Exam 12: Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity Statements

Exam 1: Intercorporate Acquisitions and Investments in Other Entities56 Questions

Exam 2: Reporting Intercorporate Investments and Consolidation of Wholly Owned Subsidiaries With No Differential52 Questions

Exam 3: The Reporting Entity and the Consolidation of Less-Than-Wholly- Owned Subsidiaries With No Differential39 Questions

Exam 4: Consolidation of Wholly Owned Subsidiaries Acquired at More Than Book Value58 Questions

Exam 5: Consolidation of Less-Than-Wholly- Owned Subsidiaries Acquired at More Than Book Value49 Questions

Exam 6: Intercompany Inventory Transactions65 Questions

Exam 7: Intercompany Transfers of Services and Noncurrent Assets56 Questions

Exam 8: Intercompany Indebtedness50 Questions

Exam 9: Consolidation Ownership Issues60 Questions

Exam 10: Additional Consolidation Reporting Issues53 Questions

Exam 11: Multinational Accounting: Foreign Currency Transactions and Financial Instruments69 Questions

Exam 12: Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity Statements66 Questions

Exam 13: Segment and Interim Reporting64 Questions

Exam 14: Sec Reporting50 Questions

Exam 15: Partnerships: Formation,operation,and Changes in Membership69 Questions

Exam 16: Partnerships: Liquidation58 Questions

Exam 17: Governmental Entities: Introduction and General Fund Accounting75 Questions

Exam 18: Governmental Entities: Special Funds and Governmentwide Financial Statements74 Questions

Exam 19: Not-For-Profit Entities115 Questions

Exam 20: Corporations in Financial Difficulty45 Questions

Exam 21: Intercompany Indebtednessfully Adjusted Equity Method Using Straight-Line Interest Amortization40 Questions

Select questions type

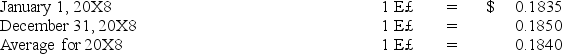

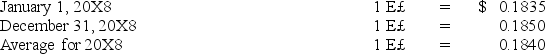

Infinity Corporation acquired 80 percent of the common stock of an Egyptian company on January 1,20X8.The goodwill associated with this acquisition was $18,350.Exchange rates at various dates during 20X8 follow:

Goodwill suffered an impairment of 20 percent during the year.If the functional currency is the U.S.dollar,how much goodwill impairment loss should be reported on Infinity's consolidated statement of income for 20X8?

Goodwill suffered an impairment of 20 percent during the year.If the functional currency is the U.S.dollar,how much goodwill impairment loss should be reported on Infinity's consolidated statement of income for 20X8?

Free

(Multiple Choice)

4.7/5  (34)

(34)

Correct Answer:

B

If the restatement method for a foreign subsidiary involves remeasuring from the recording currency into the functional currency,then translating from functional currency to U.S.dollars,the functional currency of the subsidiary is:

I.the U.S.dollar.

II.the recording currency unit.

III.a third country's currency.

Free

(Multiple Choice)

4.8/5  (40)

(40)

Correct Answer:

