Exam 9: Fixed Assets and Intangible Assets

Exam 1: Introduction to Accounting and Business188 Questions

Exam 2: Analyzing Transactions216 Questions

Exam 3: The Adjusting Process179 Questions

Exam 4: Completing the Accounting Cycle198 Questions

Exam 5: Accounting for Merchandising Businesses220 Questions

Exam 6: Inventories170 Questions

Exam 7: Sarbanes-Oxley, Internal Control, and Cash178 Questions

Exam 8: Receivables148 Questions

Exam 9: Fixed Assets and Intangible Assets177 Questions

Exam 10: Current Liabilities and Payroll174 Questions

Exam 11: Corporations: Organization, Stock Transactions, and Dividends172 Questions

Exam 12: Long-Term Liabilities: Bonds and Notes186 Questions

Exam 13: Investments and Fair Value Accounting133 Questions

Exam 14: Statement of Cash Flows161 Questions

Exam 15: Financial Statement Analysis184 Questions

Exam 16: Managerial Accounting Concepts and Principles175 Questions

Exam 17: Job Order Costing176 Questions

Exam 18: Process Cost Systems177 Questions

Exam 19: Cost Behavior and Cost-Volume-Profit Analysis215 Questions

Exam 20: Variable Costing for Management Analysis154 Questions

Exam 21: Budgeting185 Questions

Exam 22: Performance Evaluation Using Variances From Standard Costs160 Questions

Exam 23: Performance Evaluation for Decentralized Operations198 Questions

Exam 24: Differential Analysis and Product Pricing161 Questions

Exam 25: Capital Investment Analysis179 Questions

Exam 26: Cost Allocation and Activity-Based Costing111 Questions

Exam 27: Cost Management for Just-In-Time Environments122 Questions

Select questions type

As a company records depreciation expense for a period of time a corresponding cash inflow from investing activities is reported on the statement of cash flows.

(True/False)

4.8/5  (39)

(39)

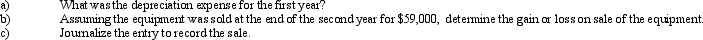

Equipment was acquired at the beginning of the year at a cost of $75,000. The equipment was depreciated using the straight-line method based upon an estimated useful life of 6 years and an estimated residual value of $7,500.

(Essay)

4.9/5  (36)

(36)

The exclusive right to use a certain name or symbol is called a

(Multiple Choice)

4.8/5  (39)

(39)

A fixed asset with a cost of $41,000 and accumulated depreciation of $36,000 is traded for a similar asset priced at $50,000. Assuming a trade-in allowance of $4,000, the cost basis of the new asset is

(Multiple Choice)

4.8/5  (38)

(38)

On June 1, 2014, Aaron Company purchased equipment at a cost of $120,000 that has a depreciable cost of $90,000 and an estimated useful life of 3 years and 30,000 hours. Using straight line depreciation, calculate depreciation expense for the second year.

(Multiple Choice)

5.0/5  (28)

(28)

Land acquired as a speculation is reported under Investments on the balance sheet.

(True/False)

5.0/5  (42)

(42)

The amount of depreciation expense for a fixed asset costing $95,000, with an estimated residual value of $5,000 and a useful life of 5 years or 20,000 operating hours, is $21,375 by the units-of-production method during a period when the asset was used for 4,500 hours.

(True/False)

4.9/5  (43)

(43)

When a company exchanges machinery and receives a trade-in allowance greater than the book value, this transaction would be recorded with the following entry (assuming the exchange was considered to have commercial substance):

(Multiple Choice)

4.7/5  (46)

(46)

Determine the depreciation, for the year of acquisition and for the following year, of a fixed asset acquired on October 1 for $500,000, with an estimated life of 5 years, and residual value of $50,000, using (a) the declining-balance method at twice the straight-line rate and (b) the straight-line method. Assume a fiscal year ending December 31.

(Essay)

4.8/5  (42)

(42)

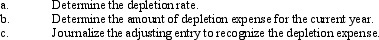

Solare Company acquired mineral rights for $60,000,000. The diamond deposit is estimated at 6,000,000 tons. During the current year, 2,300,000 tons were mined and sold.

(Essay)

4.9/5  (43)

(43)

The acquisition costs of property, plant, and equipment should include all normal, reasonable and necessary costs to get the asset in place and ready for use.

(True/False)

4.8/5  (35)

(35)

An operating lease is accounted for as if the lessee has purchased the asset.

(True/False)

4.7/5  (34)

(34)

In a lease contract, the party who legally owns the asset is the

(Multiple Choice)

4.9/5  (41)

(41)

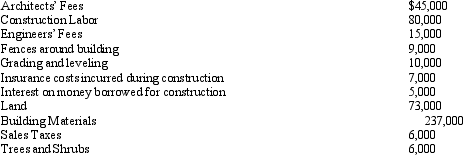

Eagle Country Club has acquired a lot to construct a clubhouse. Eagle had the following costs related to the construction:

(Essay)

4.7/5  (37)

(37)

An asset was purchased for $58,000 and originally estimated to have a useful life of 10 years with a residual value of $3,000. After two years of straight line depreciation, it was determined that the remaining useful life of the asset was only 2 years with a residual value of $2,000.

a) Determine the amount of the annual depreciation for the first two years.

b) Determine the book value at the end of the 2nd year.

c) Determine the depreciation expense for each of the remaining years after revision.

(Short Answer)

4.8/5  (36)

(36)

If a fixed asset, such as a computer, were purchased on January 1st for $3,750 with an estimated life of 3 years and a salvage or residual value of $150, the journal entry for monthly expense under straight-line depreciation is:

(Note: EOM indicates the last day of each month.)

(Multiple Choice)

4.8/5  (35)

(35)

A building with an appraisal value of $154,000 is made available at an offer price of $172,000. The purchaser acquires the property for $40,000 in cash, a 90-day note payable for $45,000, and a mortgage amounting to $75,000. The cost basis recorded in the buyer's accounting records to recognize this purchase is

(Multiple Choice)

4.8/5  (30)

(30)

A machine costing $85,000 with a 5-year life and $5,000 residual value was purchased January 2, 2011. Compute depreciation for each of the five years, using the declining-balance method at twice the straight-line rate.

(Essay)

4.7/5  (45)

(45)

Showing 101 - 120 of 177

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)