Exam 11: Current Liabilities and Fair Value Accounting

Exam 1: Accounting Principles and the Financial Statements170 Questions

Exam 2: Analyzing and Recording Business Transactions137 Questions

Exam 3: Adjusting the Accounts169 Questions

Exam 4: Completing the Accounting Cycle179 Questions

Exam 5: Foundations of Financial Reporting and the Classified Balance Sheet133 Questions

Exam 6: Accounting for Merchandising Operations177 Questions

Exam 7: Inventories162 Questions

Exam 8: Cash and Internal Control142 Questions

Exam 9: Receivables112 Questions

Exam 10: Long -Term Assets227 Questions

Exam 11: Current Liabilities and Fair Value Accounting180 Questions

Exam 12: Accounting for Partnerships153 Questions

Exam 13: Accounting for Corporations198 Questions

Exam 14: Long Term Liabilities206 Questions

Exam 15: The Statement of Cash Flows148 Questions

Exam 16: Financial Statement Analysis169 Questions

Exam 17: Managerial Accounting and Cost Concepts200 Questions

Exam 18: Costing Systems: Job Order Costing122 Questions

Exam 19: Costing Systems Process Costing139 Questions

Exam 20: Value-Based Systems: Activity-Based Costing and Lean Accounting146 Questions

Exam 21: Cost-Volume-Profit Analysis163 Questions

Exam 22: The Budgeting Process113 Questions

Exam 23: Flexible Budgets and Performance Analysis116 Questions

Exam 24: Standard Costing and Variance Analysis120 Questions

Exam 25: Short-Run Decision Analysis and Capital Budgeting185 Questions

Select questions type

The costs associated with coupons and rebates are usually reflected in contra-revenue accounts.

(True/False)

4.9/5  (42)

(42)

At the time a company signs a contract to pay an employee a certain salary in the future,it records a liability.

(True/False)

4.9/5  (34)

(34)

A contingent liability eventually becomes either a true liability or no liability at all.

(True/False)

4.7/5  (33)

(33)

Hilda wishes to deposit an amount into her savings account that will enable her to withdraw $1,600 per year for the next four years.She should deposit an amount equal to $1,600 multiplied by the

(Multiple Choice)

4.8/5  (44)

(44)

What would be the adjusting entry for a note payable whose interest is not included in the face amount of the note?

(Multiple Choice)

4.9/5  (43)

(43)

Margo Dhang is paid $8 per hour plus time-and-one-half for hours over 40 for a given week.During the week of January 21,Margo worked 46 hours.Social security taxes are 6.2 percent,Medicare taxes are 1.45 percent,$50 is withheld for federal income taxes,$12 is withheld for state income taxes,and $15 is withheld for medical insurance.In addition,Margo's employer must pay Social Security taxes of 6.2 percent,Medicare taxes of 1.45 percent,state unemployment taxes of 5.4 percent,and federal unemployment taxes of 0.8 percent.Calculate (a)Margo's gross earnings, (b)Margo's take-home pay, (c)the employer's payroll taxes expense,and (d)the total cost of employing Margo for the week.Round all amounts to the nearest penny.

a.$392.00 [(40 ´ $8)+ (6 ´ $12)]

(Essay)

5.0/5  (30)

(30)

During August,Radio City sold 200 ipods for $50 each.Each ipod had cost Audio City $31 to purchase and carried a two-year warranty.If 5 percent typically need to be replaced over the warranty period and one actually is replaced during August,the entry to record the Product Warranty Expense is

(Multiple Choice)

4.8/5  (36)

(36)

Expected obligations arising from programs,such as frequent flyer miles,are usually recorded as a reduction in sales (in a contra-sales account)with a related liability.

(True/False)

4.8/5  (33)

(33)

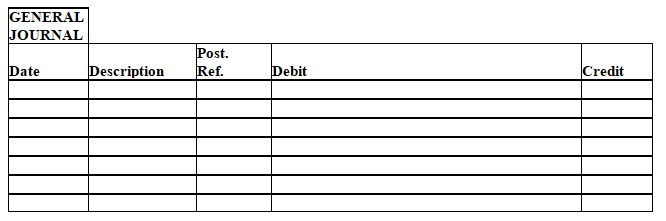

Marta Company had cash sales of $120,000 for the month of November.Sales are subject to a 4.5 percent sales tax and a 6 percent excise tax.In the journal provided,prepare a compound entry to record Marta's sales and related sales and excise taxes for the month.

(Essay)

4.8/5  (37)

(37)

Lawsuits against a company in connection with an industrial accident would not be listed in the contingent liabilities section on the balance sheet.

(True/False)

4.9/5  (40)

(40)

A company receives $200,of which $8 is for sales tax and $12 is for excise tax.The journal entry to record the sale is:

(Multiple Choice)

4.8/5  (40)

(40)

Which of the following typically would not be done to satisfy a current liability?

(Multiple Choice)

4.8/5  (36)

(36)

The FUTA tax rate most often actually paid by employers is 0.8 percent.

(True/False)

4.7/5  (40)

(40)

Which of the following most likely is an estimated liability?

(Multiple Choice)

4.8/5  (28)

(28)

Potential vacation pay should be accounted for as a commitment.

(True/False)

4.9/5  (34)

(34)

Under what circumstances is a contingent liability reflected in the accounting records as though an actual liability exists?

(Essay)

4.7/5  (38)

(38)

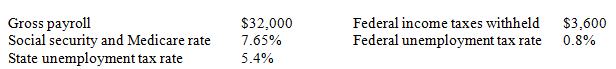

Use this information to answer the following question. Panadora Company has the following information for the pay period of January 1-15,2014.Payment occurs on January 20.

-The entry to record the payroll taxes expense would include a credit to

-The entry to record the payroll taxes expense would include a credit to

(Multiple Choice)

4.8/5  (46)

(46)

Showing 141 - 160 of 180

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)