B

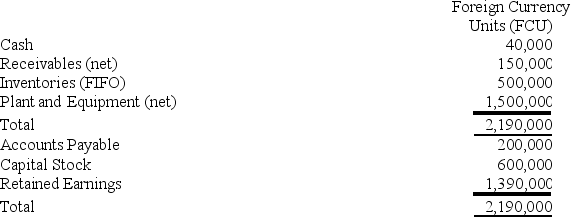

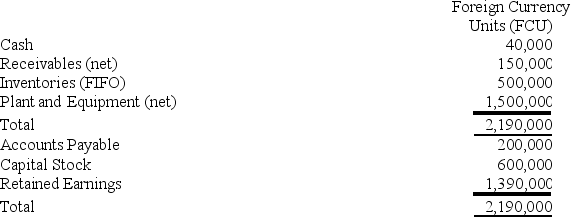

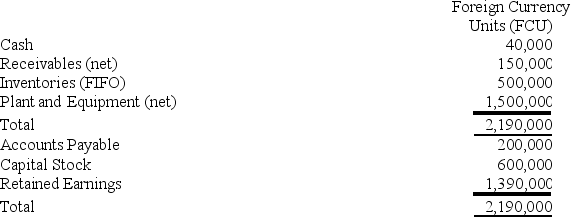

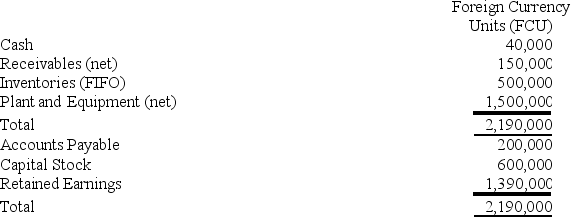

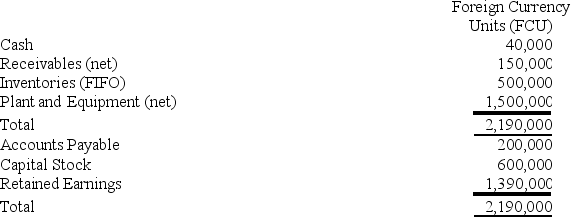

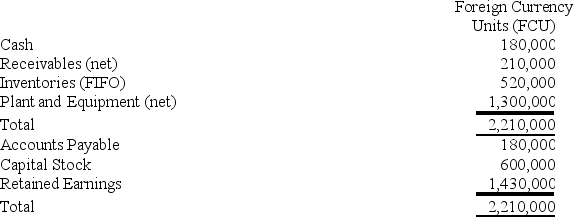

On January 2,20X8,Polaris Company acquired a 100% interest in the capital stock of Ski Company for $3,100,000.Any excess cost over book value is attributable to a patent with a 10-year remaining life.At the date of acquisition,Ski's balance sheet contained the following information:

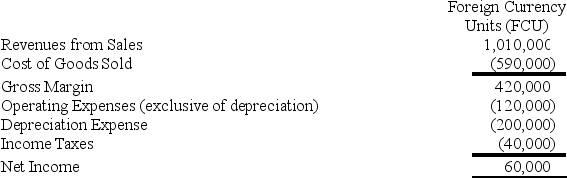

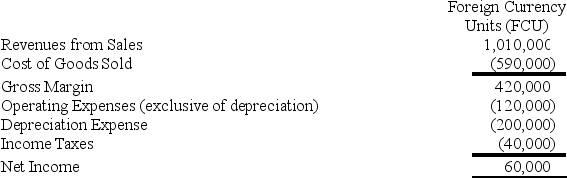

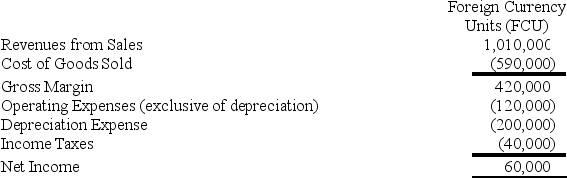

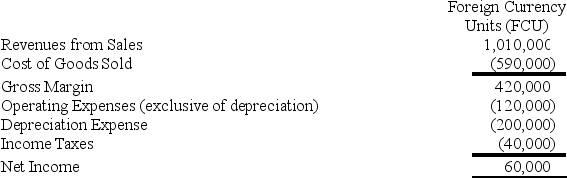

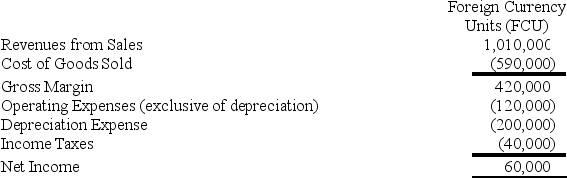

Ski's income statement for 20X8 is as follows:

Ski's income statement for 20X8 is as follows:

