Exam 22: Standard Costing and Variance Analysis

Exam 1: Uses of Accounting Information and the Financial Statements178 Questions

Exam 2: Measurement Concepts: Recording Business Transactions139 Questions

Exam 3: Measuring Business Income: Adjusting the Accounts168 Questions

Exam 4: Foundations of Financial Reporting and the Classified Balance Sheet130 Questions

Exam 5: Accounting for Merchandising Operations177 Questions

Exam 6: Inventories162 Questions

Exam 7: Cash and Internal Control141 Questions

Exam 8: Receivables111 Questions

Exam 9: Long-Term Assets227 Questions

Exam 10: Current Liabilities and Fair Value Accounting179 Questions

Exam 11: Long-Term Liabilities200 Questions

Exam 12: Stockholders Equity196 Questions

Exam 13: The Statement of Cash Flows147 Questions

Exam 14: Financial Statement Analysis164 Questions

Exam 15: Managerial Accounting and Cost Concepts199 Questions

Exam 16: Costing Systems: Job Order Costing121 Questions

Exam 17: Costing Systems: Process Costing139 Questions

Exam 18: Value-Based Systems: Activity-Based Costing and Lean Accounting146 Questions

Exam 19: Cost-Volume-Profit Analysis167 Questions

Exam 20: The Budgeting Process113 Questions

Exam 21: Flexible Budgets and Performance Analysis116 Questions

Exam 22: Standard Costing and Variance Analysis118 Questions

Exam 23: Short-Run Decision Analysis128 Questions

Exam 24: Capital Investment Analysis106 Questions

Exam 25: Pricing Decisions, including Target Costing and Transfer Pricing139 Questions

Exam 26: Quality Management and Measurement101 Questions

Exam 27: Accounting for Unincorporated Businesses106 Questions

Exam 28: Accounting for Investments112 Questions

Select questions type

The direct labor rate variance is the difference between the standard hours allowed and the actual hours multiplied by the actual labor rate.

Free

(True/False)

4.7/5  (36)

(36)

Correct Answer:

False

Nexus Star Inc.produces various kinds of oils.One of its product,Product X,is made from castor oil,beeswax,aloe vera,and a base compound.

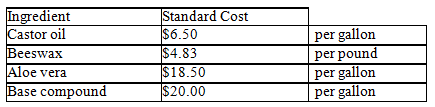

For the next 12 months,the company's purchasing agent believes that the cost of ingredients will be as follows:

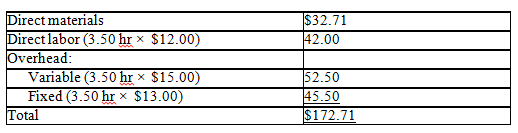

The direct labor time standard is 3.50 hours per unit at a standard direct labor rate of $12.00 per hour.The standard overhead rates are $15.00 per direct labor hour for the standard variable overhead rate and $13.00 per direct labor hour for the standard fixed overhead rate.

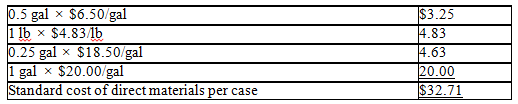

a.Using these production standards,compute the standard unit cost of direct materials per unit if it takes 0.50 gallon of castor oil,1 pound of beeswax,0.25 gallon of aloe vera,and 1 gallon of base compound to produce one unit of product X.Round values to two decimal places.

b.Using the standard unit cost of direct materials per case determined in (a)and the production standards given for direct labor and overhead,compute the standard unit cost of one unit of product X.

The direct labor time standard is 3.50 hours per unit at a standard direct labor rate of $12.00 per hour.The standard overhead rates are $15.00 per direct labor hour for the standard variable overhead rate and $13.00 per direct labor hour for the standard fixed overhead rate.

a.Using these production standards,compute the standard unit cost of direct materials per unit if it takes 0.50 gallon of castor oil,1 pound of beeswax,0.25 gallon of aloe vera,and 1 gallon of base compound to produce one unit of product X.Round values to two decimal places.

b.Using the standard unit cost of direct materials per case determined in (a)and the production standards given for direct labor and overhead,compute the standard unit cost of one unit of product X.

Free

(Essay)

4.7/5  (42)

(42)

Correct Answer:

a.

b.

The variable overhead efficiency variance is the difference between actual total overhead costs incurred and the total overhead costs applied using the standard overhead rates.

Free

(True/False)

4.8/5  (32)

(32)

Correct Answer:

False

The static budget can be adjusted automatically for changes in the level of output.

(True/False)

4.9/5  (38)

(38)

The standard overhead cost is the sum of the estimates of variable and fixed overhead costs in the next accounting period.

(True/False)

4.9/5  (35)

(35)

Discuss the keys to preparing a performance report based on standard costs and related variances.

(Essay)

4.8/5  (41)

(41)

A standard unit cost can be determined after developing standard costs for direct materials,direct labor,and variable and fixed overhead.

(True/False)

4.7/5  (41)

(41)

A performance report should contain cost or revenue items that the manager receiving the report can control.

(True/False)

4.9/5  (40)

(40)

Which of the following costs generally do not include standard unit costs?

(Multiple Choice)

4.7/5  (34)

(34)

Robert Inc.uses the standard costing method.The company's main product is a fine-quality headphones that normally takes 0.5 hour to produce.Normal annual capacity is 5,000 direct labor hours,and budgeted fixed overhead costs for the year were $8,750.During the year,the company produced and sold 5,800 units.Actual fixed overhead costs were $6,000. Using the information provided for Robert Inc.

-Compute the fixed overhead cost variance.

(Multiple Choice)

5.0/5  (28)

(28)

For which of the following can a standard cost accounting system be used?

(Multiple Choice)

4.9/5  (41)

(41)

In a fully integrated standard costing system,standard costs eventually flow into the

(Multiple Choice)

4.7/5  (34)

(34)

The purchasing agent is responsible for developing the direct materials quantity standard.

(True/False)

4.8/5  (27)

(27)

Standard costs are based solely on actual costs incurred in past.

(True/False)

4.8/5  (35)

(35)

Standard costs for company products are typically used for all except

(Multiple Choice)

4.9/5  (38)

(38)

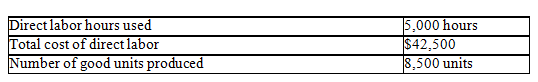

Choco Sweet Inc.gives you the following information: The standard labor time of 0.75 labor hour is required to produce one unit.The standard labor cost for a 10 pound bag of chocolate is $8 per labor hour.The following is data relating to the actual cost and usage data.

Using the above information provided for Choco Sweet.

-Compute the direct labor rate variance for Choco Sweet Inc.

Using the above information provided for Choco Sweet.

-Compute the direct labor rate variance for Choco Sweet Inc.

(Multiple Choice)

4.8/5  (36)

(36)

The final step in variance analysis is taking appropriate corrective action.

(True/False)

4.7/5  (38)

(38)

The primary difference between a fixed (static)budget and a flexible budget is that a fixed budget

(Multiple Choice)

4.9/5  (35)

(35)

Showing 1 - 20 of 118

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)