Exam 7: Internal Control and Cash

Exam 1: Introduction to Accounting and Business176 Questions

Exam 2: Analyzing Transactions210 Questions

Exam 3: The Adjusting Process183 Questions

Exam 4: Completing the Accounting Cycle168 Questions

Exam 5: Accounting for Merchandising Businesses205 Questions

Exam 6: Inventories161 Questions

Exam 7: Internal Control and Cash155 Questions

Exam 8: Receivables163 Questions

Exam 9: Long-Term Assets: Fixed and Intangible177 Questions

Exam 10: Liabilities: Current,installment Notes,and Contingencies188 Questions

Exam 11: Liabilities: Bonds Payable154 Questions

Exam 12: Corporations: Organization, stock Transactions, and Dividends193 Questions

Exam 13: Statement of Cash Flows175 Questions

Exam 14: Financial Statement Analysis189 Questions

Exam 15: Introduction to Managerial Accounting195 Questions

Exam 16: Job Order Costing185 Questions

Exam 17: Process Cost Systems180 Questions

Exam 18: Activity-Based Costing110 Questions

Exam 19: Cost-Volume-Profit Analysis421 Questions

Exam 20: Variable Costing for Management Analysis151 Questions

Exam 21: Budgeting181 Questions

Exam 22: Evaluating Variances From Standard Costs130 Questions

Exam 23: Evaluating Decentralized Operations175 Questions

Exam 24: Differential Analysis and Product Pricing173 Questions

Exam 25: Capital Investment Analysis186 Questions

Exam 26: Lean Manufacturing and Activity Analysis121 Questions

Select questions type

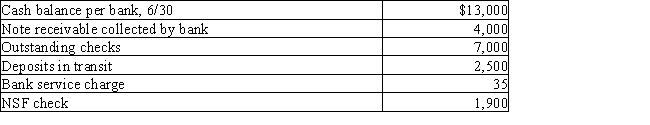

Jamison Company gathered the following reconciling information in preparing its June bank reconciliation:

Using the above information,determine the cash balance per books (before adjustments)for Jamison Company.

Using the above information,determine the cash balance per books (before adjustments)for Jamison Company.

(Multiple Choice)

4.9/5  (41)

(41)

On April 3,Snappy Sales decides to establish a $135.00 petty cash fund to relieve the burden on Accounting.

(a)Journalize the establishment of the fund.

(b)On April 11,the petty cash fund has receipts for mail and postage of $32.75,contributions and donations of

$25.25,meals and entertainment of $68.00,and $9.75 in cash.Journalize the replenishment of the fund.

(c)On April 12,Snappy Sales decides to increase petty cash to $175.00.Journalize this transaction.

(Essay)

4.8/5  (32)

(32)

Accompanying the bank statement was a debit memo for an NSF check received from a customer.What entry is required in the company's accounts?

(Multiple Choice)

4.8/5  (34)

(34)

In preparing a bank reconciliation,the amount indicated by a credit memo for a note receivable collected by the bank is added to the balance per company's records.

(True/False)

4.8/5  (37)

(37)

On April 2,Granger Sales decides to establish a $125.00 petty cash fund to relieve the burden on Accounting.

(a)Journalize the establishment of the fund.

(b)On April 10,the petty cash fund has receipts for mail and postage of $43.50,contributions and donations of

$29.50,meals and entertainment of $38.25,and $13.55 in cash.Journalize the replenishment of the fund.

(c)On April 11,Granger Sales decides to increase petty cash to $200.00.Journalize this event.

(Essay)

4.8/5  (50)

(50)

Sarbanes-Oxley's purpose is to maintain public confidence and trust in the financial reporting of companies.

(True/False)

4.9/5  (41)

(41)

For each of the following,explain whether the issue would require you to prepare a journal entry for your company,assuming any original entry is correct.If an entry is required,please include it as part of your answer.

(1)The bank recorded your deposit as $91 rather than the actual amount of $191.

(2)Two outstanding checks amounted to $450.

(3)Company check number 538 for postage was recorded incorrectly by the company bookkeeper as $50 instead

of $59.

(4)The bank paid a check for $500 after the company had issued a stop payment and voided the check.

(5)An EFT deposit was made by one of the company's customers,Atlas Design,for merchandise received.The

sale had previously been recorded when shipped and was equal to the payment amount of $125.

(Essay)

4.7/5  (37)

(37)

Businesses who have several bank accounts,petty cash,and cash on hand,would maintain a separate ledger account for each type of cash.

(True/False)

4.8/5  (40)

(40)

A debit or credit memo describing entries in the company's bank account may be enclosed with the bank statement.An example of a credit memo is

(Multiple Choice)

4.9/5  (38)

(38)

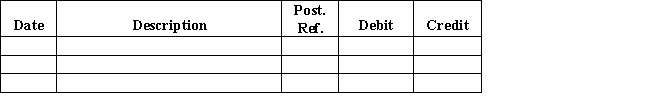

The actual cash received during the week ended June 7 for cash sales was $18,632,and the amount indicated by the cash register total was $18,628.Journalize the entry to record the cash receipts and cash sales.

Journal

(Essay)

4.9/5  (50)

(50)

The amount of cash to be reported on the balance sheet at June 30 is the

(Multiple Choice)

4.8/5  (43)

(43)

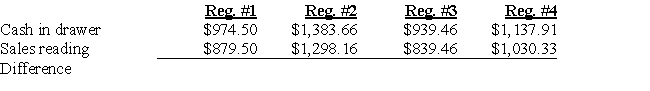

The Scharf Company is a retailer located in a state without sales tax.The following data was given to you to complete the transactions for the day's sales to be recorded.All cash drawers start with $100 in change.

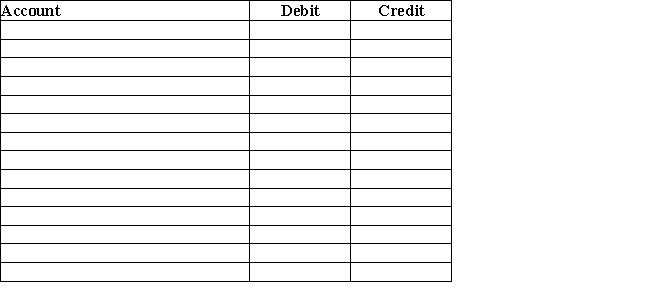

Record the journal entries for EACH cash register to determine the cashier's accuracy.

(Essay)

4.7/5  (40)

(40)

Internal control does not consist of policies and procedures that

(Multiple Choice)

4.7/5  (39)

(39)

Journal entries based on the bank reconciliation are required in the company's accounts for

(Multiple Choice)

4.7/5  (37)

(37)

A $135 petty cash fund has cash of $18 and receipts of $120.The journal entry to replenish the account would include a

(Multiple Choice)

4.9/5  (40)

(40)

In preparing a bank reconciliation,the amount indicated by a debit memo for bank service charges is added to the balance per company's records.

(True/False)

4.7/5  (33)

(33)

The debit recorded in the journal to reimburse the petty cash fund is to

(Multiple Choice)

4.7/5  (38)

(38)

A special form on which is recorded pertinent data about a liability and the particulars of its payment is called a(n)

(Multiple Choice)

4.9/5  (40)

(40)

Showing 41 - 60 of 155

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)