Exam 13: Fiscal Policy Appendix Taxes and the Multiplier

Exam 1: First Principles233 Questions

Exam 2: Economic Models319 Questions

Exam 3: Supply and Demand292 Questions

Exam 5: International Trade 5274 Questions

Exam 6: Macroeconomics: the Big Picture168 Questions

Exam 7: Gdp and Cpi: Tracking the Macroeconomy434 Questions

Exam 8: Unemployment and Inflation354 Questions

Exam 9: Long-Run Economic Growth316 Questions

Exam 10: Savings, Investment Spending, and the Financial System402 Questions

Exam 13: Fiscal Policy Appendix Taxes and the Multiplier382 Questions

Exam 14: Money, Banking, and the Federal Reserve System468 Questions

Exam 15: Monetary Policy359 Questions

Exam 16: Inflation, Disinflation, and Deflation240 Questions

Exam 17: Crises and Consequences214 Questions

Exam 18: Events and Ideas322 Questions

Exam 19: Open-Economy Macroeconomics467 Questions

Exam 20: Graphs in Economics75 Questions

Exam 21: toward a Fuller Understanding of Present Value36 Questions

Select questions type

Suppose that the budget deficit of a country remains level for five years. The federal debt will:

(Multiple Choice)

4.9/5  (32)

(32)

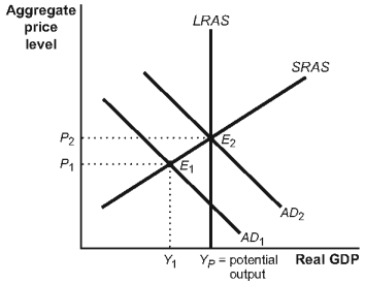

Use the following to answer questions:

Figure: Fiscal Policy II  -(Figure: Fiscal Policy II) Look at the figure Fiscal Policy II. Suppose that this economy is in equilibrium at E1. If there is a decrease in taxes, _____ will shift to the _____, causing a(n) _____ in the price level and a(n) _____ in real GDP.

-(Figure: Fiscal Policy II) Look at the figure Fiscal Policy II. Suppose that this economy is in equilibrium at E1. If there is a decrease in taxes, _____ will shift to the _____, causing a(n) _____ in the price level and a(n) _____ in real GDP.

(Multiple Choice)

4.9/5  (34)

(34)

Expansionary fiscal policy shifts the aggregate demand curve to the _____ and is used to close a(n) _____ gap.

(Multiple Choice)

4.8/5  (22)

(22)

A change in taxes shifts the aggregate demand curve by less than a change in government spending for goods and services and has a smaller effect on real GDP.

(True/False)

5.0/5  (36)

(36)

Government borrowing will not crowd out private investment spending if unemployment is _____ and the fiscal expansion causes a(n) _____ in incomes and a(n) _____ in saving at each interest rate.

(Multiple Choice)

4.7/5  (44)

(44)

Higher government transfers or lower taxes make a budget surplus smaller or a budget deficit larger.

(True/False)

4.9/5  (38)

(38)

In the United States 49 of the 50 states are required to have an annually balanced budget, which worsens the severity of the business cycle.

(True/False)

4.8/5  (34)

(34)

The income expenditure model predicts that if the marginal propensity to consume is 0.75 and the federal government increases spending by $100 billion, real GDP will increase by:

(Multiple Choice)

4.8/5  (34)

(34)

If the ratio of debt to GDP increases over time, it means that the government's burden of paying the debt is decreasing and default is less likely.

(True/False)

4.8/5  (33)

(33)

In most years since 1970, the actual budget deficit has been more than 25% of GDP.

(True/False)

4.9/5  (39)

(39)

The effect of automatic stabilizers is to increase the size of the multiplier.

(True/False)

4.9/5  (36)

(36)

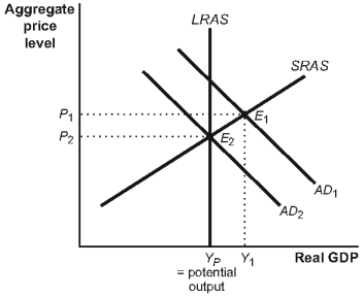

Use the following to answer questions:

Figure: Short- and Long-Run Equilibrium II  -(Figure: Short- and Long-Run Equilibrium II) Look at the figure Short- and Long-Run Equilibrium II. Which of the following would be the appropriate response on the part of the government upon viewing the state of the economy?

-(Figure: Short- and Long-Run Equilibrium II) Look at the figure Short- and Long-Run Equilibrium II. Which of the following would be the appropriate response on the part of the government upon viewing the state of the economy?

(Multiple Choice)

4.9/5  (33)

(33)

An increase in government transfer payments of $100 billion and a tax cut of $100 billion will have equal effects on the budget balance and unequal effects on real GDP.

(True/False)

4.8/5  (42)

(42)

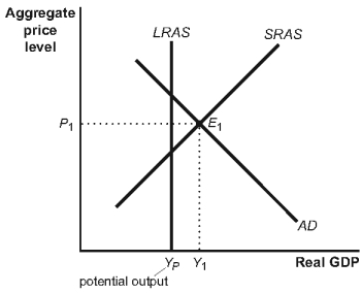

Use the following to answer questions:

Figure: Fiscal Policy I  -(Figure: Fiscal Policy I) Look at the figure Fiscal Policy I. Suppose that this economy is in equilibrium at E1. If there is a decrease in taxes, _____ will shift to the _____, causing a(n) _____ in the price level and a(n) _____ in real GDP.

-(Figure: Fiscal Policy I) Look at the figure Fiscal Policy I. Suppose that this economy is in equilibrium at E1. If there is a decrease in taxes, _____ will shift to the _____, causing a(n) _____ in the price level and a(n) _____ in real GDP.

(Multiple Choice)

4.7/5  (41)

(41)

If there is an inflationary gap in the economy, discretionary fiscal policy will likely include action to:

(Multiple Choice)

4.8/5  (41)

(41)

Assume that the marginal propensity to consume is 0.8 and potential output is $800 billion. If GDP is $850 billion:

(Multiple Choice)

4.7/5  (36)

(36)

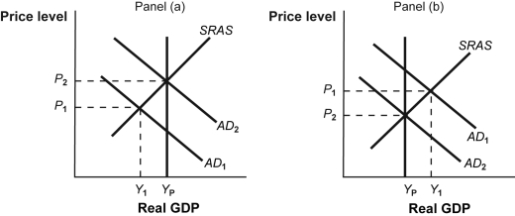

Use the following to answer questions :

Figure: Fiscal Policy Choices  -(Figure: Fiscal Policy Choices) Look at the figure Fiscal Policy Choices. If the government uses discretionary fiscal policy for the economy in panel (b) when real GDP is Y1, government spending is likely to be _____ and taxes are likely to be _____.

-(Figure: Fiscal Policy Choices) Look at the figure Fiscal Policy Choices. If the government uses discretionary fiscal policy for the economy in panel (b) when real GDP is Y1, government spending is likely to be _____ and taxes are likely to be _____.

(Multiple Choice)

4.9/5  (36)

(36)

Use the following to answer questions :

Scenario: Fiscal Policy

Consider the economy of Arcadia. Its households spend 75% of increases in their income. There are no taxes and no foreign trade. Its currency is the arc. Potential output is 600 billion arcs.

-(Scenario: Fiscal Policy) Look at the scenario Fiscal Policy. Suppose that actual output is 700 billion arcs, and the government of Arcadia decides to tax its citizens. To bring the economy to potential output, the government should:

(Multiple Choice)

4.8/5  (38)

(38)

Showing 141 - 160 of 382

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)