Exam 10: Partnerships: Formation, Operation, and Basis

Which of the following would be currently taxable as ordinary income to the service partner if received in exchange for services performed for the partnership? (In all cases, assume the interest is not sold within two years after the time it is granted to the service partner.)

C

Palmer contributes property with a fair market value of $4,000,000 and an adjusted basis of $3,000,000 to AP Partnership. Palmer shares in $1,000,000 of partnership debt under the liability sharing rules, giving him an initial adjusted basis for his partnership interest of $4,000,000. One month after the contribution, Palmer receives a cash distribution from the partnership of $2,000,000. Palmer would not have contributed the property if the partnership had not contractually obligated itself to make the distribution. Assume Palmer's share of partnership liabilities will not change as a result of this distribution.

a. Under the IRS's likely treatment of this transaction, what is the amount of gain or loss that Palmer will recognize because of the $2,000,000 cash distribution?

b. What is the partnership's basis for the property after the distribution?

c. If Palmer is unhappy with this result, can you suggest a possible alternative that may provide him with a better answer?

d. Palmer will likely recognize a $500,000 [($4,000,000 - $3,000,000) × 50% ] gain on the transaction. Palmer received a cash payment equal to one-half the value of the property he contributed. The IRS would likely treat this as a disguised sale of the property. A disguised sale is presumed to occur when a contractual agreement requires a contribution by a partner to be followed within two years by a specified distribution by the partnership, and the distribution is made without regard to partnership profits. Both these issues occur in this scenario. While Palmer could argue that the intent of this transaction is not to create a disguised sale, it is doubtful that he would be successful.

e. The partnership's total basis for the property is $3,500,000. Its basis for the purchased property is the $2,000,000 cost of the property (the partnership is deemed to have paid for the property). In addition, the partnership has a $1,500,000 carryover basis for the portion of the property that was not "purchased."

f. If Palmer can wait for more than two years to receive the distribution and if the distribution is not contractually guaranteed, the contribution and distribution transactions will be presumed not to be a disguised sale. The distribution will be treated as a normal distribution that will not create capital gain for Palmer unless the distribution amount exceeds the adjusted basis for his partnership interest when the distribution is made.

On a corporate Form 1120, Schedule M-1 (or M-3) is used to reconcile book and tax income, and Schedule M-2 reconciles retained earnings to the amounts shown on Schedule L. How are these reconciliations accomplished on a partnership return? What additional information must be provided?

A partnership is not a taxpaying entity and does not report taxable income, per se. On Form 1065, the Analysis of Income (Loss) schedule (page 5) accumulates the partnership's equivalent of taxable income based on the various income and deductions reported on the partnership's Schedule K (page 4). This taxable income equivalent is reconciled to book income on Schedules M-1 and M-3.

On Schedule L, the partnership reports partners' capital using a "book" method, such as GAAP, "§ 704(b) book," or the tax basis, depending on the method the partnership uses for any financial reporting. On Schedule M2, the partnership reports partners' capital using the same method it uses to prepare the partners' capital accounts on the partners' Schedules K1. If these methods differ, the partnership should provide a schedule reconciling the two methods of reporting partners' capital.

Match each of the following statements with the terms below that provide the best definition.

a. Organizational choice of many large accounting firms.

b. Partner's percentage allocation of current operating income.

c. Might affect any two partners' tax liabilities in different ways.

d. Brokerage and registration fees incurred for promoting and marketing partnership interests.

e. Transfer of asset to partnership followed by immediate distribution of cash to partner.

f. Must have at least one general and one limited partner.

g. All partners are jointly and severally liable for entity debts.

h. Theory treating the partner and partnership as separate economic units.

i. Partner's basis in partnership interest after taxfree contribution of asset to partnership.

j. Partnership's basis in asset after taxfree contribution of asset to partnership.

k. Owners are "members."

l. Theory treating the partnership as a collection of taxpayers joined in an agency relationship.

m. Allows many unincorporated entities to select their Federal tax status.

n. No correct match provided.

-Syndication costs

In which of the following independent situations would the transaction most likely be characterized as a disguised sale?