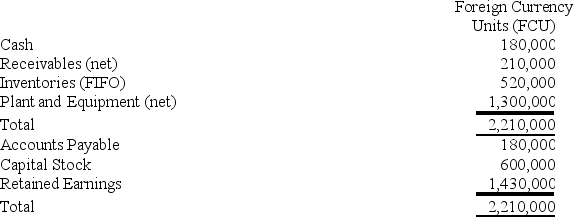

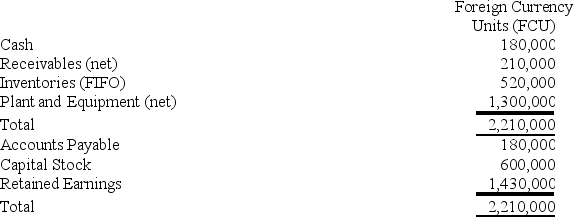

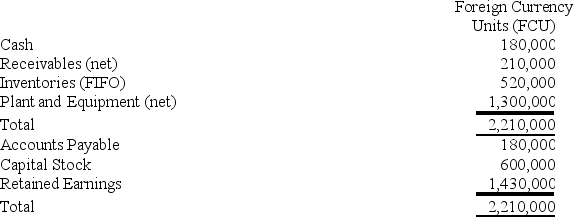

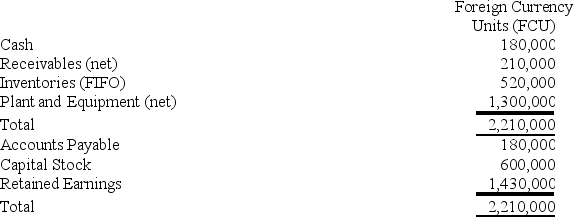

The balance sheet of Ski at December 31,20X8,is as follows:

The balance sheet of Ski at December 31,20X8,is as follows:

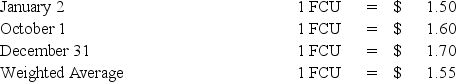

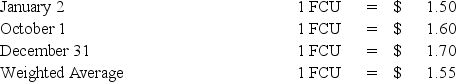

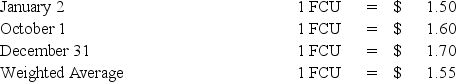

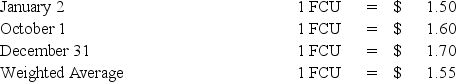

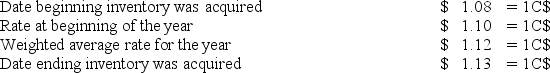

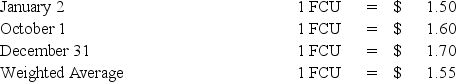

Ski declared and paid a dividend of 20,000 FCU on October 1,20X8.Spot rates at various dates for 20X8 follow:

Ski declared and paid a dividend of 20,000 FCU on October 1,20X8.Spot rates at various dates for 20X8 follow:

Assume Ski's revenues,purchases,operating expenses,depreciation expense,and income taxes were incurred evenly throughout 20X8.

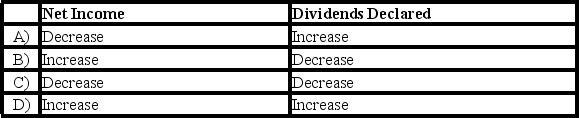

-Refer to the above information.Assuming the U.S.dollar is the functional currency,what is Ski's net income for 20X8 in U.S.dollars (include the remeasurement gain or loss in Ski's net income)?

Assume Ski's revenues,purchases,operating expenses,depreciation expense,and income taxes were incurred evenly throughout 20X8.

-Refer to the above information.Assuming the U.S.dollar is the functional currency,what is Ski's net income for 20X8 in U.S.dollars (include the remeasurement gain or loss in Ski's net income)?

