable Overhead Efficiency

(Essay)

4.8/5  (37)

(37)

The static budget, at the beginning of the month, for La Verne Company follows:

Static budget:

Sales volume: 2100 units: Sales price: $57.00 per unit

Variable cost: $13.00 per unit: Fixed costs: $25,000 per month

Operating income: $67,400

Actual results, at the end of the month, follows:

Actual results:

Sales volume: 1900 units: Sales price: $58.00 per unit

Variable cost: $17.00 per unit: Fixed costs $35,000 per month

Operating income: $42,900

Calculate the sales volume variance for variable costs.

(Multiple Choice)

4.9/5  (35)

(35)

Developing efficiency standards based on best practices is called benchmarking.

(True/False)

4.8/5  (40)

(40)

Firelight Company manufactures candles. The standard direct materials quantity required to produce one large candle is one pound at a cost of $5 per pound. During November, 7,200 large candles were produced using 7,500 pounds of direct materials that cost $45,000.

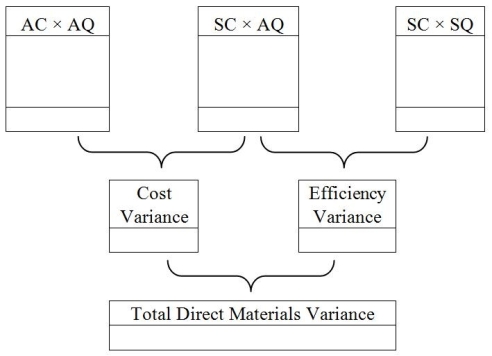

Using the format below, prepare an analysis of the direct materials variances.

(Essay)

4.7/5  (47)

(47)

SeaKist Marine Stores Company manufactures decorative fittings for luxury yachts, which require highly skilled labor, and special metallic materials. SeaKist uses standard costs to prepare its flexible budget. For the first quarter of 2016, direct materials and direct labor standards for one of their popular products were as follows: Direct materials: 1.5 pounds per unit; $4 per pound

Labor: 2 hours per unit; $18 per hour

During the first quarter, SeaKist produced 5,000 units of this product. At the end of the quarter, an examination of the direct materials records revealed that the company used 7,000 pounds of direct materials. The direct materials efficiency variance was $2,000 F. Which of the following is a logical explanation for this variance?

(Multiple Choice)

4.8/5  (33)

(33)

The fixed overhead cost variance measures the difference between actual fixed overhead and allocated fixed overhead.

(True/False)

4.9/5  (39)

(39)

Stafford Company uses standard costs for its manufacturing division. Standards specify 0.2 direct labor hours per unit of product. The allocation base for variable overhead costs is direct labor hours. At the beginning of the year, the static budget for variable overhead costs included the following data: Production volume 5000 units Budgeted variable overhead costs \ 13,500 Budgeted direct labor hours 620 hours At the end of the year, actual data were as follows:

Production volume 4100 units Actual variable overhead costs \ 15,100 Actual direct labor hours 505 hours How much is the standard cost per direct labor hour for variable overhead? (Round your answer to the nearest cent.)

(Multiple Choice)

4.9/5  (41)

(41)

A flexible budget summarizes revenues and costs for various levels of sales volume within a relevant range.

(True/False)

4.9/5  (39)

(39)

Match the variance to the correct definition

-Cost variance

(Multiple Choice)

4.8/5  (29)

(29)

Allen Boating Company manufactures special metallic materials and decorative fittings for luxury yachts that require highly skilled labor. Allen uses standard costs to prepare its flexible budget. For the first quarter of the year, direct materials and direct labor standards for one of their popular products were as follows: Direct materials: 2 pound per unit; $11 per pound

Direct labor: 2 hours per unit; $15 per hour

Allen produced 3000 units during the quarter. At the end of the quarter, an examination of the direct materials records showed that the company used 6500 pounds of direct materials and actual total materials costs were $99,300.

What is the direct materials efficiency variance?

(Multiple Choice)

4.8/5  (39)

(39)

The standard cost income statement doesn't alter the actual operating income-it simply emphasizes the variances from standard.

(True/False)

4.9/5  (34)

(34)

A company's production department was experiencing a high defect rate on the assembly line, which was slowing down production and causing a higher waste of valuable direct materials. The production manager decided to purchase a higher grade of materials that would be more reliable. This would produce a(n) ________.

(Multiple Choice)

4.8/5  (41)

(41)

When recording direct materials usage, what does an unfavorable direct materials efficiency variance represent? Will this variance have a debit or credit balance?

(Essay)

4.9/5  (23)

(23)

The static budget, at the beginning of the month, for Jabari Company follows:

Static budget:

Sales volume: 2100 units; Sales price: $52.00 per unit

Variable costs: $12.00 per unit; Fixed costs: $26,500 per month

Operating income: $57,500

Actual results, at the end of the month, follows:

Actual results:

Sales volume: 1900 units; Sales price: $58.00 per unit

Variable costs: $17.00 per unit; Fixed cost: $37,000 per month

Operating income: $40,900

Calculate the sales volume variance for operating income.

(Multiple Choice)

4.9/5  (35)

(35)

Cake Lady Bakery is famous for its pound cakes. The main ingredient of the cakes is flour, which Cake Lady purchases by the pound. In addition, the production requires a certain amount of direct labor. Cake Lady uses a standard cost system, and at the end of the first quarter, there was an unfavorable direct labor cost variance. Which of the following is a logical explanation for that variance?

(Multiple Choice)

4.7/5  (29)

(29)

Akao Products uses a standard cost system. Variable overhead costs are allocated based on direct labor hours. In the first quarter, Akao had an unfavorable efficiency variance for variable overhead costs. Which of the following scenarios is a reasonable explanation for this variance?

(Multiple Choice)

4.8/5  (38)

(38)

The flexible budget variance is the difference between the actual results and the expected results in the flexible budget for the actual units sold.

(True/False)

4.7/5  (41)

(41)

Showing 61 - 80 of 223

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)