Exam 7: Absorption, Variable and Throughput Costing

Exam 1: The Role of Accounting Information in Management Decision Making81 Questions

Exam 2: Cost Concepts, Behaviour and Estimation88 Questions

Exam 3: A Costing Framework and Cost Allocation45 Questions

Exam 4: Cost-Volume-Profit Cvp Analysis93 Questions

Exam 5: Job Costing Systems45 Questions

Exam 6: Process Costing Systems93 Questions

Exam 7: Absorption, Variable and Throughput Costing102 Questions

Exam 8: Activity Analysis: Costing and Management96 Questions

Exam 9: Relevant Costs for Decision Making122 Questions

Exam 10: Standard Costs, Flexible Budgets and Variance Analysis104 Questions

Exam 11: Operational Budgets87 Questions

Exam 12: Strategy and Control35 Questions

Exam 13: Planning and Budgeting for Strategic Success45 Questions

Exam 14: Capital Budgeting and Strategic Investment Decisions93 Questions

Exam 15: The Strategic Management of Costs and Revenues109 Questions

Exam 16: Strategic Management Control: a Lean Perspective46 Questions

Exam 17: Responsibility Accounting, Performance Evaluation and Transfer Pricing63 Questions

Exam 18: The Balanced Scorecard and Strategy Maps83 Questions

Exam 19: Rewards, Incentives and Risk Management45 Questions

Exam 20: Sustainability Management Accounting45 Questions

Select questions type

Exeter Ltd. introduced a new mass-produced specialty product early in the year. Production and sales of this product for the first four months are as follows: The firm's budgeted fixed overhead is $200,000, and budgeted output is 1,000 units per month. The volume variance, if any, is carried forward month-by-month and closed at the end of the year. When 1,000 units are produced and sold, expected monthly operating profit is $40,000.

In which month(s) was variable costing profit lower than absorption costing profit?

(Multiple Choice)

4.7/5  (43)

(43)

Shipp Ltd. budgets the following costs for a normal monthly volume of 500 units selling for $4,000 each. The product cost per unit using variable costing is

(Multiple Choice)

4.9/5  (43)

(43)

Bella Ltd has operated for 2 years. During that time it produced 1,000 units in year 1 and 800 in year 2, while sales were 800 units in year 1 and 900 in year 2. Variable production costs were $8 per unit during both years. The company uses last-in, first-out (LIFO) for inventory costing. The absorption costing income statements for these 2 years were: Ending inventory for year 2 using variable costing would be

(Multiple Choice)

5.0/5  (49)

(49)

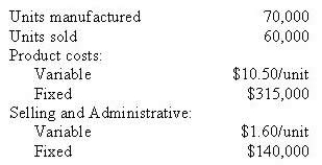

During its first year of operations, Kima Ltd. experienced the following:  The amount of variable costs deducted from revenues under the variable costing approach would be

The amount of variable costs deducted from revenues under the variable costing approach would be

(Multiple Choice)

5.0/5  (37)

(37)

Rubble Ltd develops an annual overhead budget at the start of each year (which has remained unchanged for the last 2 years), and closes any over- or underapplied overhead at year-end. For the firm's single product the following ending inventory levels have been experienced during the last 7 months:  For how many months would variable costing profit be higher than absorption?

For how many months would variable costing profit be higher than absorption?

(Multiple Choice)

4.8/5  (37)

(37)

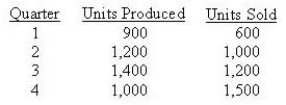

General Ltd. budgeted fixed overhead costs of $25,000 per quarter and 1,000 units per quarter in its normal absorption costing system. Any volume variance is carried forward and closed at year end. The company experienced the following activity: The volume variance for the year was

(Multiple Choice)

4.8/5  (40)

(40)

PFA Ltd uses a throughput costing system and reported the following information for its first month of operations: Units produced…………………………………..140

Units sold………………………………………..120

Material cost per unit produced……………….$3.50

Conversion cost per unit produced……………$6.50

Fixed period costs per unit produced………….$6.00

Variable period costs per unit produced………$4.00

Selling price per unit…………………………$25.00

Under which of the following costing methods would PFA report the highest operating profit?

(Multiple Choice)

4.8/5  (43)

(43)

Variable costing income statements include fixed manufacturing overhead as part of the costs of ending inventory.

(True/False)

4.9/5  (38)

(38)

Normal capacity and budgeted capacity are demand-based capacity measurements.

(True/False)

4.9/5  (38)

(38)

Taylor Ltd just finished its second year of operations. In the first year it produced 1,000 units and sold 400. The second year resulted in the same production level, but sales were 1,200 units. The variable costing income statements for both years are shown below: The operating profit for year 1 using absorption costing would be

(Multiple Choice)

4.9/5  (34)

(34)

Bella Ltd has operated for 2 years. During that time it produced 1,000 units in year 1 and 800 in year 2, while sales were 800 units in year 1 and 900 in year 2. Variable production costs were $8 per unit during both years. The company uses last-in, first-out (LIFO) for inventory costing. The absorption costing income statements for these 2 years were: Operating profit for year 1 using variable costing would be

(Multiple Choice)

4.8/5  (38)

(38)

Throughput costing assumes that product costs other than materials tend to be fixed in the short run.

(True/False)

4.9/5  (39)

(39)

Taylor Ltd just finished its second year of operations. In the first year it produced 1,000 units and sold 400. The second year resulted in the same production level, but sales were 1,200 units. The variable costing income statements for both years are shown below: The operating profit for year 2 using absorption costing would be

(Multiple Choice)

4.9/5  (43)

(43)

General Ltd. budgeted fixed overhead costs of $25,000 per quarter and 1,000 units per quarter in its normal absorption costing system. Any volume variance is carried forward and closed at year end. The company experienced the following activity:  The volume variance was favorable in quarter(s)?

The volume variance was favorable in quarter(s)?

(Multiple Choice)

4.7/5  (44)

(44)

Under generally accepted accounting principles, absorption costing is used for

(Multiple Choice)

4.9/5  (36)

(36)

Direct materials costs are treated similarly under variable costing and throughput costing.

(True/False)

4.9/5  (47)

(47)

Because absorption costing capitalises fixed manufacturing overhead costs to inventory, managers using it may build up inventories unnecessarily.

(True/False)

4.8/5  (41)

(41)

Which of the following are demand-based capacity levels? I Normal capacity

II Budgeted capacity

III Practical capacity

(Multiple Choice)

4.9/5  (43)

(43)

Showing 81 - 100 of 102

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)