Exam 6: An Introduction to Portfolio Management

Exam 1: The Investment Setting72 Questions

Exam 1: The Investment Setting: Part A6 Questions

Exam 2: Asset Allocation and Security Selection77 Questions

Exam 2: Asset Allocation and Security Selection: Part A3 Questions

Exam 3: Organization and Functioning of Securities Markets87 Questions

Exam 4: Security Market Indexes and Index Funds89 Questions

Exam 5: Efficient Capital Markets, Behavioral Finance, and Technical Analysis162 Questions

Exam 6: An Introduction to Portfolio Management114 Questions

Exam 6: An Introduction to Portfolio Management: Part A2 Questions

Exam 6: An Introduction to Portfolio Management: Part B2 Questions

Exam 7: Asset Pricing Models152 Questions

Exam 8: Equity Valuation83 Questions

Exam 9: The Top-Down Approach to Market, Industry, and Company Analysis216 Questions

Exam 10: The Practice of Fundamental Investing60 Questions

Exam 11: Equity Portfolio Management Strategies65 Questions

Exam 12: Bond Fundamentals and Valuation138 Questions

Exam 13: Bond Analysis and Portfolio Management Strategies125 Questions

Exam 14: An Introduction to Derivative Markets and Securities102 Questions

Exam 15: Forward, Futures, and Swap Contracts148 Questions

Exam 16: Option Contracts122 Questions

Exam 17: Professional Money Management, Alternative Assets, and Industry Ethics109 Questions

Exam 18: Evaluation of Portfolio Performance111 Questions

Select questions type

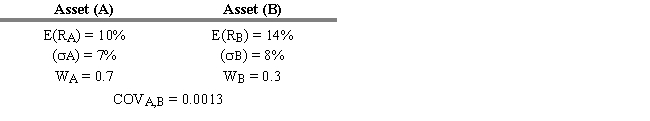

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 6.8. What is the standard deviation of this portfolio?

-Refer to Exhibit 6.8. What is the standard deviation of this portfolio?

(Multiple Choice)

4.9/5  (35)

(35)

A portfolio is efficient if no other asset or portfolios offer higher expected return with the same (or lower) risk or lower risk with the same (or higher) expected return.

(True/False)

4.8/5  (33)

(33)

The correlation coefficient and the covariance are measures of the extent to which two random variables move together.

(True/False)

4.9/5  (39)

(39)

What is the standard deviation of an equally weighted portfolio of two stocks with a covariance of 0.009, if the standard deviation of the first stock is 15% and the standard deviation of the second stock is 20%?

(Multiple Choice)

4.9/5  (44)

(44)

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 6.6. What is the expected return of a portfolio of two risky assets if the expected return E(Ri), standard deviation ( i), covariance (COVi,j), and asset weight (Wi) are as shown above?

-Refer to Exhibit 6.6. What is the expected return of a portfolio of two risky assets if the expected return E(Ri), standard deviation ( i), covariance (COVi,j), and asset weight (Wi) are as shown above?

(Multiple Choice)

5.0/5  (37)

(37)

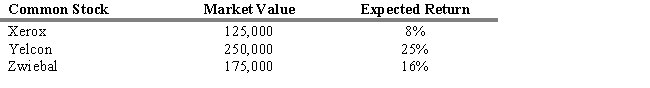

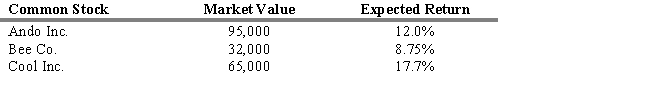

What is the expected return of the three-stock portfolio described below?

(Multiple Choice)

4.9/5  (33)

(33)

The slope of the utility curves for a strongly risk-averse investor, relative to the slope of the utility curves for a less risk-averse investor, will

(Multiple Choice)

4.9/5  (39)

(39)

A measure that only considers deviations above the mean is semi-variance.

(True/False)

4.9/5  (41)

(41)

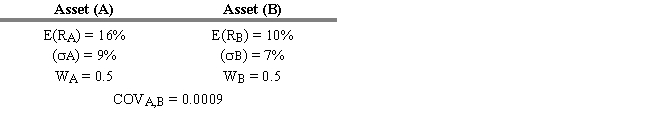

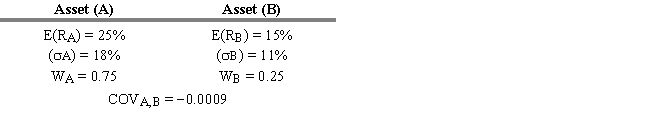

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 6.7. What is the standard deviation of this portfolio?

-Refer to Exhibit 6.7. What is the standard deviation of this portfolio?

(Multiple Choice)

4.8/5  (35)

(35)

What is the expected return of the three-stock portfolio described below?

(Multiple Choice)

4.8/5  (39)

(39)

Consider two securities, A and B. Security A and B have a correlation coefficient of 0.65. Security A has standard deviation of 12, and security B has standard deviation of 25. Calculate the covariance between these two securities.

(Multiple Choice)

4.8/5  (50)

(50)

Between 1994 and 2004, the standard deviation of the returns for the S&P 500 and the NYSE indexes were 0.27 and 0.14, respectively, and the covariance of these index returns was 0.03. What was the correlation coefficient between the two market indicators?

(Multiple Choice)

4.8/5  (41)

(41)

When identifying undervalued and overvalued assets, which of the following statements is FALSE?

(Multiple Choice)

4.9/5  (32)

(32)

All of the following are assumptions of the Markowitz model EXCEPT

(Multiple Choice)

4.8/5  (25)

(25)

As the correlation coefficient between two assets decreases, the shape of the efficient frontier

(Multiple Choice)

4.9/5  (36)

(36)

Which of the following is NOT a relaxation of the assumptions for the CAPM?

(Multiple Choice)

4.7/5  (34)

(34)

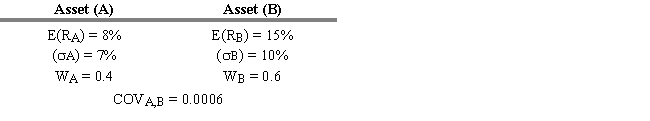

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 6.2. What is the expected return of a portfolio of two risky assets if the expected return E(Ri), standard deviation ( i), covariance (COVi,j), and asset weight (Wi) are as shown above?

-Refer to Exhibit 6.2. What is the expected return of a portfolio of two risky assets if the expected return E(Ri), standard deviation ( i), covariance (COVi,j), and asset weight (Wi) are as shown above?

(Multiple Choice)

4.8/5  (29)

(29)

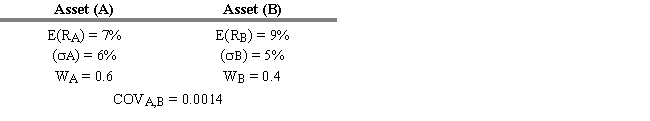

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 6.5. What is the standard deviation of this portfolio?

-Refer to Exhibit 6.5. What is the standard deviation of this portfolio?

(Multiple Choice)

4.9/5  (36)

(36)

Showing 41 - 60 of 114

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)