Exam 13: Fiscal Policy Appendix Taxes and the Multiplier

Exam 1: First Principles233 Questions

Exam 2: Economic Models319 Questions

Exam 3: Supply and Demand292 Questions

Exam 5: International Trade 5274 Questions

Exam 6: Macroeconomics: the Big Picture168 Questions

Exam 7: Gdp and Cpi: Tracking the Macroeconomy434 Questions

Exam 8: Unemployment and Inflation354 Questions

Exam 9: Long-Run Economic Growth316 Questions

Exam 10: Savings, Investment Spending, and the Financial System402 Questions

Exam 13: Fiscal Policy Appendix Taxes and the Multiplier382 Questions

Exam 14: Money, Banking, and the Federal Reserve System468 Questions

Exam 15: Monetary Policy359 Questions

Exam 16: Inflation, Disinflation, and Deflation240 Questions

Exam 17: Crises and Consequences214 Questions

Exam 18: Events and Ideas322 Questions

Exam 19: Open-Economy Macroeconomics467 Questions

Exam 20: Graphs in Economics75 Questions

Exam 21: toward a Fuller Understanding of Present Value36 Questions

Select questions type

If the economy is at potential output and consumption spending suddenly decreases because of a fall in consumer confidence, the appropriate fiscal policy is:

(Multiple Choice)

4.9/5  (40)

(40)

When potential output is less than actual aggregate output:

(Multiple Choice)

4.9/5  (39)

(39)

Use the following to answer questions:

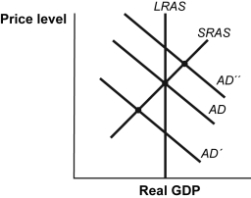

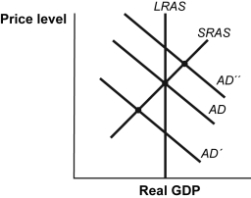

Figure: Fiscal Policy Options  -(Figure: Fiscal Policy Options) Look at the figure Fiscal Policy Options. If the aggregate demand curve is AD':

-(Figure: Fiscal Policy Options) Look at the figure Fiscal Policy Options. If the aggregate demand curve is AD':

(Multiple Choice)

4.9/5  (34)

(34)

The multiplier effect of an increase in transfer payments is smaller than that of an equal increase in government purchases of goods and services because some of the transfer payment is likely to be saved.

(True/False)

4.9/5  (29)

(29)

A change in government transfers shifts the aggregate demand curve by more than a change in government spending for goods and services and has a larger effect on real GDP.

(True/False)

4.7/5  (38)

(38)

Government tax revenue rises and falls with the business cycle as:

(Multiple Choice)

4.8/5  (32)

(32)

Most economists do not support a law that requires the federal budget to be balanced every year. Explain why.

(Essay)

4.9/5  (34)

(34)

Use the following to answer questions :

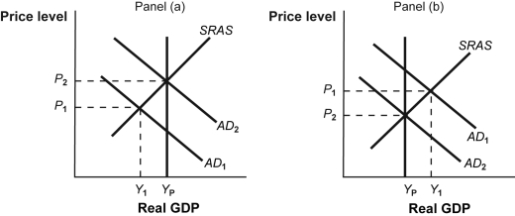

Figure: Fiscal Policy Choices  -(Figure: Fiscal Policy Choices) Look at the figure Fiscal Policy Choices. In panel (a), the economy is initially at output level Y1 and there is:

-(Figure: Fiscal Policy Choices) Look at the figure Fiscal Policy Choices. In panel (a), the economy is initially at output level Y1 and there is:

(Multiple Choice)

4.8/5  (37)

(37)

A contractionary fiscal policy either _____ government spending or _____ taxes.

(Multiple Choice)

4.9/5  (40)

(40)

Economists generally believe that during an expansion, an economy should:

(Multiple Choice)

5.0/5  (40)

(40)

States that are required by their constitution to have annually balanced budgets are likely to _____ than those not required to balance their budget.

(Multiple Choice)

4.8/5  (43)

(43)

For a marginal propensity to consume of 0.9, the multiplier effect of an increase of $100 billion in government purchases of goods and services is larger than the multiplier effect of a tax cut of $100 billion because:

(Multiple Choice)

4.8/5  (36)

(36)

Explain why a constitutional amendment requiring the federal government to balance the budget annually is a bad idea.

(Essay)

4.8/5  (32)

(32)

Spending promises made by governments that are effectively a debt, despite the fact that they are not included in the usual debt statistics, are known as:

(Multiple Choice)

4.9/5  (36)

(36)

Use the following to answer questions:

Figure: Fiscal Policy Options  -(Figure: Fiscal Policy Options) Look at the figure Fiscal Policy Options. If the aggregate demand curve is AD', the most appropriate discretionary fiscal policy is to _____ government spending and _____ income tax rates.

-(Figure: Fiscal Policy Options) Look at the figure Fiscal Policy Options. If the aggregate demand curve is AD', the most appropriate discretionary fiscal policy is to _____ government spending and _____ income tax rates.

(Multiple Choice)

4.8/5  (39)

(39)

Showing 41 - 60 of 382

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)