Exam 9: Deductions: Employee and Self-Employed-Related Expenses

Exam 1: An Introduction to Taxation and Understanding the Federal Tax Law155 Questions

Exam 2: Working With the Tax Law83 Questions

Exam 3: Tax Formula and Tax Determination; an Overview of Property Transactions153 Questions

Exam 4: Gross Income: Concepts and Inclusions125 Questions

Exam 5: Gross Income: Exclusions115 Questions

Exam 6: Deductions and Losses: in General154 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses115 Questions

Exam 8: Depreciation, cost Recovery, amortization, and Depletion116 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses140 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions106 Questions

Exam 11: Investor Losses105 Questions

Exam 12: Alternative Minimum Tax125 Questions

Exam 13: Tax Credits and Payment Procedures123 Questions

Exam 14: Property Transactions: Determination of Gain or Loss and Basis Considerations154 Questions

Exam 15: Property Transactions: Nontaxable Exchanges139 Questions

Exam 16: Property Transactions: Capital Gains and Losses76 Questions

Exam 17: Property Transactions: Section 1231 and Recapture Provisions74 Questions

Exam 18: Accounting Periods and Methods107 Questions

Exam 19: Deferred Compensation104 Questions

Exam 20: Corporations and Partnerships165 Questions

Select questions type

A taxpayer who lives and works in Kansas City is sent to Chicago on an eight-day business trip.While in Chicago,taxpayer uses the hotel valet service to have some laundry done.The valet charge is a deductible travel expense.

Free

(True/False)

4.7/5  (37)

(37)

Correct Answer:

True

By itself,credit card receipts will constitute adequate substantiation for travel expenses.

Free

(True/False)

4.8/5  (39)

(39)

Correct Answer:

False

Which of the following expenses,if any,qualify as deductible?

Free

(Multiple Choice)

4.8/5  (38)

(38)

Correct Answer:

D

Lloyd,a practicing CPA,pays tuition to attend law school.Since a law degree involves education leading to a new trade or business,the tuition is not deductible.

(True/False)

4.8/5  (39)

(39)

In terms of meeting the distance test for purposes of deducting moving expenses,which of the following statements is correct?

(Multiple Choice)

4.7/5  (32)

(32)

If a taxpayer does not own a home but rents an apartment,the office in the home deduction is not available.

(True/False)

4.8/5  (29)

(29)

The § 222 deduction for tuition and related expenses is available:

(Multiple Choice)

4.8/5  (39)

(39)

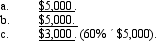

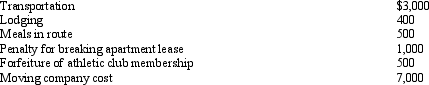

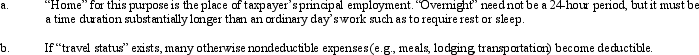

After graduating from college,Clint obtained employment in Omaha.In moving from his parents' home in Baltimore to Omaha,Clint incurred the following expenses:

(Essay)

4.7/5  (38)

(38)

In which,if any,of the following situations is the automatic mileage available?

(Multiple Choice)

4.7/5  (43)

(43)

Nicole just retired as a partner in a Philadelphia law firm.She moved to San Francisco where she took a job as an adjunct professor at a local law school.Can Nicole deduct her moving expenses? Explain

(Essay)

4.9/5  (44)

(44)

In terms of IRS attitude,what do the following expenses have in common?

(Essay)

5.0/5  (38)

(38)

Qualified moving expenses include the cost of lodging but not meals during the move.

(True/False)

4.8/5  (30)

(30)

After she finishes working at her main job, Ann returns home, has dinner, then drives to her second job. Ann may deduct the mileage between her home and second job.

(True/False)

4.9/5  (32)

(32)

Cathy takes five key clients to a nightclub and incurs the following costs: $320 limousine rental,$460 cover charge,$920 drinks and dinner,and $200 tips.Several days after the function,Cathy mails each client a pen costing $25.To the cost must be added $4 for engraving of the client's name.Assuming adequate substantiation and a business justification,what is Cathy's deduction?

(Essay)

4.9/5  (37)

(37)

Jake performs services for Maude. If Jake provides his own helper and tools, this is indicative of independent contractor (rather than employee) status.

(True/False)

4.9/5  (40)

(40)

Ethan,a bachelor with no immediate family,uses the Pine Shadows Country Club exclusively for his business entertaining.None of Ethan's annual dues for his club membership are deductible.

(True/False)

4.9/5  (48)

(48)

The tax law specifically provides that a taxpayer cannot be temporarily away from home for any period of employment that exceeds one year.

(True/False)

4.9/5  (30)

(30)

A taxpayer who claims the standard deduction will not be able to claim an office in the home deduction.

(True/False)

4.8/5  (30)

(30)

Under the automatic mileage method,one rate does not cover every type of expense.For 2012,what are the rates for business use,education,moving,charitable,and medical?

(Essay)

4.9/5  (35)

(35)

For self-employed taxpayers,travel expenses are not subject to the 2%-of-AGI floor.

(True/False)

4.8/5  (36)

(36)

Showing 1 - 20 of 140

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)