Exam 3: The Adjusting Process

Exam 1: Introduction to Accounting and Business233 Questions

Exam 2: Analyzing Transactions235 Questions

Exam 3: The Adjusting Process208 Questions

Exam 4: Completing the Accounting Cycle215 Questions

Exam 5: Accounting Systems200 Questions

Exam 6: Accounting for Merchandising Businesses232 Questions

Exam 7: Inventories204 Questions

Exam 8: Internal Control and Cash183 Questions

Exam 9: Receivables192 Questions

Exam 10: Long-Term Assets: Fixed and Intangible219 Questions

Exam 11: Current Liabilities and Payroll197 Questions

Exam 12: Accounting for Partnerships and Limited Liability Companies199 Questions

Exam 13: Corporations: Organization, stock Transactions, and Dividends215 Questions

Exam 14: Long-Term Liabilities: Bonds and Notes177 Questions

Exam 15: Investments and Fair Value Accounting169 Questions

Exam 16: Statement of Cash Flows187 Questions

Exam 17: Financial Statement Analysis200 Questions

Select questions type

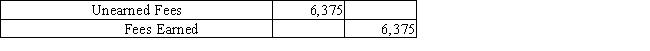

What effect will this adjustment have on the accounting records?

(Multiple Choice)

4.9/5  (33)

(33)

If the effect of the debit portion of an adjusting entry is to increase the balance of an expense account,which of the following describes the effect of the credit portion of the entry?

(Multiple Choice)

4.8/5  (29)

(29)

The net income reported on the income statement is $58,000.However,adjusting entries have not been made at the end of the period for supplies expense of $2,200 and accrued salaries of $1,300.Net income,as corrected,is

(Multiple Choice)

4.8/5  (30)

(30)

At the end of the fiscal year,the usual adjusting entry for depreciation on equipment was omitted.Which of the following is true?

(Multiple Choice)

4.9/5  (31)

(31)

At the end of the fiscal year,the usual adjusting entry to prepaid insurance to record expired insurance was omitted.Which of the following statements is true?

(Multiple Choice)

4.9/5  (44)

(44)

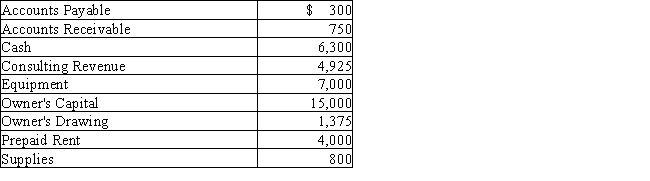

Jordon James started JJJ Consulting on January 1.The following are the account balances at the end of the first month of business,before adjusting entries were recorded:  Adjustment data:Supplies on hand at the end of the month,$200Unbilled consulting revenue,$700Rent expense for the month,$1,000Depreciation on equipment,$90

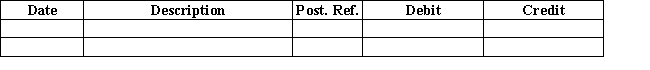

(a) Prepare the required adjusting entries,adding accounts as needed.

(b) Prepare an adjusted trial balance for JJJ Consulting as of January 31.

Adjustment data:Supplies on hand at the end of the month,$200Unbilled consulting revenue,$700Rent expense for the month,$1,000Depreciation on equipment,$90

(a) Prepare the required adjusting entries,adding accounts as needed.

(b) Prepare an adjusted trial balance for JJJ Consulting as of January 31.

(Essay)

4.9/5  (36)

(36)

If the effect of the credit portion of an adjusting entry is to increase the balance of a liability account,which of the following describes the effect of the debit portion of the entry?

(Multiple Choice)

4.8/5  (35)

(35)

Depreciation on an office building is $2,800.The adjusting entry on December 31 would be:

(Essay)

4.9/5  (39)

(39)

The adjusting entry to record the depreciation of a building for the fiscal period is

(Multiple Choice)

4.8/5  (43)

(43)

Identify the effect (a through h) that omitting each of the following items would have on the balance sheet.

-Wages are paid every Friday for the five-day workweek.The month ended on Monday and no adjustment was recorded.

(Multiple Choice)

4.9/5  (37)

(37)

Which of the following is the proper adjusting entry,based on a prepaid insurance account balance before adjustment of $14,000 and unexpired insurance of $3,000,for the fiscal year ending on April 30?

(Multiple Choice)

4.9/5  (43)

(43)

A one-year insurance policy was purchased on June 1 for $2,400.The adjusting entry on December 31 would be:

(Essay)

4.8/5  (34)

(34)

Indicate whether the following error would cause the adjusted trial balance totals to be unequal.If the error would cause the adjusted trial balance totals to be unequal,indicate whether the debit or credit total is higher and by how much.The adjustment for accrued fees of $1,170 was journalized as a debit to Accounts Receivable for $1,170 and a credit to Fees Earned for $1,107.

(Essay)

4.9/5  (39)

(39)

Zoey Bella Company has a payroll of $10,000 for a five-day workweek.Its employees are paid each Friday for the five-day workweek.Prepare the adjusting entry on December 31 assuming the year ends on Thursday.

(Essay)

4.7/5  (41)

(41)

Which of the following is considered to be unearned revenue?

(Multiple Choice)

4.8/5  (39)

(39)

Match the type of account (a through e) with the business transactions that follow.

-Annual property taxes that are paid at the end of the year.

(Multiple Choice)

4.7/5  (34)

(34)

At January 31,the end of the first month of the year,the usual adjusting entry transferring expired insurance to an expense account is omitted.Which items will be incorrectly stated,because of the error,on

(a)the income statement for January and

(b)the balance sheet as of January 31? Also indicate whether the items in error will be overstated or understated.

(Essay)

4.9/5  (34)

(34)

List the four basic types of accounts that require adjusting entries and give an example of each.

(Essay)

4.8/5  (41)

(41)

Showing 181 - 200 of 208

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)