Exam 9: Fixed Assets and Intangible Assets

Exam 1: Introduction to Accounting and Business188 Questions

Exam 2: Analyzing Transactions216 Questions

Exam 3: The Adjusting Process179 Questions

Exam 4: Completing the Accounting Cycle198 Questions

Exam 5: Accounting for Merchandising Businesses220 Questions

Exam 6: Inventories170 Questions

Exam 7: Sarbanes-Oxley, Internal Control, and Cash178 Questions

Exam 8: Receivables148 Questions

Exam 9: Fixed Assets and Intangible Assets177 Questions

Exam 10: Current Liabilities and Payroll174 Questions

Exam 11: Corporations: Organization, Stock Transactions, and Dividends172 Questions

Exam 12: Long-Term Liabilities: Bonds and Notes186 Questions

Exam 13: Investments and Fair Value Accounting133 Questions

Exam 14: Statement of Cash Flows161 Questions

Exam 15: Financial Statement Analysis184 Questions

Exam 16: Managerial Accounting Concepts and Principles175 Questions

Exam 17: Job Order Costing176 Questions

Exam 18: Process Cost Systems177 Questions

Exam 19: Cost Behavior and Cost-Volume-Profit Analysis215 Questions

Exam 20: Variable Costing for Management Analysis154 Questions

Exam 21: Budgeting185 Questions

Exam 22: Performance Evaluation Using Variances From Standard Costs160 Questions

Exam 23: Performance Evaluation for Decentralized Operations198 Questions

Exam 24: Differential Analysis and Product Pricing161 Questions

Exam 25: Capital Investment Analysis179 Questions

Exam 26: Cost Allocation and Activity-Based Costing111 Questions

Exam 27: Cost Management for Just-In-Time Environments122 Questions

Select questions type

When a seller allows a buyer an amount for old equipment that is traded in for new equipment of similar use, this amount is known as boot.

(True/False)

4.9/5  (35)

(35)

Intangible assets differ from property, plant and equipment assets in that they lack physical substance.

(True/False)

4.8/5  (40)

(40)

The units of production depreciation method provides a good match of expenses against revenue.

(True/False)

4.8/5  (38)

(38)

A fixed asset with a cost of $41,000 and accumulated depreciation of $36,500 is traded for a similar asset priced at $60,000. Assuming a trade-in allowance of $3,000, the recognized loss on the trade is

(Multiple Choice)

4.8/5  (38)

(38)

Machinery was purchased on January 1, 2010 for $51,000. The machinery has an estimated life of 7 years and an estimated salvage value of $9,000. Double-declining balance depreciation for 2011 would be

(Multiple Choice)

4.8/5  (30)

(30)

Revising depreciation estimates does affect the amounts of depreciation expense recorded in past periods.

(True/False)

4.8/5  (30)

(30)

The double-declining-balance method is an accelerated depreciation method.

(True/False)

4.9/5  (28)

(28)

Computer equipment was acquired at the beginning of the year at a cost of $57,000 that has an estimated residual value of $9,000 and an estimated useful life of 5 years. Determine the 2nd year's depreciation using straight-line depreciation.

(Multiple Choice)

4.8/5  (40)

(40)

The cost of new equipment is called a revenue expenditure because it will help generate revenues in the future.

(True/False)

4.8/5  (38)

(38)

On July 1st, Hartford Construction purchases a bulldozer for $228,000. The equipment has a 9 year life with a residual value of $16,000. Hartford uses units-of-production method depreciation and the bulldozer is expected to yield 26,500 operating hours.

(a) Calculate the depreciation expense per hour of operation.

(b) The bulldozer is operated 1,250 hours in the first year, 2,755 hours in the second year, and 1,225 hours in the third year of operations. Journalize the depreciation expense for each year.

(Essay)

4.7/5  (39)

(39)

On December 31, Strike Company has decided to sell one of its batting cages. The initial cost of the equipment was $310,000 with an accumulated depreciation of $260,000. Depreciation has been taken up to the end of the year. The company found a company that is willing to buy the equipment for $20,000. What is the amount of the gain or loss on this transaction?

(Multiple Choice)

4.9/5  (42)

(42)

When exchanging equipment, if the trade-in allowance is greater than the book value a loss results.

(True/False)

4.8/5  (42)

(42)

The amount of the depreciation expense for the second full year of use of a fixed asset costing $100,000, with an estimated residual value of $5,000 and a useful life of 4 years, is $25,000 by the declining-balance method at twice the straight-line rate.

(True/False)

4.8/5  (31)

(31)

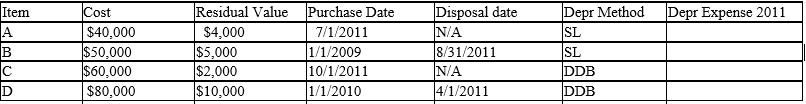

For each of the following fixed assets, determine the depreciation expense and the book value for the dates requested:

Disposal date is N/A if asset is still in use.

Method: SL = Straight Line; DDB = Double Declining Balance

Assume the estimated life was 5 years for each asset.

(Essay)

4.8/5  (36)

(36)

Expenditures for research and development are generally recorded as

(Multiple Choice)

4.8/5  (33)

(33)

Copy equipment was acquired at the beginning of the year at a cost of $72,000 that has an estimated residual value of $9,000 and an estimated useful life of 5 years. It is estimated that the machine has an estimated 1,000,000 copies. This year 315,000 copies were made. Determine the (a) depreciable cost, (b) depreciation rate, and (c) the units-of-production depreciation for the year.

(Essay)

4.8/5  (38)

(38)

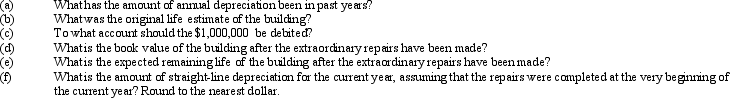

A number of major structural repairs completed at the beginning of the current fiscal year at a cost of $1,000,000 are expected to extend the life of a building 10 years beyond the original estimate. The original cost of the building was $6,552,000, and it has been depreciated by the straight-line method for 25 years. Estimated residual value is negligible and has been ignored. The related accumulated depreciation account after the depreciation adjustment at the end of the preceding fiscal year is $4,550,000.

(Essay)

4.9/5  (44)

(44)

It is not necessary for a company to use the same depreciation method for financial statements and for determining income taxes.

(True/False)

4.8/5  (42)

(42)

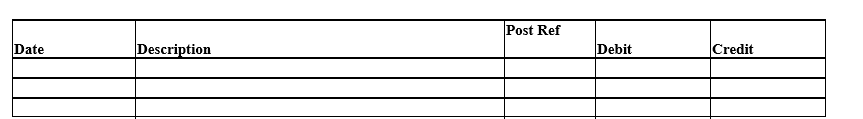

Macon Co. acquired drilling rights for $7,500,000. The oil deposit is estimated at 37,500,000 gallons. During the current year, 3,000,000 gallons were drilled. Journalize the adjusting entry at December 31, 2011 to recognize the depletion expense.

Journal

(Essay)

4.8/5  (34)

(34)

Both the initial cost of the asset and the accumulated depreciation will be taken off the books with the disposal of the asset.

(True/False)

4.8/5  (37)

(37)

Showing 61 - 80 of 177

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)