Exam 3: The Adjusting Process

Exam 1: Accounting and the Business Environment246 Questions

Exam 2: Recording Business Transactions219 Questions

Exam 3: The Adjusting Process225 Questions

Exam 4: Completing the Accounting Cycle208 Questions

Exam 5: Merchandising Operations301 Questions

Exam 6: Merchandise Inventory199 Questions

Exam 7: Accounting Information Systems164 Questions

Exam 8: Internal Control and Cash258 Questions

Exam 9: Receivables233 Questions

Exam 10: Plant Assets, natural Resources, and Intangibles212 Questions

Exam 11: Current Liabilities and Payroll221 Questions

Exam 12: Partnerships171 Questions

Exam 13: Corporations277 Questions

Exam 14: Long-Term Liabilities207 Questions

Exam 15: Investments193 Questions

Exam 16: The Statement of Cash Flows183 Questions

Exam 17: Financial Statement Analysis161 Questions

Select questions type

Oakland Tax Planning Service bought computer equipment for $24,000 on January 1,2018.It has an estimated useful life of four years and zero residual value.Oakland uses the straight-line method to calculate depreciation and records depreciation expense in the books at the end of each month.Calculate the amount of Depreciation Expense for the period,January 1,2018 through September 30,2018,for this equipment.(Round any intermediate calculations to two decimal places,and your final answer to the nearest dollar. )

(Multiple Choice)

4.8/5  (33)

(33)

On July 1,Lamba Company paid rent of $15,000 for an equipment storage building from July 1 until December 31.Prepare the adjusting journal entry on July 31.(Ignore explanation).Assume the deferred expense is initially recorded as an asset.

(Essay)

4.8/5  (39)

(39)

When does a company account for revenue if it uses cash basis accounting?

(Multiple Choice)

4.9/5  (39)

(39)

Which of the following assumes that the financial statements of a business can be prepared for specific periods?

(Multiple Choice)

4.8/5  (45)

(45)

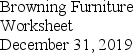

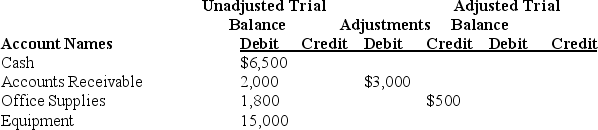

The partial worksheet of Browning Furniture is as follows:

Accumulated

Accumulated

Calculate and enter the amounts for the Adjusted Trial Balance columns.

Calculate and enter the amounts for the Adjusted Trial Balance columns.

(Essay)

4.7/5  (44)

(44)

Which of the following is the correct formula for calculating depreciation under the straight-line method?

(Multiple Choice)

4.9/5  (36)

(36)

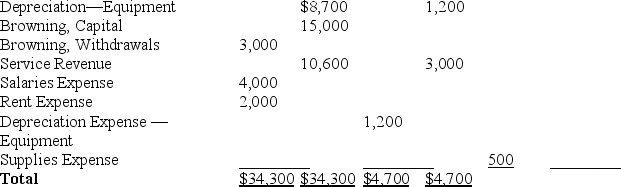

Reece Consultants had the following balances before preparing adjusting entries in the books on December 31,2019.

Prepare the adjusted trial balance after considering these adjustments:

a.Office Supplies used,$800.Assume the office supplies were initially recorded as an asset.

b.Accrued salaries on December 31,$600.

c.Revenue earned but not recorded,$200.

Prepare the adjusted trial balance after considering these adjustments:

a.Office Supplies used,$800.Assume the office supplies were initially recorded as an asset.

b.Accrued salaries on December 31,$600.

c.Revenue earned but not recorded,$200.

(Essay)

4.9/5  (38)

(38)

Big Rig Delivery Service has the following plant assets: Communications Equipment: Cost,$3,840 with useful life of 8 years;Delivery Equipment: Cost,$17,712 with useful life of 12 years;and Computer: Cost,$12,960 with useful life of 4 years.Assume the residual value of all the assets is zero and the straight-line method is used. Big Rig's monthly depreciation journal entry will include a ________.

(Multiple Choice)

4.9/5  (34)

(34)

Anthony Delivery Service has a weekly payroll of $34,000.December 31 falls on Tuesday and Anthony will pay its employees the following Monday (January 6)for the previous full week.Assume that Anthony has a five-day workweek and has an unadjusted balance in Salaries Expense of $925,000 at December 31.What is the December 31 balance of Salaries Expense after adjusting entries are recorded and posted?

(Multiple Choice)

4.8/5  (42)

(42)

Which of the following entries would be recorded by a company that uses the cash basis method of accounting?

(Multiple Choice)

4.7/5  (45)

(45)

Maxwell Tax Planning Service bought communications equipment for $10,200 on January 1,2019.The equipment has an estimated useful life of five years and zero residual value.Maxwell uses the straight-line method to calculate depreciation and records depreciation expense in the books at the end of each month.As of June 30,2019,the balance in the Accumulated Depreciation account for this equipment is ________.

(Multiple Choice)

4.8/5  (35)

(35)

Which of the following statements is TRUE of accrual basis accounting?

(Multiple Choice)

4.7/5  (40)

(40)

The key differences between the cash basis and accrual basis of accounting can be explained by understanding the rules of debits and credits.

(True/False)

4.8/5  (43)

(43)

A worksheet is an external document that forms a part of the financial statements.

(True/False)

4.9/5  (36)

(36)

Which of the following entries would be made because of the matching principle?

(Multiple Choice)

4.9/5  (40)

(40)

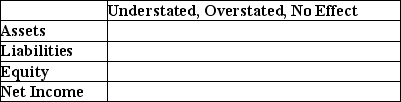

On December 31,2018,interest of $1,500 has accrued on a bank note.This interest payment is due on January 20,2019.If no adjusting entry is made on December 31,2018,indicate the effect on assets,liabilities,equity,and net income.

(Essay)

4.8/5  (31)

(31)

A business purchased equipment for $145,000 on January 1,2019.The equipment will be depreciated over the five years of its estimated useful life using the straight-line depreciation method.The business records depreciation once a year on December 31.Which of the following is the adjusting entry required to record depreciation on the equipment for the year 2019? (Assume the residual value of the acquired equipment to be zero. )

(Multiple Choice)

4.9/5  (41)

(41)

Accumulated Depreciation is a(n)________ account and carries a normal ________ balance.

(Multiple Choice)

4.8/5  (37)

(37)

Showing 121 - 140 of 225

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)