Match each of the following statements with the terms below that provide the best definition.

a. Organizational choice of many large accounting firms.

b. Partner's percentage allocation of current operating income.

c. Might affect any two partners' tax liabilities in different ways.

d. Brokerage and registration fees incurred for promoting and marketing partnership interests.

e. Transfer of asset to partnership followed by immediate distribution of cash to partner.

f. Must have at least one general and one limited partner.

g. All partners are jointly and severally liable for entity debts.

h. Theory treating the partner and partnership as separate economic units.

i. Partner's basis in partnership interest after taxfree contribution of asset to partnership.

j. Partnership's basis in asset after taxfree contribution of asset to partnership.

k. Owners are "members."

l. Theory treating the partnership as a collection of taxpayers joined in an agency relationship.

m. Allows many unincorporated entities to select their Federal tax status.

n. No correct match provided.

-Separately stated item

In the current year, Derek formed an equal partnership with Cody. Derek contributed land with an adjusted basis of $110,000 and a fair market value of $200,000. Derek also contributed $50,000 cash to the partnership. Cody contributed land with an adjusted basis of $80,000 and a fair market value of $230,000. The land contributed by Derek was encumbered by a $60,000 nonrecourse debt. The land contributed by Cody was encumbered by $40,000 of nonrecourse debt. Assume the partners share debt equally. Immediately after the formation, what is the basis of Cody's partnership interest?

Match each of the following statements with the terms below that provide the best definition.

a. Organizational choice of many large accounting firms.

b. Partner's percentage allocation of current operating income.

c. Might affect any two partners' tax liabilities in different ways.

d. Brokerage and registration fees incurred for promoting and marketing partnership interests.

e. Transfer of asset to partnership followed by immediate distribution of cash to partner.

f. Must have at least one general and one limited partner.

g. All partners are jointly and severally liable for entity debts.

h. Theory treating the partner and partnership as separate economic units.

i. Partner's basis in partnership interest after taxfree contribution of asset to partnership.

j. Partnership's basis in asset after taxfree contribution of asset to partnership.

k. Owners are "members."

l. Theory treating the partnership as a collection of taxpayers joined in an agency relationship.

m. Allows many unincorporated entities to select their Federal tax status.

n. No correct match provided.

-Substituted

A partnership's allocations of income and deductions to the partners are required to be proportionate to the partners' percentage ownership of partnership capital in order to meet the substantial economic effect tests.

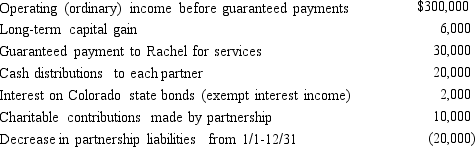

An examination of the RB Partnership's tax books provides the following information for the current year:

Rachel is a 30% general partner in partnership capital, profits, and losses. Assume the adjusted basis of her partnership interest is $60,000 at the beginning of the year, and she shares in 30% of the partnership's liabilities for basis purposes.

a. What is Rachel's adjusted basis for the partnership interest at the end of the year?

b. How much income must Rachel report on her tax return for the current year? What is the character of the income and what types of tax might apply to it?

Rachel is a 30% general partner in partnership capital, profits, and losses. Assume the adjusted basis of her partnership interest is $60,000 at the beginning of the year, and she shares in 30% of the partnership's liabilities for basis purposes.

a. What is Rachel's adjusted basis for the partnership interest at the end of the year?

b. How much income must Rachel report on her tax return for the current year? What is the character of the income and what types of tax might apply to it?

Sharon contributed property to the newly formed QRST Partnership. The property had a $100,000 adjusted basis to Sharon and a $160,000 fair market value on the contribution date. The property was also encumbered by a $120,000 nonrecourse debt, which was transferred to the partnership on that date. Another partner, Rochelle, shares 30% of the partnership income, gain, loss, deduction, and credit. Under IRS regulations, Rochelle's share of the nonrecourse debt for basis purposes is:

Alicia and Barry form the AB Partnership at the start of the current year with a land contribution by Barry and a cash contribution by Alicia. Barry's contributed property is subject to a recourse mortgage assumed by the partnership. Barry has an 80% interest in AB's profits and losses. The land has been held by Barry for the past 6 years as an investment. It will be used by AB as an operating asset in its parking lot business. Which of the following statements is correct?

