Exam 14: Property Transactions: Capital Gains and Losses,1231,and Recapure Provisions

Exam 1: An Introduction to Taxation and Understanding the Federal Tax Law139 Questions

Exam 2: Working With the Tax Law78 Questions

Exam 3: Computing the Tax130 Questions

Exam 4: Gross Income: Concepts and Inclusions125 Questions

Exam 5: Gross Income: Exclusions116 Questions

Exam 6: Deductions and Losses: in General144 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses90 Questions

Exam 8: Depreciation,cost Recovery,amortization,and Depletion108 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses150 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions100 Questions

Exam 11: Investor Losses94 Questions

Exam 12: Tax Credits and Payments104 Questions

Exam 13: Part 1--Property Transactions: Determination of Gain or Loss,basis Considerations,and Nontaxable Exchanges199 Questions

Exam 13: Part 2--Property Transactions: Determination of Gain or Loss,basis Considerations,and Nontaxable Exchanges82 Questions

Exam 14: Property Transactions: Capital Gains and Losses,1231,and Recapure Provisions144 Questions

Exam 15: Alternative Minimum Tax119 Questions

Exam 16: Accounting Periods and Methods86 Questions

Exam 17: Corporations: Introduction and Operating Rules108 Questions

Exam 18: Corporations: Organization and Capital Structure93 Questions

Exam 19: Corporations: Distributions Not in Complete Liquidation136 Questions

Exam 20: Distributions in Complete Liquidation and an Overview of Reorganizations66 Questions

Exam 21: Partnerships157 Questions

Exam 22: S Corporations144 Questions

Exam 23: Exempt Entities132 Questions

Exam 24: Multistate Corporate Taxation119 Questions

Exam 25: Taxation of International Transactions146 Questions

Exam 26: Tax Practice and Ethics135 Questions

Exam 27: The Federal Gift and Estate Taxes144 Questions

Exam 28: Income Taxation of Trusts and Estates132 Questions

Select questions type

Kari owns depreciable residential rental real estate which has accumulated depreciation (all from straight-line)of $45,000.If Kari sold the property,she would have a $33,000 gain.The initial characterization of the gain would be:

Free

(Multiple Choice)

4.7/5  (41)

(41)

Correct Answer:

B

The holding period of property given up in a like-kind exchange includes the holding period of the asset received if the property that has been exchanged is a capital asset.

Free

(True/False)

5.0/5  (41)

(41)

Correct Answer:

False

Section 1239 (relating to the sale of certain property between related taxpayers)does not apply unless the property:

(Multiple Choice)

4.9/5  (42)

(42)

Harold is a mechanical engineer and,while unemployed,invents a switching device for computer networks.He patents the device,but does not reduce it to practice.Harold has a zero tax basis for the patent.In consideration of $300,000 plus a $1 royalty per device sold,Harold assigns the patent to a computer manufacturing company.Harold assigned all substantial rights in the patent.Which of the following is correct?

(Multiple Choice)

4.8/5  (38)

(38)

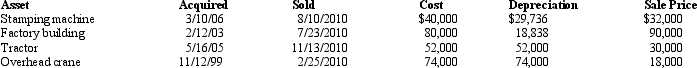

The chart below describes the § 1231 assets sold by the Burgundy Company (a sole proprietorship)this year.Compute the gain or loss from each asset disposition and determine the net § 1231 gain treated as long-term capital gain for the year.Assume there is a § 1231 lookback loss of $4,000.

(Essay)

4.8/5  (35)

(35)

What characteristics must the seller of a patent have in order to be classified as a holder?

(Essay)

4.8/5  (28)

(28)

Nonrecaptured § 1231 losses from the seven prior tax years may cause current year net § 1231 gain to be treated as ordinary income.

(True/False)

4.9/5  (46)

(46)

Harry inherited a residence from his mother when she died.The mother had a tax basis of $566,000 for the residence when she died and the residence was worth $433,000 at the date of her death.Which of the statements below is correct?

(Multiple Choice)

4.8/5  (36)

(36)

Short-term capital losses are netted against long-term capital gains and long-term capital losses are netted against short-term capital gains.

(True/False)

5.0/5  (43)

(43)

In the "General Procedure for § 1231 Computation: Step 2.§ 1231 Netting," if the gains exceed the losses,the net gain is offset by the "lookback" nonrecaptured § 1231 losses.

(True/False)

4.9/5  (37)

(37)

The § 1245 depreciation recapture potential does not reduce the amount of the charitable contribution deduction under § 170.

(True/False)

4.8/5  (37)

(37)

Short-term capital gain is eligible for a special tax rate only when it exceeds long-term capital gain.

(True/False)

4.8/5  (36)

(36)

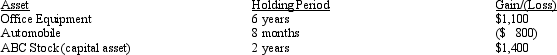

The following assets in Jack's business were sold in 2010:  The office equipment had a zero adjusted basis and was purchased for $8,000.The automobile was purchased for $2,000 and sold for $1,200.The ABC stock was purchased for $1,800 and sold for $3,200.In 2010 (the year of sale),Jack should report what amount of net capital gain and net ordinary income?

The office equipment had a zero adjusted basis and was purchased for $8,000.The automobile was purchased for $2,000 and sold for $1,200.The ABC stock was purchased for $1,800 and sold for $3,200.In 2010 (the year of sale),Jack should report what amount of net capital gain and net ordinary income?

(Multiple Choice)

4.8/5  (35)

(35)

A retail building used in the business of a sole proprietor is sold on March 10,2010,for $322,000.The building was acquired in 2000 for $400,000 and straight-line depreciation of $104,000 had been taken on the building.What is the maximum unrecaptured § 1250 gain from the disposition of this building?

(Multiple Choice)

4.8/5  (35)

(35)

Describe the circumstances in which the maximum unrecaptured § 1250 gain (25% gain)does not become part of the Schedule D netting process for an individual taxpayer?

(Essay)

5.0/5  (39)

(39)

A business taxpayer trades in a used fully depreciated machine on a replacement machine.Because the machine traded in was worth more than the replacement machine,the taxpayer received cash in the transaction.Assume the used machine originally cost $100,000,was worth $32,000 when it was traded in,and the replacement machine was worth $20,000.Consequently,the taxpayer received $12,000 cash in the transaction.Is there recognized gain in this transaction and,if so,what type of gain?

(Essay)

4.8/5  (49)

(49)

Verway,Inc. ,has a 2010 net § 1231 gain of $55,000 and had a $62,000 net § 1231 loss in 2009.For 2010,Verway's net § 1231 gain is treated as:

(Multiple Choice)

4.8/5  (37)

(37)

As a general rule,the sale or exchange of an option to buy or sell property results in capital gain or loss if the property subject to the option is (or would be)a capital asset in the hands of the option holder.

(True/False)

4.9/5  (40)

(40)

The 2009 "Qualified Dividends and Capital Gain Worksheet" is used:

(Multiple Choice)

4.9/5  (39)

(39)

Showing 1 - 20 of 144

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)