Exam 11: Current Liabilities and Fair Value Accounting

Exam 1: Accounting Principles and the Financial Statements170 Questions

Exam 2: Analyzing and Recording Business Transactions137 Questions

Exam 3: Adjusting the Accounts169 Questions

Exam 4: Completing the Accounting Cycle179 Questions

Exam 5: Foundations of Financial Reporting and the Classified Balance Sheet133 Questions

Exam 6: Accounting for Merchandising Operations177 Questions

Exam 7: Inventories162 Questions

Exam 8: Cash and Internal Control142 Questions

Exam 9: Receivables112 Questions

Exam 10: Long -Term Assets227 Questions

Exam 11: Current Liabilities and Fair Value Accounting180 Questions

Exam 12: Accounting for Partnerships153 Questions

Exam 13: Accounting for Corporations198 Questions

Exam 14: Long Term Liabilities206 Questions

Exam 15: The Statement of Cash Flows148 Questions

Exam 16: Financial Statement Analysis169 Questions

Exam 17: Managerial Accounting and Cost Concepts200 Questions

Exam 18: Costing Systems: Job Order Costing122 Questions

Exam 19: Costing Systems Process Costing139 Questions

Exam 20: Value-Based Systems: Activity-Based Costing and Lean Accounting146 Questions

Exam 21: Cost-Volume-Profit Analysis163 Questions

Exam 22: The Budgeting Process113 Questions

Exam 23: Flexible Budgets and Performance Analysis116 Questions

Exam 24: Standard Costing and Variance Analysis120 Questions

Exam 25: Short-Run Decision Analysis and Capital Budgeting185 Questions

Select questions type

Wages are compensation of employees at a yearly or monthly rate.

(True/False)

4.9/5  (32)

(32)

Which of the following most likely is an example of an accrued liability?

(Multiple Choice)

4.8/5  (32)

(32)

Which of the following statements is true regarding the time value of money?

(Multiple Choice)

4.9/5  (40)

(40)

During May,Phone Mart sold 150 iphones for $200 each.Each camera had cost Phone Mart $108 to purchase and carried a one-year warranty.If 4 percent typically need to be replaced over the warranty period and two actually are replaced during May,the entry to record the Product Warranty Expense is

(Multiple Choice)

4.8/5  (40)

(40)

A company wishes to make annual contributions into a fund intended to retire $700,000 in debt five years from now.The amount to contribute each year equals $700,000

(Multiple Choice)

4.8/5  (36)

(36)

Second National Bank computes interest semiannually.If the annualized interest rate (APR)is currently 6 percent,the amount deposited today should be multiplied by which future value factor to calculate the amount that will accumulate by the end of 10 years?

(Multiple Choice)

4.9/5  (33)

(33)

Unearned revenue arises from the acceptance of payment in advance for a service to be performed.

(True/False)

4.8/5  (35)

(35)

The current portion of long-term debt is classified as a current liability only if it is due within the next year and is to be paid from current assets.

(True/False)

4.9/5  (39)

(39)

The entry that includes a debit to Payroll Taxes and Benefits Expense would also include credits to Social Security Tax Payable and Medicare Tax Payable.

(True/False)

4.8/5  (36)

(36)

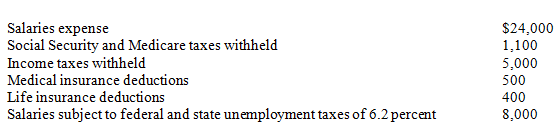

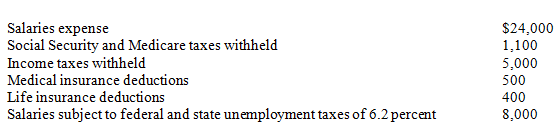

Use this information to answer the following question. The following totals for the month of September were taken from the payroll register of Meadors Company:

-The entry to record the accrual of employer's payroll taxes would include a debit to Payroll Taxes and Benefits Expense for

-The entry to record the accrual of employer's payroll taxes would include a debit to Payroll Taxes and Benefits Expense for

(Multiple Choice)

5.0/5  (40)

(40)

Toojay Company manufactures and sells widgets.Each widget costs $60 and sells for $100.Each widget carries a warranty that provides for free replacement if it fails for any reason during the next 36 months.In the past,4 percent of the widgets have had to be replaced under the warranty.During April,Toojay sold 2,000 widgets and replaced 150 under warranty.Calculate the product warranty expense for the month.Show your computation.

(Essay)

4.8/5  (34)

(34)

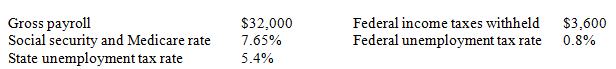

Use this information to answer the following question. Panadora Company has the following information for the pay period of January 1-15,2014.Payment occurs on January 20.

-Payroll Taxes and Benefits Expense would be recorded for

-Payroll Taxes and Benefits Expense would be recorded for

(Multiple Choice)

4.8/5  (37)

(37)

Contrast the accounting problems presented by definitely determinable liabilities and those associated with estimated liabilities.

(Essay)

4.8/5  (43)

(43)

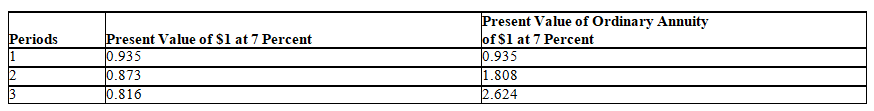

Use this information to answer the following question.  -What amount must be deposited today to grow to $900 in three years,assuming an APR of 7 percent?

-What amount must be deposited today to grow to $900 in three years,assuming an APR of 7 percent?

(Multiple Choice)

4.9/5  (29)

(29)

There is no limit to the amount of income subject to the FUTA tax.

(True/False)

4.9/5  (37)

(37)

A business accepts a 12 percent,$94,000 note due in three years.Assuming simple interest,how much will the business receive when the note falls due?

(Multiple Choice)

4.8/5  (33)

(33)

Compound interest is computed quarterly on $700 for seven years at 12 percent annual interest.The future value table is used by multiplying the $700 by which factor?

(Multiple Choice)

4.9/5  (44)

(44)

The amount recorded for Payroll Taxes and Benefits Expense is borne entirely by the employee.

(True/False)

4.9/5  (38)

(38)

Use this information to answer the following question. The following totals for the month of September were taken from the payroll register of Meadors Company:

-The amount of liabilities relating to payroll,other than Salaries Payable,is

-The amount of liabilities relating to payroll,other than Salaries Payable,is

(Multiple Choice)

5.0/5  (42)

(42)

Showing 61 - 80 of 180

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)