Exam 13: Comparative Forms of Doing Business

Exam 1: Understanding and Working With the Federal Tax Law68 Questions

Exam 2: Corporations: Introduction and Operating Rules113 Questions

Exam 3: Corporations: Special Situations110 Questions

Exam 4: Corporations: Organization and Capital Structure93 Questions

Exam 5: Corporations: Earnings Profits and Dividend Distributions98 Questions

Exam 6: Corporations: Redemptions and Liquidations112 Questions

Exam 7: Corporations: Reorganizations116 Questions

Exam 8: Consolidated Tax Returns141 Questions

Exam 9: Taxation of International Transactions149 Questions

Exam 10: Partnerships: Formation, operation, and Basis99 Questions

Exam 11: Partnerships: Distributions, transfer of Interests, and Terminations97 Questions

Exam 12: S: Corporations154 Questions

Exam 13: Comparative Forms of Doing Business141 Questions

Exam 14: Taxes on the Financial Statements87 Questions

Exam 15: Exempt Entities145 Questions

Exam 16: Multistate Corporate Taxation145 Questions

Exam 17: Tax Practice and Ethics152 Questions

Exam 18: The Federal Gift and Estate Taxes170 Questions

Exam 19: Family Tax Planning149 Questions

Exam 20: Income Taxation of Trusts and Estates150 Questions

Select questions type

Which of the following are "reasonable needs" that will help a corporation in avoiding the accumulated earnings tax?

(Multiple Choice)

4.9/5  (42)

(42)

The profits of a business owned by Taylor (60%)and Maggie (40%)for the current tax year are $100,000.If the business is a C corporation or an S corporation,there is no effect on Taylor's basis in her stock.If the business is a partnership or an LLC,Taylor's basis in her partnership interest or basis in her stock is increased by $60,000.

(True/False)

4.8/5  (35)

(35)

Lime,Inc. ,has taxable income of $334,000.If Lime is a C corporation,its tax liability must be either $113,510 [($50,000 ´ 15%)+ ($25,000 ´ 25%)+ ($25,000 ´ 34%)+ ($234,000 ´ 39%)] or $116,900.

(True/False)

4.8/5  (29)

(29)

Molly transfers land with an adjusted basis of $28,000 and a fair market value of $65,000 to the Sand Partnership for a 30% ownership interest.The land is encumbered by a mortgage of $18,000 which the partnership assumes.Her basis for her ownership interest is $10,000 ($28,000 - $18,000).

(True/False)

4.9/5  (41)

(41)

The § 469 passive activity loss rules do not apply to corporations other than S corporations.

(True/False)

4.7/5  (37)

(37)

Do the § 465 at-risk rules treat recourse debt and nonrecourse debt differently?

(Essay)

4.9/5  (36)

(36)

The AMT statutory rate for C corporations and for S corporation shareholders on the AMT base is 20%.

(True/False)

4.8/5  (34)

(34)

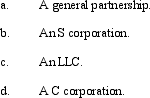

April is going to invest $200,000 in a business entity.She will manage the business entity.Her projected share of the loss for the first year is $50,000.April's marginal tax rate is 33%.Determine the cash flow benefit of the loss to April if the business form is:

(Essay)

4.9/5  (38)

(38)

Factors that should be considered in making the S corporation election for the current tax year include the following:

(Multiple Choice)

4.8/5  (31)

(31)

Gerald has a 30% ownership interest in a business for which his basis is $300,000.During the year,the entity earns profits of $90,000 and makes cash distributions to the owners of $50,000.How do these transactions affect Gerald's basis if:

(Essay)

4.8/5  (25)

(25)

If an individual contributes an appreciated personal use asset to a C corporation in a transaction which qualifies for nonrecognition treatment under § 351,the corporation's basis in the asset is the same as was the shareholder's adjusted basis.

(True/False)

4.7/5  (29)

(29)

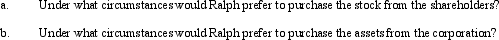

Ralph wants to purchase either the stock or the assets of Red,Inc. ,a C corporation.

(Essay)

4.8/5  (34)

(34)

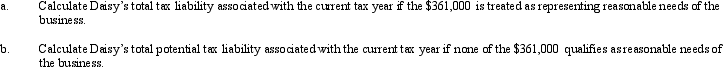

Daisy,Inc. ,has taxable income of $850,000 during 2012,its first year of operations.Daisy distributes dividends of $200,000 to its 10 shareholders (i.e. ,$20,000 each).Daisy earmarks $361,000 of its earnings for potential future expansion into other cities.

(Essay)

4.8/5  (47)

(47)

Aaron purchases a building for $500,000 which is going to be used by his wholly-owned corporation.Which of the following statements are correct?

(Multiple Choice)

4.9/5  (40)

(40)

Barb and Chuck each own one-half of the stock of Wren,Inc. ,a C corporation.Each shareholder has a stock basis of $175,000.Wren has accumulated E & P of $300,000.Wren's taxable income for the current year is $100,000,and it distributes $75,000 to each shareholder.Barb's stock basis at the end of the year is:

(Multiple Choice)

4.7/5  (30)

(30)

A limited partnership can indirectly avoid unlimited liability of the general partner if the general partner is a corporation.

(True/False)

5.0/5  (36)

(36)

If lease rental payments to a noncorporate shareholder-lessor are classified as unreasonable,the taxable income of a C corporation decreases and the gross income of the shareholder remains the same.

(True/False)

4.9/5  (36)

(36)

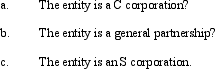

Of the corporate types of entities,all are subject to double taxation on current earnings.

(True/False)

4.7/5  (38)

(38)

Showing 101 - 120 of 141

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)