Exam 18: Activity-Based Costing

Exam 1: Introduction to Accounting and Business176 Questions

Exam 2: Analyzing Transactions210 Questions

Exam 3: The Adjusting Process183 Questions

Exam 4: Completing the Accounting Cycle168 Questions

Exam 5: Accounting for Merchandising Businesses205 Questions

Exam 6: Inventories161 Questions

Exam 7: Internal Control and Cash155 Questions

Exam 8: Receivables163 Questions

Exam 9: Long-Term Assets: Fixed and Intangible177 Questions

Exam 10: Liabilities: Current,installment Notes,and Contingencies188 Questions

Exam 11: Liabilities: Bonds Payable154 Questions

Exam 12: Corporations: Organization, stock Transactions, and Dividends193 Questions

Exam 13: Statement of Cash Flows175 Questions

Exam 14: Financial Statement Analysis189 Questions

Exam 15: Introduction to Managerial Accounting195 Questions

Exam 16: Job Order Costing185 Questions

Exam 17: Process Cost Systems180 Questions

Exam 18: Activity-Based Costing110 Questions

Exam 19: Cost-Volume-Profit Analysis421 Questions

Exam 20: Variable Costing for Management Analysis151 Questions

Exam 21: Budgeting181 Questions

Exam 22: Evaluating Variances From Standard Costs130 Questions

Exam 23: Evaluating Decentralized Operations175 Questions

Exam 24: Differential Analysis and Product Pricing173 Questions

Exam 25: Capital Investment Analysis186 Questions

Exam 26: Lean Manufacturing and Activity Analysis121 Questions

Select questions type

Use of a plantwide factory overhead rate assumes that the activities causing overhead costs are different across different departments and products.

(True/False)

4.9/5  (39)

(39)

Multiple production department factory overhead rates are most useful when production departments significantly differ in their manufacturing processes.

(True/False)

4.8/5  (43)

(43)

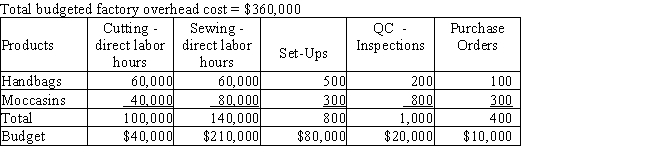

The Pikes Peak Leather Company manufactures leather handbags and moccasins.The company has been using the factory overhead rate method but has decided to evaluate activity based costing to allocate factory overhead.The factory overhead estimated per unit together with direct materials and direct labor will help determine selling prices.

Calculate the amount of factory overhead to be allocated to each unit using activity based costing.The factory plans to produce 60,000 handbags and 40,000 moccasins.

Calculate the amount of factory overhead to be allocated to each unit using activity based costing.The factory plans to produce 60,000 handbags and 40,000 moccasins.

(Essay)

4.7/5  (41)

(41)

If the budgeted factory overhead cost is $460,000,the budgeted direct labor hours is 80,000,and the actual direct labor hours is 6,700 for the month,the amount of factory overhead to be allocated is $38,525 (if the allocation is based on direct labor hours).

(True/False)

4.7/5  (39)

(39)

A plantwide factory overhead rate is computed by dividing total budgeted factory overhead costs by the plantwide allocation base.

(True/False)

4.8/5  (41)

(41)

Shubelik Company is changing to an activity-based costing method.They have determined that they will use three cost pools: setups,inspections,and assembly.Which of the following would not be used as the activity base for any of these three activities?

(Multiple Choice)

4.8/5  (40)

(40)

Use of a plantwide factory overhead rate distorts product costs when there are differences in the factory overhead rates across different production departments and when products require different ratios of allocation-base usage in each production department.

(True/False)

4.9/5  (49)

(49)

Multiple production department factory overhead rates are less accurate than are plantwide factory overhead rates.

(True/False)

4.9/5  (37)

(37)

Calculate the overhead per unit to be charged to small lamps.

(Multiple Choice)

4.8/5  (40)

(40)

ABC is used to allocate selling and administrative expenses to each product based on the product's individual differences in consuming these activities.

(True/False)

4.9/5  (34)

(34)

Using a single plantwide rate,determine the overhead rate per unit for Blue Ridge Marketing Inc.'s Product B.

(Multiple Choice)

4.9/5  (39)

(39)

If selling and administrative expenses are allocated to different products,they should be reported as a

(Multiple Choice)

4.8/5  (33)

(33)

The Camper's Edge Factory produces two products - canopies and tents.It has two separate departments - Cutting and Sewing.The budget is $350,000 for the Cutting Department and $400,000 for the Sewing Department.Each canopy requires 2 hours of cutting and 1 hour of sewing.Each tent requires 1 hour of cutting and 6 hours of sewing.The budget estimates that 20,000 canopies and 10,000 tents will be manufactured during the year.Determine (a)the total number of budgeted direct labor hours for the year in each department,(b)the departmental factory overhead rates for both departments,and (c)the factory overhead allocated per unit of each product using the department factory overhead allocation rates using direct labor hours as the base.

(Essay)

4.8/5  (44)

(44)

Activity rates are computed by dividing the cost budgeted for each activity pool by the estimated activity base for that pool.

(True/False)

4.8/5  (34)

(34)

Activity-based costing for selling and administrative expenses can also be beneficial in allocating expenses to various products.Which of the following is the best allocation base for help desk costs?

(Multiple Choice)

4.8/5  (43)

(43)

If the budget estimates that a desk lamp will require 1 hours of finishing and 2 hours of production,what is the total amount of factory overhead the Kaumajet Factory will allocate to desk lamps using the multiple production department factory overhead rate method with an allocation base of direct labor hours,if 26,000 units are produced?

(Multiple Choice)

4.7/5  (33)

(33)

Using a plantwide factory overhead rate distorts product costs when:

(Multiple Choice)

4.9/5  (44)

(44)

Using the single plantwide factory overhead rate with an allocation base of direct labor hours,how much factory overhead will Challenger Factory allocate to deluxe widget production if budgeted production for the period is 50,000 units and actual production for the period is 58,000 units?

(Multiple Choice)

4.8/5  (43)

(43)

Showing 61 - 80 of 110

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)