Exam 9: Long-Term Assets: Fixed and Intangible

Exam 1: Introduction to Accounting and Business176 Questions

Exam 2: Analyzing Transactions210 Questions

Exam 3: The Adjusting Process183 Questions

Exam 4: Completing the Accounting Cycle168 Questions

Exam 5: Accounting for Merchandising Businesses205 Questions

Exam 6: Inventories161 Questions

Exam 7: Internal Control and Cash155 Questions

Exam 8: Receivables163 Questions

Exam 9: Long-Term Assets: Fixed and Intangible177 Questions

Exam 10: Liabilities: Current,installment Notes,and Contingencies188 Questions

Exam 11: Liabilities: Bonds Payable154 Questions

Exam 12: Corporations: Organization, stock Transactions, and Dividends193 Questions

Exam 13: Statement of Cash Flows175 Questions

Exam 14: Financial Statement Analysis189 Questions

Exam 15: Introduction to Managerial Accounting195 Questions

Exam 16: Job Order Costing185 Questions

Exam 17: Process Cost Systems180 Questions

Exam 18: Activity-Based Costing110 Questions

Exam 19: Cost-Volume-Profit Analysis421 Questions

Exam 20: Variable Costing for Management Analysis151 Questions

Exam 21: Budgeting181 Questions

Exam 22: Evaluating Variances From Standard Costs130 Questions

Exam 23: Evaluating Decentralized Operations175 Questions

Exam 24: Differential Analysis and Product Pricing173 Questions

Exam 25: Capital Investment Analysis186 Questions

Exam 26: Lean Manufacturing and Activity Analysis121 Questions

Select questions type

A fixed asset with a cost of $30,000 and accumulated depreciation of $28,500 is sold for $3,500.What is the amount of the gain or loss on disposal of the fixed asset?

Free

(Multiple Choice)

4.8/5  (45)

(45)

Correct Answer:

D

A fixed asset with a cost of $41,000 and accumulated depreciation of $36,000 is traded for a similar asset priced at $50,000 (fair market value)in a transaction with commercial substance.Assuming a trade-in allowance of $4,000,at what cost will the new equipment be recorded in the books?

Free

(Multiple Choice)

4.9/5  (39)

(39)

Correct Answer:

D

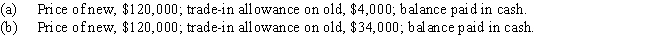

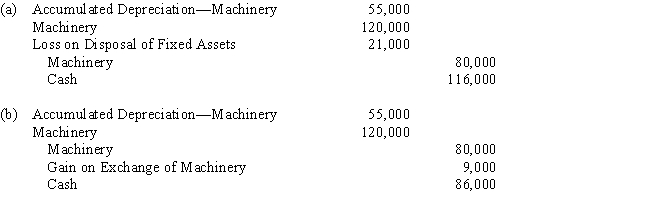

Machinery acquired at a cost of $80,000 and on which there is accumulated depreciation of $55,000 (including depreciation for the current year to date)is exchanged for similar machinery.Assume that the transaction has commercial substance.For financial reporting purposes,present entries to record the exchange of the machinery under each of the following assumptions:

Free

(Essay)

4.9/5  (39)

(39)

Correct Answer:

A copy machine acquired on July 1 with a cost of $1,450 has an estimated useful life of 4 years.Assuming that it will have a residual value of $250,determine the depreciation for the first year by the double-declining-balance method.

(Essay)

4.9/5  (39)

(39)

When exchanging equipment,if the trade-in allowance is greater than the book value a loss results.

(True/False)

4.8/5  (36)

(36)

The method used to calculate the depletion of a natural resource is the straight-line method.

(True/False)

4.8/5  (38)

(38)

Which of the following below is an example of a capital expenditure?

(Multiple Choice)

4.8/5  (40)

(40)

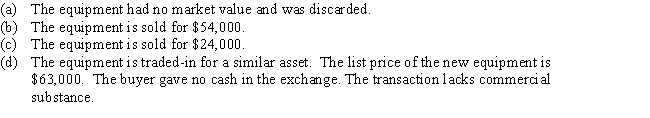

Equipment acquired at a cost of $126,000 has a book value of $42,000.Journalize the disposal of the equipment under the following independent assumptions.

Journal

Journal

(Essay)

4.9/5  (36)

(36)

When a company exchanges machinery and receives a trade-in allowance less than the book value,this transaction would be recorded with which of the following entries?

(Multiple Choice)

4.9/5  (42)

(42)

Computer equipment was acquired at the beginning of the year at a cost of $63,000 that has an estimated residual value of $3,000 and an estimated useful life of 5 years.Determine the (a)depreciable cost (b)double-declining-balance rate,and (c)double-declining-balance depreciation for the first year.

(Essay)

4.9/5  (35)

(35)

Though a piece of equipment is still being used,the equipment should be removed from the accounts if it has been fully depreciated.

(True/False)

4.7/5  (42)

(42)

When selling a piece of equipment for cash,a loss will result when the proceeds of the sale are less than the book value of the asset.

(True/False)

4.8/5  (42)

(42)

Patents are exclusive rights to produce and sell goods with one or more unique features.

(True/False)

4.7/5  (33)

(33)

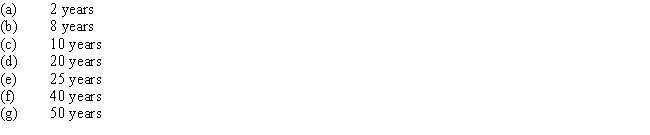

Convert each of the following estimates of useful life to a straight-line depreciation rate,stated as a percentage.

(Essay)

4.8/5  (34)

(34)

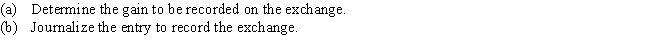

On the first day of the fiscal year,a new walk-in cooler with a list price of $58,000 was acquired in exchange for an old cooler and $44,000 cash.The old cooler had a cost of $25,000 and accumulated depreciation of $16,000.

Assume the transaction has commercial substance.

(Essay)

4.9/5  (35)

(35)

Losses on the discarding of fixed assets are reported in the income statement.

(True/False)

4.9/5  (34)

(34)

Which of the following are criteria for determining whether to record an asset as a fixed asset?

(Multiple Choice)

4.7/5  (38)

(38)

When a property,plant,and equipment asset is sold for cash,any gain or loss on the asset sold should be recorded.

(True/False)

4.9/5  (41)

(41)

Land acquired as a speculation is reported under Investments on the balance sheet.

(True/False)

4.9/5  (35)

(35)

Showing 1 - 20 of 177

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)