Seven years ago, Paul purchased residential rental estate that he has been depreciating as MACRS property over 27.5 years. This year, when his adjusted basis in the property was $250,000, Paul transferred the property to the newly formed PLA LLC in exchange for a one-third interest in the LLC. PLA incurred $10,000 of transfer taxes and fees related to the property. PLA must treat the $260,000 basis in the property, fees, and expenses, as new MACRS property depreciable over 27.5 years.

Match each of the following statements with the terms below that provide the best definition.

a. Adjusted basis of each partnership asset.

b. Operating expenses incurred after entity is formed but before it begins doing business.

c. Each partner's basis in the partnership.

d. Reconciles book income to "taxable income."

e. Tax accounting election made by partnership.

f. Tax accounting calculation made by partner.

g. Tax accounting election made by partner.

h. Does not include liabilities.

i. Designed to prevent excessive deferral of taxation of partnership income.

j. Amount that may be received by partner for performance of services for the partnership.

k. Computation that determines the way recourse debt is shared.

l. Will eventually be allocated to partner making tax-free property contribution to partnership.

m. Partner's share of partnership items.

n. Must generally be satisfied by any allocation to the partners.

o. Justification for a tax year other than the required taxable year.

p. No correct match is provided.

-Guaranteed payment

Match each of the following statements with the terms below that provide the best definition.

a. Organizational choice of many large accounting firms.

b. Partner's percentage allocation of current operating income.

c. Might affect any two partners' tax liabilities in different ways.

d. Brokerage and registration fees incurred for promoting and marketing partnership interests.

e. Transfer of asset to partnership followed by immediate distribution of cash to partner.

f. Must have at least one general and one limited partner.

g. All partners are jointly and severally liable for entity debts.

h. Theory treating the partner and partnership as separate economic units.

i. Partner's basis in partnership interest after taxfree contribution of asset to partnership.

j. Partnership's basis in asset after taxfree contribution of asset to partnership.

k. Owners are "members."

l. Theory treating the partnership as a collection of taxpayers joined in an agency relationship.

m. Allows many unincorporated entities to select their Federal tax status.

n. No correct match provided.

-Entity concept

JLK Partnership incurred $6,000 of organizational costs and $50,000 of startup costs in 2014. JKL may deduct $5,000 each of organizational and startup costs, and the remaining costs ($1,000 of organizational costs and $45,000 of startup costs) may be amortized over 60 months.

Sharon and Sue are equal partners in the S&S Partnership. On January 1 of the current year, each partner's adjusted basis in S&S was $80,000 (including each partner's $20,000 share of the partnership's $40,000 of liabilities). During the current year, S&S repaid $30,000 of the debt and borrowed $20,000 for which Sharon and Sue are equally liable. In the current year ended December 31, S&S also sustained a net operating loss of $40,000 and earned $10,000 of interest income from investments. If liabilities are shared equally by the partners, on January 1 of the next year how much is each partner's basis in her interest in S&S?

Match each of the following statements with the terms below that provide the best definition.

a. Adjusted basis of each partnership asset.

b. Operating expenses incurred after entity is formed but before it begins doing business.

c. Each partner's basis in the partnership.

d. Reconciles book income to "taxable income."

e. Tax accounting election made by partnership.

f. Tax accounting calculation made by partner.

g. Tax accounting election made by partner.

h. Does not include liabilities.

i. Designed to prevent excessive deferral of taxation of partnership income.

j. Amount that may be received by partner for performance of services for the partnership.

k. Computation that determines the way recourse debt is shared.

l. Will eventually be allocated to partner making tax-free property contribution to partnership.

m. Partner's share of partnership items.

n. Must generally be satisfied by any allocation to the partners.

o. Justification for a tax year other than the required taxable year.

p. No correct match is provided.

-Outside basis

Tara and Robert formed the TR Partnership four years ago. Because they decided the company needed some expertise in multimedia presentations, they offered Katie a 1/3 interest in partnership capital if she would come to work for the partnership. She will also receive a 25% interest in future partnership profits. On July 1 of the current year, the unrestricted partnership capital interest (fair market value of $25,000) was transferred to Katie. How should Katie treat the receipt of the partnership interest in the current year?

On the formation of a partnership, when might a "disguised sale" occur? How can this treatment be avoided?

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)