Exam 11: Return and Risk: the Capital Asset Pricing Model

Exam 1: Introduction to Corporate Finance61 Questions

Exam 2: Financial Statements and Cash Flow92 Questions

Exam 3: Financial Statements Analysis and Long-Term Planning117 Questions

Exam 5: Net Present Value and Other Investment Rules92 Questions

Exam 8: Interest Rates and Bond Valuation67 Questions

Exam 10: Risk and Return: Lessons From Market History81 Questions

Exam 11: Return and Risk: the Capital Asset Pricing Model125 Questions

Exam 12: An Alternative View of Risk and Return: the Arbitrage Pricing Theory45 Questions

Exam 14: Efficient Capital Markets and Behavioral Challenges50 Questions

Exam 15: Long-Term Financing: an Introduction43 Questions

Exam 20: Raising Capital65 Questions

Exam 22: Options and Corporate Finance93 Questions

Exam 23: Options and Corporate Finance: Extensions and Applications42 Questions

Exam 24: Warrants and Convertibles52 Questions

Exam 25: Derivatives and Hedging Risk56 Questions

Exam 31: International Corporate Finance93 Questions

Select questions type

You want your portfolio beta to be 1.20.Currently,your portfolio consists of $100 invested in stock A with a beta of 1.4 and $300 in stock B with a beta of .6.You have another $400 to invest and want to divide it between an asset with a beta of 1.6 and a risk-free asset.How much should you invest in the risk-free asset?

(Multiple Choice)

4.9/5  (44)

(44)

A stock with a beta of zero would be expected to have a rate of return equal to:

(Multiple Choice)

4.7/5  (44)

(44)

When stocks with the same expected return are combined into a portfolio:

(Multiple Choice)

4.8/5  (34)

(34)

The _____ tells us that the expected return on a risky asset depends only on that asset's nondiversifiable risk.

(Multiple Choice)

4.7/5  (38)

(38)

According to the CAPM,the expected return on a risky asset depends on three components.

Describe each component,and explain its role in determining expected return.

(Essay)

4.8/5  (36)

(36)

The linear relation between an asset's expected return and its beta coefficient is the:

(Multiple Choice)

4.7/5  (31)

(31)

Kali's Ski Resort,Inc.stock is quite cyclical.In a boom economy,the stock is expected to return 30% in comparison to 12% in a normal economy and a negative 20% in a recessionary period.The probability of a recession is 15%.There is a 30% chance of a boom economy.The remainder of the time,the economy will be at normal levels.What is the standard deviation of the returns on Kali's Ski Resort,Inc.stock?

(Multiple Choice)

4.7/5  (34)

(34)

The market has an expected rate of return of 10.2%.The long-term government bond is expected to yield 4.2% and the U.S.Treasury bill is expected to yield 3.8%.The inflation rate is 3.1%.What is the market risk premium?

(Multiple Choice)

4.8/5  (35)

(35)

The risk-free rate of return is 5% and the market risk premium is 7%.What is the expected rate of return on a stock with a beta of 1.56?

(Multiple Choice)

4.7/5  (37)

(37)

A portfolio has 50% of its funds invested in Security One and 50% of its funds invested in Security Two.Security One has a standard deviation of 6%.Security Two has a standard deviation of 12%.The securities have a coefficient of correlation of 0.5.Which of the following values is closest to portfolio variance?

(Multiple Choice)

4.7/5  (41)

(41)

The market has an expected rate of return of 9.8%.The long-term government bond is expected to yield 4.5% and the U.S.Treasury bill is expected to yield 3.4%.The inflation rate is 3.1%.What is the market risk premium?

(Multiple Choice)

4.8/5  (31)

(31)

You recently purchased a stock that is expected to earn 25% in a booming economy,9% in a normal economy and lose 8% in a recessionary economy.There is a 15% probability of a boom,a 65% chance of a normal economy,and a 10% chance of a recession.What is your expected rate of return on this stock?

(Multiple Choice)

4.9/5  (36)

(36)

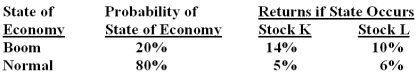

What is the expected return on a portfolio comprised of $3,000 in stock K and $5,000 in stock L if the economy is normal?

(Multiple Choice)

4.9/5  (45)

(45)

Diversification can effectively reduce risk.Once a portfolio is diversified,the type of risk remaining is:

(Multiple Choice)

4.8/5  (28)

(28)

Showing 81 - 100 of 125

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)