Exam 1: An Introduction to Taxation and Understanding the Federal Tax Law

Exam 1: An Introduction to Taxation and Understanding the Federal Tax Law139 Questions

Exam 2: Working With the Tax Law78 Questions

Exam 3: Computing the Tax130 Questions

Exam 4: Gross Income: Concepts and Inclusions125 Questions

Exam 5: Gross Income: Exclusions116 Questions

Exam 6: Deductions and Losses: in General144 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses90 Questions

Exam 8: Depreciation,cost Recovery,amortization,and Depletion108 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses150 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions100 Questions

Exam 11: Investor Losses94 Questions

Exam 12: Tax Credits and Payments104 Questions

Exam 13: Part 1--Property Transactions: Determination of Gain or Loss,basis Considerations,and Nontaxable Exchanges199 Questions

Exam 13: Part 2--Property Transactions: Determination of Gain or Loss,basis Considerations,and Nontaxable Exchanges82 Questions

Exam 14: Property Transactions: Capital Gains and Losses,1231,and Recapure Provisions144 Questions

Exam 15: Alternative Minimum Tax119 Questions

Exam 16: Accounting Periods and Methods86 Questions

Exam 17: Corporations: Introduction and Operating Rules108 Questions

Exam 18: Corporations: Organization and Capital Structure93 Questions

Exam 19: Corporations: Distributions Not in Complete Liquidation136 Questions

Exam 20: Distributions in Complete Liquidation and an Overview of Reorganizations66 Questions

Exam 21: Partnerships157 Questions

Exam 22: S Corporations144 Questions

Exam 23: Exempt Entities132 Questions

Exam 24: Multistate Corporate Taxation119 Questions

Exam 25: Taxation of International Transactions146 Questions

Exam 26: Tax Practice and Ethics135 Questions

Exam 27: The Federal Gift and Estate Taxes144 Questions

Exam 28: Income Taxation of Trusts and Estates132 Questions

Select questions type

For the negligence penalty to apply,the underpayment must be caused by intentional disregard of rules and regulations without intent to defraud.

(True/False)

4.8/5  (33)

(33)

The IRS is required to redetermine the interest rate on underpayments and overpayments once a year.

(True/False)

4.9/5  (31)

(31)

If an income tax return is not filed by a taxpayer,there is no statute of limitations on assessments of tax by the IRS.

(True/False)

4.9/5  (40)

(40)

Burt and Lisa are married and live in a common law state.Burt wants to make gifts to their five children in 2010.What is the maximum amount of the annual exclusion they will be allowed for these gifts?

(Multiple Choice)

4.8/5  (40)

(40)

Which,if any,of the following provisions of the tax law cannot be justified as promoting administrative feasibility (simplifying the task of the IRS)?

(Multiple Choice)

4.8/5  (32)

(32)

The tax law provides various tax credits,deductions,and exclusions that are designed to encourage taxpayers to obtain additional education.These provisions can be justified on both economic and social grounds.

(True/False)

4.8/5  (39)

(39)

Which of the following is a characteristic of the audit process?

(Multiple Choice)

4.8/5  (29)

(29)

For Federal income tax purposes,there never has been a general amnesty period.

(True/False)

4.8/5  (42)

(42)

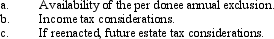

In spite of legislative changes which phase out the estate tax,considerable motivation continues to exist for making lifetime gifts.Explain this motivation in the light of the following:

(Essay)

4.8/5  (32)

(32)

The principal objective of the FUTA tax is to provide some measure of retirement security.

(True/False)

4.8/5  (31)

(31)

If a "special agent" becomes involved in the audit of a return,this indicates that the IRS suspects that fraud is involved.

(True/False)

4.7/5  (34)

(34)

Under the Tax Relief Reconciliation Act of 2001,only the Federal estate tax is scheduled to be repealed.

(True/False)

5.0/5  (44)

(44)

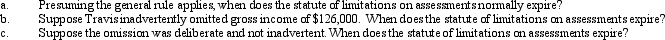

For the tax year 2010,Travis reported gross income of $500,000 on his timely filed Federal income tax return.

(Essay)

4.8/5  (34)

(34)

On transfers by death,the Federal government relies on an estate tax,while states use only an inheritance tax.

(True/False)

5.0/5  (31)

(31)

The Federal gas-guzzler tax applies only to automobiles manufactured overseas and imported into the U.S.

(True/False)

4.8/5  (35)

(35)

Stealth taxes have the effect of generating additional taxes from lower income taxpayers.

(True/False)

4.8/5  (37)

(37)

Various tax provisions encourage the creation of certain types of retirement plans.Such provisions can be justified on both economic and equity grounds.

(True/False)

4.8/5  (34)

(34)

In an office audit,the audit by the IRS takes place at the taxpayer's office.

(True/False)

4.8/5  (45)

(45)

Showing 121 - 139 of 139

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)