Exam 7: Performance Evaluation Using Variances From Standard Costs

Exam 1: Managerial Accounting Concepts and Principles201 Questions

Exam 2: Job Order Costing195 Questions

Exam 3: Process Cost Systems198 Questions

Exam 4: Cost Behavior and Cost-Volume-Profit Analysis225 Questions

Exam 5: Variable Costing for Management Analysis160 Questions

Exam 6: Budgeting197 Questions

Exam 7: Performance Evaluation Using Variances From Standard Costs175 Questions

Exam 8: Performance Evaluation for Decentralized Operations218 Questions

Exam 9: Differential Analysis, Product Pricing, and Activity-Based Costing175 Questions

Exam 10: Capital Investment Analysis190 Questions

Exam 11: Cost Allocation and Activity-Based Costing110 Questions

Exam 12: Lean Principles, Lean Accounting, and Activity Analysis137 Questions

Exam 13: Statement of Cash Flows189 Questions

Exam 14: Financial Statement Analysis198 Questions

Select questions type

The fact that workers are unable to meet a properly determined direct labor standard is sufficient cause to change the standard.

(True/False)

4.8/5  (30)

(30)

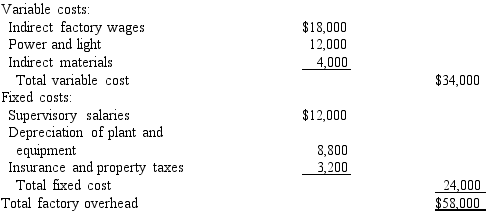

The Finishing Department of Pinnacle Manufacturing Co.prepared the following factory overhead cost budget for October of the current year, during which it expected to operate at a 100% capacity of 10,000 machine hours.

During October, the plant was operated for 9,000 machine hours and the factory overhead costs incurred were as follows: indirect factory wages, $16,400; power and light, $10,000; indirect materials, $3,000; supervisory salaries, $12,000; depreciation of plant and equipment, $8,800; insurance and property taxes, $3,200.

Prepare a factory overhead cost variance report for October.The budgeted amounts for actual amount produced should be based on 9,000 machine hours.

During October, the plant was operated for 9,000 machine hours and the factory overhead costs incurred were as follows: indirect factory wages, $16,400; power and light, $10,000; indirect materials, $3,000; supervisory salaries, $12,000; depreciation of plant and equipment, $8,800; insurance and property taxes, $3,200.

Prepare a factory overhead cost variance report for October.The budgeted amounts for actual amount produced should be based on 9,000 machine hours.

(Essay)

4.8/5  (44)

(44)

Rosser Company produces a container that requires 4 yards of material per unit.The standard price of one yard of material is $4.50.During the month, 9,500 chairs were manufactured using 37,300 yards of material.

Journalize the entry to record the standard direct materials used in production.

(Essay)

4.8/5  (39)

(39)

Standard and actual costs for direct materials for the manufacture of 1,000 units of product were as follows:

Actual costs 1,550 lbs.at $9.10

Standard costs 1,600 lbs.at $9.00

Determine the direct materials a quantity variance, b price variance, and c total cost variance.

(Essay)

4.8/5  (38)

(38)

If employees are given bonuses for exceeding normal standards, the standards may be very effective in motivating employees.

(True/False)

4.8/5  (41)

(41)

Standard and actual costs for direct labor for the manufacture of 1,000 units of product were as follows:

Actual costs 950 hours at $37

Standard costs 975 hours at $36

Determine the direct labor a time variance, b rate variance, and c total direct labor cost variance.

(Essay)

4.8/5  (34)

(34)

Match the following descriptions with the term a-e it describes:

-an example is the number of customer complaints

(Multiple Choice)

4.9/5  (43)

(43)

Myers Corporation has the following data related to direct materials costs for November: actual costs for 5,000 pounds of material, $4.50; And standard costs for 4,800 pounds of material at $5.10 per pound. What is the direct materials price variance?

(Multiple Choice)

4.8/5  (40)

(40)

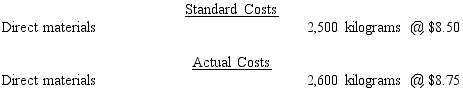

The standard costs and actual costs for direct materials for the manufacture of 2,500 actual units of product are  The amount of the direct materials quantity variance is

The amount of the direct materials quantity variance is

(Multiple Choice)

4.8/5  (40)

(40)

If the standard to produce a given amount of product is 2,000 units of direct materials at $12 and the actual was 1,600 units at $13, the direct materials quantity variance was $5,200 favorable.

(True/False)

5.0/5  (39)

(39)

A company records inventory purchases at standard cost and also records purchase price variances.Prepare the journal entry for a purchase of 6,000 widgets that were bought at $8.00 and have a standard cost of $8.15.

(Essay)

4.9/5  (38)

(38)

A company should only use nonfinancial performance measures when financial measures cannot be calculated.

(True/False)

4.9/5  (48)

(48)

Tippi Company produces lamps that require 2.25 standard hours per unit at an hourly rate of $15.00 per hour.Production of 7,700 units required 17,550 hours at an hourly rate of $15.20 per hour.

What is the direct labor a rate variance, b time variance, and c total cost variance?

(Essay)

5.0/5  (38)

(38)

Match the following formulas or descriptions with the term a-e it defines.

-Actual price - Standard price × Actual quantity

(Multiple Choice)

4.9/5  (27)

(27)

Standard costs are used in companies for a variety of reasons.Which of the following is not one of the benefits for using standard costs?

(Multiple Choice)

4.8/5  (36)

(36)

Using the following information, prepare a factory overhead flexible budget for Jacob Company where the total factory overhead cost is $206,500 at normal capacity 100%.Include capacity at 60%, 80%, 100%, and 120%.Total variable cost is $15.25 per unit and total fixed costs are $54,000.The information is for month ended October

(Essay)

4.9/5  (32)

(32)

Showing 21 - 40 of 175

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)