Exam 7: Absorption, Variable and Throughput Costing

Exam 1: The Role of Accounting Information in Management Decision Making81 Questions

Exam 2: Cost Concepts, Behaviour and Estimation88 Questions

Exam 3: A Costing Framework and Cost Allocation45 Questions

Exam 4: Cost-Volume-Profit Cvp Analysis93 Questions

Exam 5: Job Costing Systems45 Questions

Exam 6: Process Costing Systems93 Questions

Exam 7: Absorption, Variable and Throughput Costing102 Questions

Exam 8: Activity Analysis: Costing and Management96 Questions

Exam 9: Relevant Costs for Decision Making122 Questions

Exam 10: Standard Costs, Flexible Budgets and Variance Analysis104 Questions

Exam 11: Operational Budgets87 Questions

Exam 12: Strategy and Control35 Questions

Exam 13: Planning and Budgeting for Strategic Success45 Questions

Exam 14: Capital Budgeting and Strategic Investment Decisions93 Questions

Exam 15: The Strategic Management of Costs and Revenues109 Questions

Exam 16: Strategic Management Control: a Lean Perspective46 Questions

Exam 17: Responsibility Accounting, Performance Evaluation and Transfer Pricing63 Questions

Exam 18: The Balanced Scorecard and Strategy Maps83 Questions

Exam 19: Rewards, Incentives and Risk Management45 Questions

Exam 20: Sustainability Management Accounting45 Questions

Select questions type

Variable costing data can often be used for making non-routine operating decisions.

(True/False)

4.9/5  (40)

(40)

Absorption costing will produce a larger operating profit than variable costing if

(Multiple Choice)

4.9/5  (45)

(45)

Total production overhead is treated as a product cost when using

(Multiple Choice)

4.7/5  (38)

(38)

Brady Ltd uses a normal absorption costing system in which the overhead rate and variable manufacturing costs have remained unchanged for the last 2 years. During the current year the following activity occurred: The firm had no beginning or ending work in process inventories. However, there were 1,000 units in beginning finished goods.

The sales revenue for the year was

(Multiple Choice)

4.8/5  (36)

(36)

During its first year of operations, Kima Ltd. experienced the following: The cost of goods sold under absorption costing would be

(Multiple Choice)

4.9/5  (42)

(42)

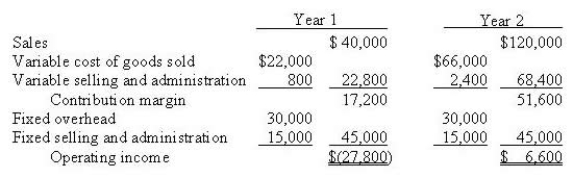

Taylor Ltd just finished its second year of operations. In the first year it produced 1,000 units and sold 400. The second year resulted in the same production level, but sales were 1,200 units. The variable costing income statements for both years are shown below:  The product cost per unit during year 1 using absorption would be

The product cost per unit during year 1 using absorption would be

(Multiple Choice)

4.7/5  (34)

(34)

Throughput costing was an outgrowth of the Theory of Constraints.

(True/False)

4.8/5  (39)

(39)

Absorption costing statements conform to generally accepted accounting principles.

(True/False)

4.8/5  (39)

(39)

Brady Ltd uses a normal absorption costing system in which the overhead rate and variable manufacturing costs have remained unchanged for the last 2 years. During the current year the following activity occurred: The firm had no beginning or ending work in process inventories. However, there were 1,000 units in beginning finished goods.

If variable costing had been used, the cost of goods sold would be:

(Multiple Choice)

4.8/5  (42)

(42)

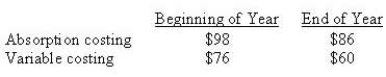

Philpott's operating profit using absorption costing is $100. Its inventories using both absorption and variable costing are as follows:  Under variable costing, operating profit would be:

Under variable costing, operating profit would be:

(Multiple Choice)

4.8/5  (31)

(31)

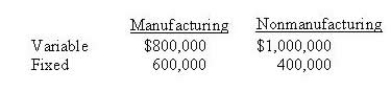

Shipp Ltd. budgets the following costs for a normal monthly volume of 500 units selling for $4,000 each.  The product cost per unit using absorption costing is

The product cost per unit using absorption costing is

(Multiple Choice)

4.9/5  (33)

(33)

"Cost" and "expense" are two terms for describing the same concept.

(True/False)

4.8/5  (43)

(43)

PFA Ltd uses a throughput costing system and reported the following information for its first month of operations: Units produced…………………………………..140

Units sold………………………………………..120

Material cost per unit produced……………….$3.50

Conversion cost per unit produced……………$6.50

Fixed period costs per unit produced………….$6.00

Variable period costs per unit produced………$4.00

Selling price per unit…………………………$25.00

PFA's throughput costing operating profit will be

(Multiple Choice)

4.8/5  (29)

(29)

Under which costing method(s) are administrative and selling costs considered period expenses? I Absorption costing

II Throughput costing

III Variable costing

(Multiple Choice)

4.8/5  (38)

(38)

Improved information technology has increased the availability of variable costing and throughput costing income statements.

(True/False)

4.9/5  (33)

(33)

Supply-based capacity levels include I Normal capacity

II Practical capacity

III Theoretical capacity

(Multiple Choice)

4.8/5  (34)

(34)

In throughput costing, direct labor and variable overhead are treated as

(Multiple Choice)

4.7/5  (35)

(35)

Showing 41 - 60 of 102

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)