Exam 6: Estimating the Costs of Products and Inventory

Exam 1: Management Accounting in Context200 Questions

Exam 2: Different Costs for Different Purposes325 Questions

Exam 3: Determining How Costs Behave182 Questions

Exam 4: Costvolumeprofit Analysis211 Questions

Exam 5: Estimating the Cost of Producing Services100 Questions

Exam 6: Estimating the Costs of Products and Inventory356 Questions

Exam 7: Target Costing, Managing Activities and Managing Capacity155 Questions

Exam 8: Activity-Based Management and Activity-Based Costing230 Questions

Exam 9: Pricing and Customer Profitability171 Questions

Exam 10: Decision Making and Relevant Information211 Questions

Exam 11: Budgeting, Management Control and Responsibility Accounting215 Questions

Exam 12: Flexible Budgets, Direct Cost Variances and Management Control246 Questions

Exam 13: Flexible Budgets, Overhead Cost Variances and Management Control170 Questions

Exam 14: Allocation of Support-Department Costs, Common Costs and Revenues137 Questions

Exam 15: Strategy Formation, Strategic Control and the Balanced Scorecard157 Questions

Exam 16: Quality, Time and the Balanced Scorecard120 Questions

Exam 17: Inventory Management, Just-In-Time and Simplified Costing Methods126 Questions

Exam 18: Capital Budgeting and Cost Analysis140 Questions

Exam 19: Management Control Systems, Transfer Pricing and Multinational Considerations140 Questions

Exam 20: Performance Measurement, Compensation and Multinational Considerations140 Questions

Exam 21: Measuring and Reporting Sustainability50 Questions

Select questions type

On occasion,the FIFO and the weighted-average methods of process costing will result in the same dollar amount of costs being transferred to the next department.Which of the following scenarios would have that result?

(Multiple Choice)

4.9/5  (38)

(38)

Pet Products Company uses an automated process to manufacture its pet replica products.For June,the company had the following activities:

Beginning work-in-process inventory 4500 items, 1/4 complete Units placed in production 15000 units Units completed 17500 units Ending work-in-process inventory 2000 items, 3/4 complete Cost of beginning work in process \ 5250 Direct material costs, current \ 16500 Conversion costs, current \ 23945

Direct materials are placed into production at the beginning of the process and conversion costs are incurred evenly throughout the process.

Required:

Prepare a production cost worksheet using the FIFO method.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

(Essay)

4.8/5  (45)

(45)

In a normal costing system,which of the following is TRUE about the Manufacturing Overhead Control account?

Variant question

(Multiple Choice)

4.9/5  (40)

(40)

Answer the following questions using the information below:

The Townsend Tractor Company manufactures small garden tractors on a highly automated assembly line.Its costing system uses two cost categories,direct materials and conversion costs.Each tractor must pass through the Assembly Department and the Testing Department.Direct materials are added at the beginning of the production process.

Conversion costs are allocated evenly throughout production.Townsend Tractor uses weighted-average costing.

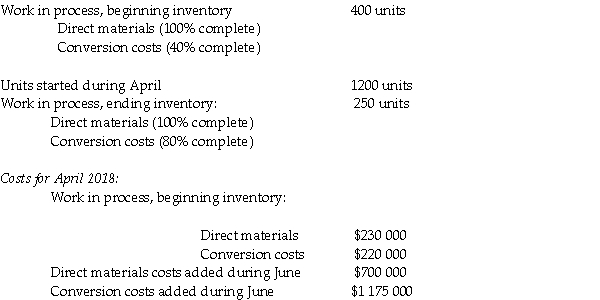

Data for the Assembly Department for April 2018 are:

-What amount of conversion costs are assigned to the ending Work-in-Process account for April?

-What amount of conversion costs are assigned to the ending Work-in-Process account for April?

(Multiple Choice)

4.7/5  (36)

(36)

A manager can increase operating profit by deferring maintenance beyond the current accounting period when absorption costing is used.

(True/False)

4.8/5  (36)

(36)

Which of the following cost(s)are inventoried when using absorption costing?

(Multiple Choice)

4.9/5  (40)

(40)

The weighted-average cost is the total of all costs entering the Work-in-Process account (whether they are from beginning work in process or from work started during the current period)divided by total equivalent units of work done to date.

