Exam 3: The Adjusting Process

Exam 1: Accounting and the Business Environment197 Questions

Exam 2: Recording Business Transactions177 Questions

Exam 3: The Adjusting Process179 Questions

Exam 4: Completing the Accounting Cycle170 Questions

Exam 5: Merchandising Operations203 Questions

Exam 6: Merchandise Inventory163 Questions

Exam 7: Accounting Information Systems143 Questions

Exam 8: Internal Control and Cash185 Questions

Exam 9: Receivables170 Questions

Exam 10: Plant Assets, natural Resources, and Intangibles181 Questions

Exam 11: Current Liabilities and Payroll187 Questions

Exam 12: Partnerships161 Questions

Exam 13: Corporations206 Questions

Exam 14: Long-Term Liabilities192 Questions

Exam 15: Investments146 Questions

Exam 16: The Statement of Cash Flows164 Questions

Exam 17: Financial Statement Analysis167 Questions

Exam 18: Introduction to Managerial Accounting210 Questions

Exam 19: Job Order Costing170 Questions

Exam 20: Process Costing167 Questions

Exam 21: Cost-Volume-Profit Analysis238 Questions

Exam 22: Master Budgets172 Questions

Exam 23: Flexible Budgets and Standard Cost Systems204 Questions

Exam 24: Cost Allocation and Responsibility Accounting189 Questions

Exam 25: Short-Term Business Decisions181 Questions

Exam 26: Capital Investment Decisions142 Questions

Select questions type

Adjusting entries either credit a revenue account or debit an expense account.

(True/False)

4.8/5  (31)

(31)

The Brighton Dental Company prepays the rent on its dental office.On July 1,the business paid $18,000 for 6 months of rent.How much Rent Expense should Brighton Dental Company record the three months ended September 30 under the accrual basis? Why?

(Essay)

4.7/5  (42)

(42)

What is the difference between cash basis accounting and accrual basis accounting?

(Essay)

5.0/5  (29)

(29)

Accumulated Depreciation is a(n)________ account and carries a normal ________ balance.

(Multiple Choice)

4.9/5  (51)

(51)

During the accounting period,office supplies were purchased on account for $3,900.A physical count,on the last day of the accounting period,shows $1,600 of office supplies on hand.Supplies Expense for the accounting period is $3,100.What was the beginning balance of Office Supplies?

(Multiple Choice)

4.8/5  (41)

(41)

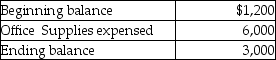

The following Office Supplies account information is available for Able Company:

From the above information,calculate the amount of office supplies purchased.

From the above information,calculate the amount of office supplies purchased.

(Multiple Choice)

4.8/5  (36)

(36)

On January 1,2016,Prepaid Insurance of Maywood Company had a beginning balance of $900.Three months of insurance premiums remain in the beginning balance.On February 1,2016,the company paid an annual insurance premium in the amount of $3,400 for the period beginning April 1.On February 28,2016,the balance in Prepaid Insurance is $600.The deferred expense was initially recorded as an asset.

(True/False)

4.7/5  (43)

(43)

All of the accounts and the account balances of a company appear on the ________.

(Multiple Choice)

4.8/5  (31)

(31)

Which of the following entries would be recorded by a company that uses the cash basis method of accounting?

(Multiple Choice)

4.8/5  (43)

(43)

Which of the following entries would be made because of the matching principle?

(Multiple Choice)

5.0/5  (39)

(39)

A worksheet is an external document that forms a part of the financial statements.

(True/False)

4.8/5  (39)

(39)

On December 31,2016,the balance in Pinnacle Exploration Company's Unearned Revenue account was a credit of $6,000.In January,2017,the company received an advance payment of $14,000 from a new customer for services to be performed.By January 31,adjustments were made to recognize $4,000 of the revenue that had been earned during January.What was the balance in Unearned Revenue on January 31,2017?

(Multiple Choice)

4.7/5  (34)

(34)

Get in Shape,a healthy living magazine,collected $528,000 in subscription revenue on May 31.Each subscriber will receive an issue of the magazine in each of the next 12 months,beginning with the June issue.The company uses the accrual method of accounting.What is the balance in the Unearned Revenue account as of December 31?

(Multiple Choice)

5.0/5  (33)

(33)

Under cash basis accounting,an expense is recorded only when cash is paid.

(True/False)

4.9/5  (46)

(46)

The accounting records for Patricia Event Planning Services include the following select unadjusted balances on December 31,2016: Salaries Expense,$6,000;Service Revenue: $19,000;Unearned Revenue,$400;Supplies Expense,$600;Rent Expense,$300;Depreciation Expense-Equipment,$200.

During December,the company worked with a new client and provided event planning services for an upcoming event.It will receive the full amount of $2,100 when the event is completed in January 2017.As of the end of December 2016,it performed one-third of the services covered by the contract.The company made the accrual adjustments.The balance of Service Revenue,as shown on the adjusted trial balance,should be a ________.

(Multiple Choice)

4.8/5  (33)

(33)

Under accrual basis accounting,an expense is recorded only when cash is paid.

(True/False)

4.8/5  (41)

(41)

On July 1,Alpha Company prepaid rent for a small equipment storage area.Alpha paid $20,000 to rent the area from July 1 through the end of the year.Provide the journal entry needed on July 1 when the payment is made.(Ignore explanation. )Assume the deferred expense is initially recorded as an asset.

(Essay)

4.8/5  (34)

(34)

On September 1,Capitol Maintenance Company contracted to provide monthly maintenance services for the next seven months at a rate of $2,300 per month.The client paid Capitol $16,100 on September 1.The maintenance services began on that date.Assuming Capitol records deferred revenues using the alternative treatment,what would be the adjusting entry recorded on December 31?

(Multiple Choice)

4.9/5  (36)

(36)

Showing 161 - 179 of 179

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)