Exam 3: Organizing and Financing a New Venture

Exam 1: Introduction and Overview86 Questions

Exam 2: From the Idea to the Business Plan82 Questions

Exam 3: Organizing and Financing a New Venture79 Questions

Exam 4: Measuring Financial Performance68 Questions

Exam 5: Evaluating Financial Performance72 Questions

Exam 6: Financial Planning:short Term and Long Term66 Questions

Exam 7: Types and Costs of Financial Capital66 Questions

Exam 8: Securities Law Considerations When Obtaining Venture Financing77 Questions

Exam 9: Valuing Early-Stage Ventures62 Questions

Exam 10: Venture Capital Valuation Methods54 Questions

Exam 11: Professional Venture Capital57 Questions

Exam 12: Other Financing Alternatives59 Questions

Exam 13: Security Structures and Determining Enterprise Values57 Questions

Exam 14: Harvesting the Business Venture Investment66 Questions

Exam 15: Financially Troubled Ventures: Turnaround Opportunities67 Questions

Select questions type

"Trademarks" are intellectual property rights that allow firms to differentiate their products and services through the use of unique marks.

(True/False)

4.9/5  (36)

(36)

The marginal tax rate for the first dollar of taxable income is higher for corporations than for individuals.

(True/False)

4.9/5  (39)

(39)

Which of the following are intellectual property rights in the form of inventions and information such as formulas,processes,and customer lists that are not generally known to others and which convey economic advantage to the holders?

(Multiple Choice)

4.9/5  (42)

(42)

Based on 2009 tax schedules,the highest marginal tax rate on corporate taxable income is:

(Multiple Choice)

4.9/5  (43)

(43)

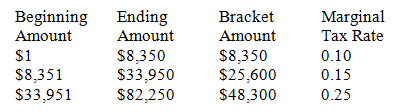

Following is a partial 2009 personal income tax schedule for a single filer:

Taxable Income

-The dollar amount of income taxes paid by a single filer who has taxable income of $8,350 would be:

-The dollar amount of income taxes paid by a single filer who has taxable income of $8,350 would be:

(Multiple Choice)

4.8/5  (34)

(34)

Which of the following are intellectual property rights granted for inventions that are useful,novel,and non-obvious?

(Multiple Choice)

4.8/5  (34)

(34)

The difference between a limited partnership and a general partnership is that the limited partnership has partners who actively manage the day-to-day operations but also has passive investors.

(True/False)

4.9/5  (33)

(33)

In which form of business organization is the taxation effects characterized by the income flowing to shareholders taxed at personal tax rates?

(Multiple Choice)

4.7/5  (37)

(37)

Patents,trade secrets,trademarks,and copyrights are intangible assets.

(True/False)

4.9/5  (34)

(34)

Based on 2009 tax schedules,the first dollar of corporate income is taxed at which of the following marginal tax rates:

(Multiple Choice)

4.8/5  (36)

(36)

Which of the following business organizational forms provides the owners with limited investor liability and passes its income before taxes through to the owners?

(Multiple Choice)

4.8/5  (38)

(38)

Professional corporations (PCs)and service corporations (SCs)are corporate structures that "states" provide for professionals such as physicians,dentists,lawyers,and accountants.

(True/False)

4.9/5  (44)

(44)

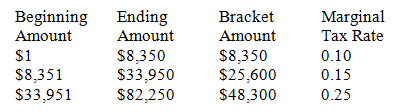

Following is a partial 2009 personal income tax schedule for a single filer:

Taxable Income

-The average tax rate for a single filer with taxable income of $82,250 would be:

-The average tax rate for a single filer with taxable income of $82,250 would be:

(Multiple Choice)

4.9/5  (30)

(30)

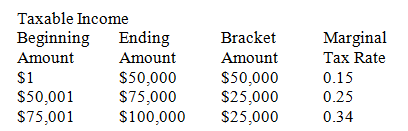

Following is a partial 2009 corporate income tax schedule:

-The average tax rate for a corporation with taxable income of $75,000 would be:

-The average tax rate for a corporation with taxable income of $75,000 would be:

(Multiple Choice)

4.9/5  (34)

(34)

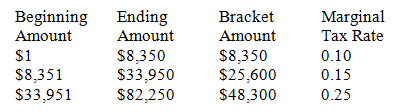

Following is a partial 2009 personal income tax schedule for a single filer:

Taxable Income

-The maximum dollar amount of income taxes in the $33,951-$82,250 "bracket" paid by a single filer with taxable income of $77,100 would be:

-The maximum dollar amount of income taxes in the $33,951-$82,250 "bracket" paid by a single filer with taxable income of $77,100 would be:

(Multiple Choice)

4.9/5  (28)

(28)

The rules and procedures established to govern the corporation are called the

(Multiple Choice)

4.8/5  (40)

(40)

Which form of business organization typically offers the easiest transfer of ownership?

(Multiple Choice)

4.8/5  (29)

(29)

Showing 21 - 40 of 79

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)