Exam 1: An Introduction to Taxation and Understanding the Federal Tax Law

Exam 1: An Introduction to Taxation and Understanding the Federal Tax Law139 Questions

Exam 2: Working With the Tax Law78 Questions

Exam 3: Computing the Tax130 Questions

Exam 4: Gross Income: Concepts and Inclusions125 Questions

Exam 5: Gross Income: Exclusions116 Questions

Exam 6: Deductions and Losses: in General144 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses90 Questions

Exam 8: Depreciation,cost Recovery,amortization,and Depletion108 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses150 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions100 Questions

Exam 11: Investor Losses94 Questions

Exam 12: Tax Credits and Payments104 Questions

Exam 13: Part 1--Property Transactions: Determination of Gain or Loss,basis Considerations,and Nontaxable Exchanges199 Questions

Exam 13: Part 2--Property Transactions: Determination of Gain or Loss,basis Considerations,and Nontaxable Exchanges82 Questions

Exam 14: Property Transactions: Capital Gains and Losses,1231,and Recapure Provisions144 Questions

Exam 15: Alternative Minimum Tax119 Questions

Exam 16: Accounting Periods and Methods86 Questions

Exam 17: Corporations: Introduction and Operating Rules108 Questions

Exam 18: Corporations: Organization and Capital Structure93 Questions

Exam 19: Corporations: Distributions Not in Complete Liquidation136 Questions

Exam 20: Distributions in Complete Liquidation and an Overview of Reorganizations66 Questions

Exam 21: Partnerships157 Questions

Exam 22: S Corporations144 Questions

Exam 23: Exempt Entities132 Questions

Exam 24: Multistate Corporate Taxation119 Questions

Exam 25: Taxation of International Transactions146 Questions

Exam 26: Tax Practice and Ethics135 Questions

Exam 27: The Federal Gift and Estate Taxes144 Questions

Exam 28: Income Taxation of Trusts and Estates132 Questions

Select questions type

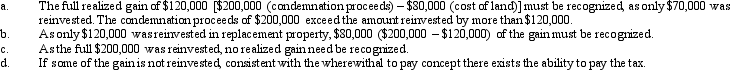

Several years ago,Gordon purchased extra grazing land for his ranch at a cost of $80,000.In 2010,the land is condemned by the state for development as a highway maintenance depot.Under the condemnation award,Gordon receives $200,000 for the land.Within the same year,he replaces the property with other grazing land.What is Gordon's tax situation if the replacement land cost:

Free

(Essay)

4.8/5  (37)

(37)

Correct Answer:

An inheritance tax is a tax on an heir's right to receive property from a decedent.

Free

(True/False)

4.8/5  (31)

(31)

Correct Answer:

True

Because they are politically unpopular,many cities are reducing or eliminating their hotel occupancy and car rental surcharges.

Free

(True/False)

4.9/5  (34)

(34)

Correct Answer:

False

A state income tax cannot be imposed on nonresident taxpayers who earn income within the state or on an itinerant basis.

(True/False)

4.8/5  (39)

(39)

Some states have offered income tax amnesty programs on more than one occasion.

(True/False)

4.8/5  (33)

(33)

The Federal income tax on individuals generates more revenue than the Federal income tax on corporations.

(True/False)

5.0/5  (37)

(37)

The value added tax (VAT)has not had wide acceptance in the international community.

(True/False)

4.7/5  (30)

(30)

Which,if any,of the following is a typical characteristic of an ad valorem tax on personality?

(Multiple Choice)

4.8/5  (40)

(40)

A tax cut enacted by Congress that contains a sunset provision will make the tax cut permanent.

(True/False)

4.9/5  (45)

(45)

Gene files his tax return 45 days after the due date.Along with the return,Gene remits a check for $40,000 which is the balance of the tax owed.Disregarding the interest element,Gene's total failure to file and to pay penalties are:

(Multiple Choice)

4.9/5  (45)

(45)

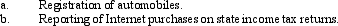

A lack of compliance in the payment of use taxes can be eased by several means.In this regard,comment on the following:

(Essay)

5.0/5  (34)

(34)

Under Clint's will,all of his property passes to either the Lutheran Church or to his wife.No Federal estate tax will be due on Clint's death in 2009.

(True/False)

4.9/5  (33)

(33)

Regarding proper ethical guidelines,which (if any)of the following is correct?

(Multiple Choice)

4.8/5  (28)

(28)

The ratification of the Sixteenth Amendment to the U.S.Constitution was necessary to validate the Federal income tax on corporations.

(True/False)

4.8/5  (39)

(39)

The tax law allows an income tax deduction for state and local income taxes or state and local sales taxes paid.Explain the justification for each.

(Essay)

4.9/5  (35)

(35)

A major advantage of a flat tax type of income tax is its simplicity.

(True/False)

4.9/5  (33)

(33)

One of the major reasons for the enactment of the Federal estate tax was to prevent large amounts of wealth from being accumulated within the family unit.

(True/False)

4.8/5  (29)

(29)

The Garfields were surprised to learn that the ad valorem taxes on their personal residence have been increased for 2010.They have made no capital improvements to the residence and the property tax rate has not changed.Furthermore,they feel that property values have recently declined since several homes in the neighborhood are scheduled for foreclosure.What probably caused the property tax increase?

(Essay)

4.7/5  (36)

(36)

Showing 1 - 20 of 139

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)