Free

(Multiple Choice)

4.8/5  (40)

(40)

Correct Answer:

A

Infinity Corporation acquired 80 percent of the common stock of an Egyptian company on January 1,20X8.The goodwill associated with this acquisition was $18,350.Exchange rates at various dates during 20X8 follow:

Goodwill suffered an impairment of 20 percent during the year.If the functional currency is the Egyptian Pound,how much goodwill impairment loss should be reported on Infinity's consolidated statement of income for 20X8?

Goodwill suffered an impairment of 20 percent during the year.If the functional currency is the Egyptian Pound,how much goodwill impairment loss should be reported on Infinity's consolidated statement of income for 20X8?

(Multiple Choice)

4.8/5  (33)

(33)

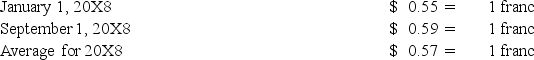

Elan,a U.S.corporation,completed the December 31,20X8,foreign currency translation of its 70 percent owned Swiss subsidiary's trial balance using the current rate method.The translation resulted in a debit adjustment of $25,000.The subsidiary had reported net income of 800,000 Swiss francs for 20X8 and paid dividends of 50,000 Swiss francs on September 1,20X8.The translation rates for the year were:

The January 1 balance of the Investment in the Swiss subsidiary account was $1,600,000.Elan acquired its interest in the Swiss subsidiary at book value with no differential or goodwill recorded at acquisition.

Elan's Investment in Swiss subsidiary account at December 31,20X8,is:

The January 1 balance of the Investment in the Swiss subsidiary account was $1,600,000.Elan acquired its interest in the Swiss subsidiary at book value with no differential or goodwill recorded at acquisition.

Elan's Investment in Swiss subsidiary account at December 31,20X8,is:

(Multiple Choice)

4.7/5  (33)

(33)

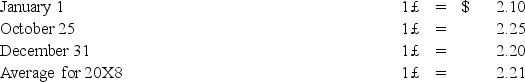

Michigan-based Leo Corporation acquired 100 percent of the common stock of a British company on January 1,20X8,for $1,100,000.The British subsidiary's net assets amounted to 500,000 pounds on the date of acquisition.On January 1,20X8,the book values of its identifiable assets and liabilities approximated their fair values.As a result of an analysis of functional currency indicators,Leo determined that the British pound was the functional currency.On December 31,20X8,the British subsidiary's adjusted trial balance,translated into U.S.dollars,contained $17,000 more debits than credits.The British subsidiary reported income of 33,000 pounds for 20X8 and paid a cash dividend of 8,000 pounds on October 25,20X8.Included on the British subsidiary's income statement was depreciation expense of 3,500 pounds.Leo uses the fully adjusted equity method of accounting for its investment in the British subsidiary and determined that goodwill in the first year had an impairment loss of 25 percent of its initial amount.Exchange rates at various dates during 20X8 follow:

-Based on the preceding information,the receipt of the dividend will result in a credit to the investment account for:

-Based on the preceding information,the receipt of the dividend will result in a credit to the investment account for:

(Multiple Choice)

5.0/5  (41)

(41)

On January 2,20X8,Polaris Company acquired a 100% interest in the capital stock of Ski Company for $3,100,000.Any excess cost over book value is attributable to a patent with a 10-year remaining life.At the date of acquisition,Ski's balance sheet contained the following information:

Ski's income statement for 20X8 is as follows:

Ski's income statement for 20X8 is as follows:

The balance sheet of Ski at December 31,20X8,is as follows:

The balance sheet of Ski at December 31,20X8,is as follows:

Ski declared and paid a dividend of 20,000 FCU on October 1,20X8.Spot rates at various dates for 20X8 follow:

Ski declared and paid a dividend of 20,000 FCU on October 1,20X8.Spot rates at various dates for 20X8 follow:

Assume Ski's revenues,purchases,operating expenses,depreciation expense,and income taxes were incurred evenly throughout 20X8.

-Refer to the above information.Assuming Ski's FCU is the functional currency,what is the amount of patent amortization for 20X8 that results from Polaris's acquisition of Ski's stock on January 2,20X8.Round your answer to the nearest dollar.

