Exam 3: The Adjusting Process

Exam 1: Accounting and the Business Environment246 Questions

Exam 2: Recording Business Transactions219 Questions

Exam 3: The Adjusting Process225 Questions

Exam 4: Completing the Accounting Cycle208 Questions

Exam 5: Merchandising Operations301 Questions

Exam 6: Merchandise Inventory199 Questions

Exam 7: Accounting Information Systems164 Questions

Exam 8: Internal Control and Cash258 Questions

Exam 9: Receivables233 Questions

Exam 10: Plant Assets, natural Resources, and Intangibles212 Questions

Exam 11: Current Liabilities and Payroll221 Questions

Exam 12: Partnerships171 Questions

Exam 13: Corporations277 Questions

Exam 14: Long-Term Liabilities207 Questions

Exam 15: Investments193 Questions

Exam 16: The Statement of Cash Flows183 Questions

Exam 17: Financial Statement Analysis161 Questions

Select questions type

The goal of the time period concept is to compute an accurate net income or net loss.

(True/False)

4.8/5  (35)

(35)

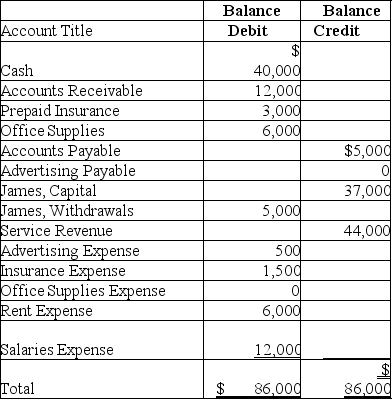

The unadjusted trial balance of James Business Consulting at December 31,2018,and the data for the adjustments follow:

James Business Consulting

Unadjusted Trial Balance

December 31,2018

Data for adjustments:

a.James prepaid 6 months of business insurance on September 30,2018,with coverage beginning on October 1.James treats deferred expenses initially as assets.

b.A physical count of office supplies was made on December 31,2018.This count showed a balance of $4,200 office supplies on hand.

c.On December 31,2018,James received a bill for the November and December advertising in a local newspaper,$800.This bill will be paid on its due date,which is 1/10/2019.

James is preparing financial statements for the quarter ending December 31,2018.

Requirements

1.Journalize the adjusting entries on December 31,2018.

2.Prepare the December 31,2018 adjusted trial balance.Use a proper heading.

Data for adjustments:

a.James prepaid 6 months of business insurance on September 30,2018,with coverage beginning on October 1.James treats deferred expenses initially as assets.

b.A physical count of office supplies was made on December 31,2018.This count showed a balance of $4,200 office supplies on hand.

c.On December 31,2018,James received a bill for the November and December advertising in a local newspaper,$800.This bill will be paid on its due date,which is 1/10/2019.

James is preparing financial statements for the quarter ending December 31,2018.

Requirements

1.Journalize the adjusting entries on December 31,2018.

2.Prepare the December 31,2018 adjusted trial balance.Use a proper heading.

(Essay)

4.8/5  (36)

(36)

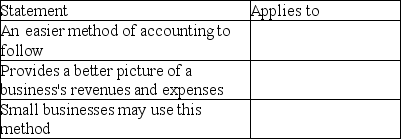

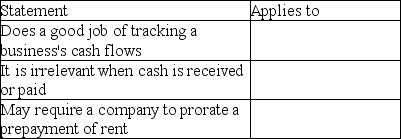

For each of the following statements,indicate whether it applies to:

the cash basis of accounting (cash basis)

the accrual basis of accounting (accrual basis)

both the cash and accrual basis of accounting (both)

neither the cash nor the accrual basis of accounting (neither).

Your response should be cash basis,accrual basis,both,or neither.

(Essay)

4.9/5  (35)

(35)

The revenue recognition principle requires companies to follow a five-step process.List these five steps.

(Short Answer)

4.9/5  (39)

(39)

If a company is using accrual basis accounting,when should it record revenue?

(Multiple Choice)

4.8/5  (31)

(31)

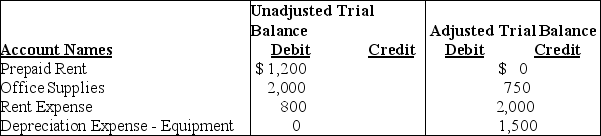

The following extract was taken from the worksheet of Miller and Miller Company for the year 2019.

From the above information,determine the amount of the Rent Expense adjustment.

From the above information,determine the amount of the Rent Expense adjustment.

(Short Answer)

4.8/5  (33)

(33)

The adjusted trial balance is prepared after the adjustments have been journalized and posted.

(True/False)

4.9/5  (37)

(37)

The matching principle ensures all expenses are recorded when they are incurred during the period and are matched to the cash payments for expenses.

(True/False)

4.8/5  (34)

(34)

Generally Accepted Accounting Principles (GAAP)require the use of the accrual basis of accounting.

(True/False)

4.9/5  (37)

(37)

The major difference between a cash basis accounting system and an accrual basis accounting system is the timing of recording revenues and assets.

(True/False)

4.9/5  (34)

(34)

Which of the following entries would be made because of the matching principle?

(Multiple Choice)

4.9/5  (40)

(40)

The accounting principle that ensures all expenses are recorded during the period when they are incurred and offsets those expenses against the revenues of the period is called the ________ principle.

(Multiple Choice)

4.9/5  (41)

(41)

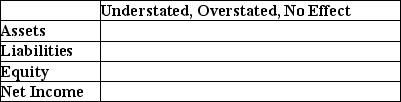

During December 2018,April Service Company performed $1,500 of services,but as of December 31,2018,the clients have not yet been billed.If April fails to make an adjusting entry on December 31,2018,indicate the effect on assets,liabilities,equity,and net income.

(Essay)

4.8/5  (34)

(34)

In the case of deferred revenue,the adjusting entry at the end of the period includes a debit to Service Revenue.Assume the deferred revenue is initially recorded as a liability.

(True/False)

4.9/5  (42)

(42)

Deferred Revenue is a liability created when a business collects cash from customers in advance of completing a service or delivering a product.

(True/False)

4.8/5  (44)

(44)

For each of the following statements,indicate whether it applies to:

the cash basis of accounting (cash basis)

the accrual basis of accounting (accrual basis)

both the cash and accrual basis of accounting (both)

neither the cash nor the accrual basis of accounting (neither).

Your response should be cash basis,accrual basis,both,or neither.

(Essay)

4.9/5  (37)

(37)

Jones Financial Services Company performed accounting services for a client in December.A bill was mailed to the client on December 30.The company received the client's check by mail on January 5.Which of the following accounts should appear on the income statement for the year ended December 31 as related to the services performed?

(Multiple Choice)

4.8/5  (26)

(26)

Showing 41 - 60 of 225

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)