Exam 8: Inventories

Exam 1: Uses of Accounting Information and the Financial Statements167 Questions

Exam 2: Analyzing Business Transactions189 Questions

Exam 3: Measuring Business Income171 Questions

Exam 4: Completing the Accounting Cycle176 Questions

Exam 5: Financial Reporting and Analysis177 Questions

Exam 6: The Operating Cycle and Merchandising Operations145 Questions

Exam 7: Internal Control117 Questions

Exam 8: Inventories154 Questions

Exam 9: Cash and Receivables177 Questions

Exam 10: Current Liabilities and Fair Value Accounting180 Questions

Exam 11: Long Term Assets241 Questions

Exam 12: Contributed Capital189 Questions

Exam 13: Long Term Liabilities194 Questions

Exam 14: The Corporate Income Statement and the Statement of Stockholders Equity176 Questions

Exam 15: The Statement of Cash Flows149 Questions

Exam 16: Financial Performance Measurement163 Questions

Exam 17: Partnerships129 Questions

Exam 18: The Changing Business Environment-A Managers Pers130 Questions

Exam 19: Cost Concepts and Cost Allocation188 Questions

Exam 20: Costing Systems: Job Order Costing88 Questions

Exam 21: Costing Systems Process Costing136 Questions

Exam 22: Activity-Based Systems-Abm and Lean152 Questions

Exam 23: Cost Behavior Analysis166 Questions

Exam 24: The Budgeting Process116 Questions

Exam 25: Performance Management and Evaluation117 Questions

Exam 26: Standard Costing and Variance Analysis120 Questions

Exam 27: Short Run Decision Analysis90 Questions

Exam 28: Capital Investment Analysis123 Questions

Select questions type

The LIFO method tends to smooth out the peaks and valleys of a business cycle.

(True/False)

4.7/5  (32)

(32)

A company has cost of goods available for sale of $250,000, sales of $305,000, and a gross profit percentage of 30 percent. Using the gross profit method, what is the ending inventory?

(Multiple Choice)

4.9/5  (34)

(34)

In a period of rising prices, which inventory method is best to use for tax purposes?

(Multiple Choice)

4.7/5  (36)

(36)

What is a LIFO liquidation, and what is its effect on income before income taxes?

(Essay)

4.8/5  (30)

(30)

The lower-of-cost-or-market rule implies that it is unrealistic to carry inventory at a cost that is in excess of its market value.

(True/False)

4.8/5  (49)

(49)

Inventory costing methods place primary reliance on assumptions about the flow of

(Multiple Choice)

4.8/5  (38)

(38)

When the average-cost method is applied to a perpetual inventory system, a moving average cost per unit is computed with each purchase.

(True/False)

4.8/5  (35)

(35)

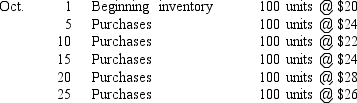

During October, Tedesco Company sold 240 units of Product R. Its beginning inventory and purchases during the month were as follows:

Assume the periodic inventory system is used

Compute the cost of goods sold under each of three methods: (a) average-cost, (b) LIFO, and (c) FIFO. (Show your work.)

Compute the cost of goods sold under each of three methods: (a) average-cost, (b) LIFO, and (c) FIFO. (Show your work.)

(Essay)

4.9/5  (39)

(39)

Why are the amounts determined for ending inventory and cost of goods sold the same under both the periodic and perpetual inventory systems when FIFO is used but not when LIFO is used?

(Essay)

4.9/5  (36)

(36)

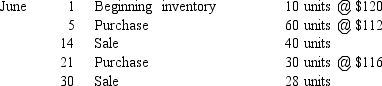

Use this inventory information for the month of June to answer the following question.  Assuming that a periodic inventory system is used, what is cost of goods sold under the average-cost method?

Assuming that a periodic inventory system is used, what is cost of goods sold under the average-cost method?

(Multiple Choice)

4.8/5  (38)

(38)

The computer has made the perpetual inventory system more popular and easier to apply.

(True/False)

4.7/5  (38)

(38)

Prior to a fire that destroyed most of its inventory, Verona Company had inventory purchases during the period of $80,000 and sales of $250,000. Verona began the period with $190,000 in inventory. Verona's typical gross profit percentage is 20 percent. Inventory that cost $10,000 survived the fire. Using the gross profit method, estimate the inventory loss from the fire. (Show your work.)

(Essay)

4.8/5  (36)

(36)

Manufacturing overhead would not include which of the following costs?

(Multiple Choice)

4.8/5  (40)

(40)

When the average-cost method is applied to a perpetual inventory system, the sale of goods will change the unit cost of the goods that remain in inventory.

(True/False)

4.9/5  (41)

(41)

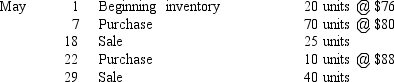

Use this inventory information for the month of May to answer the following question.  Assuming that a periodic inventory system is used

What is ending inventory under the LIFO method?

Assuming that a periodic inventory system is used

What is ending inventory under the LIFO method?

(Multiple Choice)

4.9/5  (33)

(33)

When applying the lower-of-cost-or-market rule to inventory valuation, market generally means

(Multiple Choice)

4.7/5  (36)

(36)

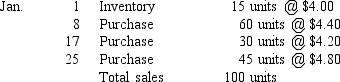

Use this information to answer the following question.  Assuming that the specific identification method is used and that ending inventory consists of 15 units from each of the three purchases and five units from the January 1 inventory, cost of goods sold is

Assuming that the specific identification method is used and that ending inventory consists of 15 units from each of the three purchases and five units from the January 1 inventory, cost of goods sold is

(Multiple Choice)

4.8/5  (31)

(31)

A cost-to-retail percentage must be calculated when applying the retail method.

(True/False)

4.8/5  (36)

(36)

Showing 121 - 140 of 154

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)