Assume Ski's revenues,purchases,operating expenses,depreciation expense,and income taxes were incurred evenly throughout 20X8.

-Refer to the above information.Assuming Ski's FCU is the functional currency,what is the amount of patent amortization for 20X8 that results from Polaris's acquisition of Ski's stock on January 2,20X8.Round your answer to the nearest dollar.

(Multiple Choice)

4.7/5  (39)

(39)

Nichols Company owns 90% of the capital stock of a foreign subsidiary located in Ireland.As a result of translating the subsidiary's accounts,a debit of $160,000 was needed in the translation adjustments account so that the foreign subsidiary's debits and credits were equal in U.S.dollars.How should Nichols report its translation adjustments on its consolidated financial statements?

(Multiple Choice)

4.8/5  (36)

(36)

On January 2,20X8,Polaris Company acquired a 100% interest in the capital stock of Ski Company for $3,100,000.Any excess cost over book value is attributable to a patent with a 10-year remaining life.At the date of acquisition,Ski's balance sheet contained the following information:

Ski's income statement for 20X8 is as follows:

Ski's income statement for 20X8 is as follows:

The balance sheet of Ski at December 31,20X8,is as follows:

The balance sheet of Ski at December 31,20X8,is as follows:

Ski declared and paid a dividend of 20,000 FCU on October 1,20X8.Spot rates at various dates for 20X8 follow:

Ski declared and paid a dividend of 20,000 FCU on October 1,20X8.Spot rates at various dates for 20X8 follow:

Assume Ski's revenues,purchases,operating expenses,depreciation expense,and income taxes were incurred evenly throughout 20X8.

-Refer to the above information.Assuming the U.S.dollar is the functional currency,what is the amount of patent amortization for 20X8 that results from Polaris's acquisition of Ski's stock on January 2,20X8?

Assume Ski's revenues,purchases,operating expenses,depreciation expense,and income taxes were incurred evenly throughout 20X8.

-Refer to the above information.Assuming the U.S.dollar is the functional currency,what is the amount of patent amortization for 20X8 that results from Polaris's acquisition of Ski's stock on January 2,20X8?

(Multiple Choice)

4.8/5  (38)

(38)

On January 2,20X8,Polaris Company acquired a 100% interest in the capital stock of Ski Company for $3,100,000.Any excess cost over book value is attributable to a patent with a 10-year remaining life.At the date of acquisition,Ski's balance sheet contained the following information:

Ski's income statement for 20X8 is as follows:

Ski's income statement for 20X8 is as follows:

The balance sheet of Ski at December 31,20X8,is as follows:

The balance sheet of Ski at December 31,20X8,is as follows:

Ski declared and paid a dividend of 20,000 FCU on October 1,20X8.Spot rates at various dates for 20X8 follow:

Ski declared and paid a dividend of 20,000 FCU on October 1,20X8.Spot rates at various dates for 20X8 follow:

Assume Ski's revenues,purchases,operating expenses,depreciation expense,and income taxes were incurred evenly throughout 20X8.

-Refer to the above information.Assuming the U.S.dollar is the functional currency,what is the balance in Polaris's investment in foreign subsidiary account at December 31,2008?

Assume Ski's revenues,purchases,operating expenses,depreciation expense,and income taxes were incurred evenly throughout 20X8.

-Refer to the above information.Assuming the U.S.dollar is the functional currency,what is the balance in Polaris's investment in foreign subsidiary account at December 31,2008?

(Multiple Choice)

4.7/5  (42)

(42)

All of the following are benefits the U.S.would gain from the adoption of globally consistent accounting standards except for:

(Multiple Choice)

4.9/5  (38)

(38)

All of the following describe the International Accounting Standard Board (IASB)except for:

(Multiple Choice)

4.7/5  (24)

(24)

For each of the items listed below,when the foreign currency strengthened relative to the U.S.dollar during the year,what is the effect on the cumulative translation adjustment (assuming a credit balance at the beginning of the year).

