Exam 19: Deferred Compensation

Exam 1: An Introduction to Taxation and Understanding the Federal Tax Law155 Questions

Exam 2: Working With the Tax Law83 Questions

Exam 3: Tax Formula and Tax Determination; an Overview of Property Transactions153 Questions

Exam 4: Gross Income: Concepts and Inclusions125 Questions

Exam 5: Gross Income: Exclusions115 Questions

Exam 6: Deductions and Losses: in General154 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses115 Questions

Exam 8: Depreciation, cost Recovery, amortization, and Depletion116 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses140 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions106 Questions

Exam 11: Investor Losses105 Questions

Exam 12: Alternative Minimum Tax125 Questions

Exam 13: Tax Credits and Payment Procedures123 Questions

Exam 14: Property Transactions: Determination of Gain or Loss and Basis Considerations154 Questions

Exam 15: Property Transactions: Nontaxable Exchanges139 Questions

Exam 16: Property Transactions: Capital Gains and Losses76 Questions

Exam 17: Property Transactions: Section 1231 and Recapture Provisions74 Questions

Exam 18: Accounting Periods and Methods107 Questions

Exam 19: Deferred Compensation104 Questions

Exam 20: Corporations and Partnerships165 Questions

Select questions type

Group term life insurance is considered to be a type of deferred compensation.

(True/False)

4.8/5  (43)

(43)

What statement is false with respect to an incentive stock option (ISO)?

(Multiple Choice)

4.8/5  (39)

(39)

Traditional IRA contributions made after an individual reaches the age of 59 1/2 are treated as excess contributions and are subject to a nondeductible 6% excise penalty tax.

(True/False)

5.0/5  (41)

(41)

The $1 million limitation for deductible executive compensation does not apply to the alternative minimum tax.

(True/False)

4.9/5  (32)

(32)

Any pre-tax amount elected by an employee as a plan contribution to a § 401(k)plan that does not exceed the statutory limit is not includible in gross income in the year of deferral and is 100% vested.

(True/False)

4.9/5  (37)

(37)

Distributions from a Roth IRA that are subject to taxation are treated first as from earnings and last as from contributions.

(True/False)

4.9/5  (38)

(38)

A direct transfer of funds from a qualified retirement plan to an IRA is not subject to the withholding rules.

(True/False)

4.9/5  (32)

(32)

Dana,age 48,is the sole remaining participant of a money purchase pension plan.The plan is terminated and a $240,000 taxable distribution is made to Dana.The early distribution penalty tax,if any,for 2012 is:

(Multiple Choice)

4.8/5  (42)

(42)

Roxy,Inc.,grants 1,000 NQSO to an employee,Carol,entitling her to purchase Roxy stock at $10 per share (the current price of the stock).Roxy simultaneously grants 1,000 ISOs to another employee,Donna,entitling her to buy 1,000 shares of Roxy at $10 per share over a two-year period.One year later,2012,the stock has risen to $20 per share,and Carol and Donna both exercise their options in full,receiving stock not subject to an SRF.

(Essay)

4.9/5  (22)

(22)

Harry receives a $10,000 distribution from a CESA.On this date,his total account balance is $16,000,with $4,000 representing earnings.If his qualified higher education expenses are $8,000,the amount included in gross income is:

(Multiple Choice)

4.8/5  (40)

(40)

A NQDC plan may discriminate in favor of officers or other highly compensated employees.

(True/False)

4.8/5  (34)

(34)

Pony,Inc.,issues restricted stock to employees in July 2012,with a two-year vesting period and an SRF.An employee must remain a full-time employee of Pony for two years after the restricted stock is issued.The stock is trading at $10 per share when the stock is issued.An employee,Sam,decides to make the § 83(b)election with his 1,000 shares.At the end of 2012,the stock is trading at $13 per share.How much income,if any,must Sam recognize in 2012?

(Multiple Choice)

4.9/5  (45)

(45)

A taxpayer who receives a distribution can avoid current taxation by rolling the distribution into another qualified employer retirement plan or into an IRA.

(True/False)

4.9/5  (33)

(33)

Fred is a self-employed accountant with gross earned income of $140,000 per year (after the deduction for one-half of any self-employment tax).He has a profit sharing plan (i.e.,defined contribution plan).What is the maximum amount Fred can contribute to his retirement plan?

(Multiple Choice)

4.8/5  (33)

(33)

The minimum annual distributions must be made over the life of the participant or the life of the participant and a designated individual beneficiary.

(True/False)

4.8/5  (34)

(34)

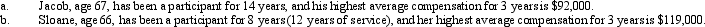

Susan,an executive,receives a golden parachute payment of $500,000 from her employer.Her average annual compensation for the most recent five years is $100,000.Which of the following statements is correct?

(Multiple Choice)

5.0/5  (41)

(41)

Scott,age 68,has accumulated $850,000 in a defined contribution plan,$100,000 of which represents his own after-tax contributions.If the full amount is distributed in 2012,his early distribution penalty is:

(Multiple Choice)

4.9/5  (39)

(39)

Under what circumstances is it advantageous for an employee to elect to be taxed immediately as ordinary income on the FMV in excess of the amount paid for restricted property?

(Essay)

4.9/5  (31)

(31)

Showing 81 - 100 of 104

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)