(True/False)

4.8/5  (33)

(33)

Answer the following questions using the information below:

Healesville Animates produces and sells a luxury animal pillow for $40.00 per unit.In the first month of operation,3000 units were produced and 2250 units were sold.Actual fixed costs are the same as the amount budgeted for the month.Other information for the month includes:

Variable manufacturing costs \ 19 per unit Variable marketing costs \ 1 per unit Fixed manufacturing costs \ 30000 per month Administrative expenses, all fixed \ 6000 per month Ending inventories: Direct materials -0- WIP -0- Finished goods 750 units

-________ is a method of inventory costing in which all variable and fixed manufacturing costs are included as inventoriable costs.

(Multiple Choice)

4.8/5  (32)

(32)

Answer the following questions using the information below:

Healesville Animates produces and sells a luxury animal pillow for $40.00 per unit.In the first month of operation,3000 units were produced and 2250 units were sold.Actual fixed costs are the same as the amount budgeted for the month.Other information for the month includes:

Variable manufacturing costs \ 19 per unit Variable marketing costs \ 1 per unit Fixed manufacturing costs \ 30000 per month Administrative expenses, all fixed \ 6000 per month Ending inventories: Direct materials -0- WIP -0- Finished goods 750 units

-Bradman Corporation has reported operating profit of $30 000 and a fixed overhead cost rate is $20 per unit for the current accounting period.Under absorption costing,if this company now produces an additional 100 units of inventory,then operating profit:

(Multiple Choice)

4.9/5  (37)

(37)

Gross margin percentage can be used to compare the profitability of different jobs.

(True/False)

4.9/5  (33)

(33)

The Wynnum Corporation was recently formed to produce a semiconductor chip that forms an essential part of the personal computer manufactured by a major corporation.The direct materials are added at the start of the production process while conversion costs are added uniformly throughout the production process.June is Wynnum's first month of operations,and therefore,there was no beginning inventory.Direct materials cost for the month totalled $895 000,while conversion costs equalled $4 225 000.Accounting records indicate that 475 000 chips were started in June and 425 000 chips were completed.

Ending inventory was 50% complete as to conversion costs.

Required:

a.What is the total manufacturing cost per chip for June?

b.Allocate the total costs between the completed chips and the chips in ending inventory.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

(Essay)

4.8/5  (37)

(37)

Universal Industries operates a division in Zimbabwe,a country with very high inflation rates.Traditionally,the company has used the same costing techniques in all countries to facilitate reporting to corporate headquarters.However,the financial accounting reports from Zimbabwe never seem to match the actual unit results of the division.Management has studied the problem and it appears that beginning inventories may be the cause of the unmatched information.The reason for this is that the inventories have a different financial base because of the severe inflation.

Required:

How can process costing assist in addressing the problem facing Universal Industries?

_____________________________________________________________________________________________

_____________________________________________________________________________________________

(Essay)

4.8/5  (40)

(40)

Which of the following statements about normal costing is TRUE?

(Multiple Choice)

4.9/5  (31)

(31)

Why do we need to accumulate and calculate unit costs in process costing (and also job costing)?

_____________________________________________________________________________________________

_____________________________________________________________________________________________

(Essay)

5.0/5  (37)

(37)

Normal costing assigns indirect costs based on an actual indirect-cost rate.

(True/False)

4.9/5  (35)

(35)

Describe job-costing and process-costing systems.Explain when it would be appropriate to use each.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

(Essay)

4.9/5  (33)

(33)

What amount of conversion costs are assigned to the ending Work-in-Process account for June?

(Multiple Choice)

4.7/5  (29)

(29)

Normandeau Company's actual manufacturing overhead is $1 400 000.Overhead is allocated on the basis of direct labour hours which were 25 000 for the period.What is the manufacturing overhead rate?

(Multiple Choice)

4.8/5  (36)

(36)

Answer the following questions using the information below:

Wangaratta Corporation incurred fixed manufacturing costs of $6000 during 2018.Other information for 2018 includes:

The budgeted denominator level is 1000 units.

Units produced total 750 units.

Units sold total 600 units.

Beginning inventory was zero.

The company uses absorption costing and the fixed manufacturing cost rate is based on the budgeted denominator level.Manufacturing variances are closed to cost of goods sold.

-Fixed manufacturing costs included in ending inventory total:

(Multiple Choice)

4.8/5  (40)

(40)

The budgeted indirect cost rate is the budgeted indirect costs divided by budgeted quantity of the cost-allocation base.

(True/False)

4.9/5  (37)

(37)

Showing 101 - 120 of 356

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)