(Multiple Choice)

4.8/5  (31)

(31)

The Canadian subsidiary of a U.S.company reported cost of goods sold of 50,000 C$,for the current year ended December 31.The beginning inventory was 15,000 C$,and the ending inventory was 10,000 C$.Spot rates for various dates are as follows:

Assuming the U.S.dollar is the functional currency of the Canadian subsidiary,the remeasured amount of cost of goods sold that should appear in the consolidated income statement is

Assuming the U.S.dollar is the functional currency of the Canadian subsidiary,the remeasured amount of cost of goods sold that should appear in the consolidated income statement is

(Multiple Choice)

4.8/5  (36)

(36)

Stack Company is a subsidiary of Pile Company and is located in Valparaíso,Chile,where the currency is the Chilean Peso.Data on Stack's inventory and purchases are as follows:

The beginning inventory was acquired during the fourth quarter of 20X7,and the ending inventory was acquired during the fourth quarter of 20X8.Purchases were made evenly over the year.Exchange rates were as follows:

The beginning inventory was acquired during the fourth quarter of 20X7,and the ending inventory was acquired during the fourth quarter of 20X8.Purchases were made evenly over the year.Exchange rates were as follows:

-Refer the information provided above.Assuming the U.S.dollar is the functional currency,what is the amount of Stack's cost of goods sold remeasured in U.S.dollars?

-Refer the information provided above.Assuming the U.S.dollar is the functional currency,what is the amount of Stack's cost of goods sold remeasured in U.S.dollars?

(Multiple Choice)

4.8/5  (34)

(34)

Parent Company's wholly-owned subsidiary,Son Corporation,maintains its accounting records in Danish krone.However,because all of Son's branch offices are in Sweden,its functional currency is the Swedish krona.Remeasurement of Son's 20X3 financial statements resulted in a $3,200 loss,and translation of its financial statement resulted in a $2,600 loss.What amount should Parent report as a loss in its income statement for the year ended December 31,20X3?

(Multiple Choice)

4.9/5  (42)

(42)

Which of the following statements is true regarding the SEC's timeline for convergence?

(Multiple Choice)

4.8/5  (31)

(31)

In cases of operations located in highly inflationary economies:

(Multiple Choice)

4.7/5  (44)

(44)

On January 2,20X8,Polaris Company acquired a 100% interest in the capital stock of Ski Company for $3,100,000.Any excess cost over book value is attributable to a patent with a 10-year remaining life.At the date of acquisition,Ski's balance sheet contained the following information:

Ski's income statement for 20X8 is as follows:

Ski's income statement for 20X8 is as follows:

The balance sheet of Ski at December 31,20X8,is as follows:

The balance sheet of Ski at December 31,20X8,is as follows:

Ski declared and paid a dividend of 20,000 FCU on October 1,20X8.Spot rates at various dates for 20X8 follow:

Ski declared and paid a dividend of 20,000 FCU on October 1,20X8.Spot rates at various dates for 20X8 follow:

Assume Ski's revenues,purchases,operating expenses,depreciation expense,and income taxes were incurred evenly throughout 20X8.

-Refer to the above information.Assuming Ski's FCU is the functional currency,what is the amount of translation adjustment that appears on Polaris's consolidated financial statements at December 31,20X8?

Assume Ski's revenues,purchases,operating expenses,depreciation expense,and income taxes were incurred evenly throughout 20X8.

-Refer to the above information.Assuming Ski's FCU is the functional currency,what is the amount of translation adjustment that appears on Polaris's consolidated financial statements at December 31,20X8?

(Multiple Choice)

4.9/5  (34)

(34)

Under the temporal method,which of the following is usually used to translate monetary amounts to the functional currency?

I.The current exchange rate

II.The historical exchange rate

III.Average exchange rate

(Multiple Choice)

4.7/5  (46)

(46)

Showing 1 - 20 of 66

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)