Exam 3: Consolidationssubsequent to the Date of Acquisition

Exam 1: The Equity Method of Accounting for Investments119 Questions

Exam 2: Consolidation of Financial Information118 Questions

Exam 3: Consolidationssubsequent to the Date of Acquisition122 Questions

Exam 4: Consolidated Financial Statements and Outside Ownership115 Questions

Exam 5: Consolidated Financial Statementsintra-Entity Asset Transactions127 Questions

Exam 6: Variable Interest Entities, Intra-Entity Debt, Consolidated Cash Flows, and Other Issues115 Questions

Exam 7: Foreign Currency Transactions and Hedging Foreign Exchange Risk93 Questions

Exam 8: Translation of Foreign Currency Financial Statements97 Questions

Exam 9: Partnerships: Formation and Operation88 Questions

Exam 10: Partnerships: Termination and Liquidation69 Questions

Exam 11: Accounting for State and Local Governments Part 178 Questions

Exam 12: Accounting for State and Local Governments Part 251 Questions

Select questions type

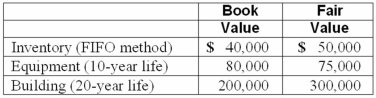

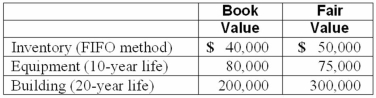

Watkins, Inc. acquires all of the outstanding stock of Glen Corporation on January 1, 2010. At that date, Glen owns only three assets and has no liabilities:

If Watkins pays $400,000 in cash for Glen, what amount would be represented as the subsidiary's Building in a consolidation at December 31, 2012, assuming the book value of the building at that date is still $200,000?

If Watkins pays $400,000 in cash for Glen, what amount would be represented as the subsidiary's Building in a consolidation at December 31, 2012, assuming the book value of the building at that date is still $200,000?

(Multiple Choice)

4.7/5  (41)

(41)

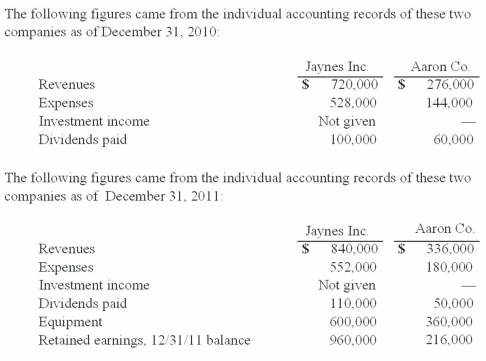

Jaynes Inc. acquired all of Aaron Co.'s common stock on January 1, 2010, by issuing 11,000 shares of $1 par value common stock. Jaynes' shares had a $17 per share fair value. On that date, Aaron reported a net book value of $120,000. However, its equipment (with a five-year remaining life) was undervalued by $6,000 in the company's accounting records. Any excess of consideration transferred over fair value of assets and liabilities is assigned to an unrecorded patent to be amortized over ten years.

What balance would Jaynes' Investment in Aaron Co. account have shown on December 31, 2010, when the equity method was applied for this acquisition?

(Essay)

4.8/5  (42)

(42)

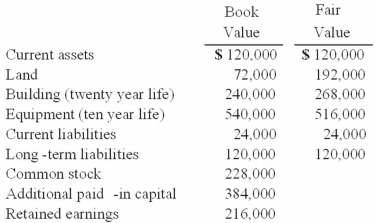

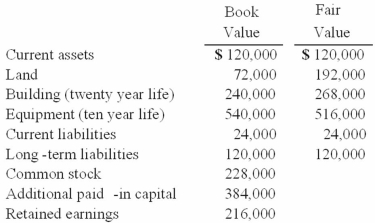

On January 1, 2010, Cale Corp. paid $1,020,000 to acquire Kaltop Co. Kaltop maintained separate incorporation. Cale used the equity method to account for the investment. The following information is available for Kaltop's assets, liabilities, and stockholders' equity accounts:

Kaltop earned net income for 2010 of $126,000 and paid dividends of $48,000 during the year.

The 2010 total amortization of allocations is calculated to be

Kaltop earned net income for 2010 of $126,000 and paid dividends of $48,000 during the year.

The 2010 total amortization of allocations is calculated to be

(Multiple Choice)

4.9/5  (43)

(43)

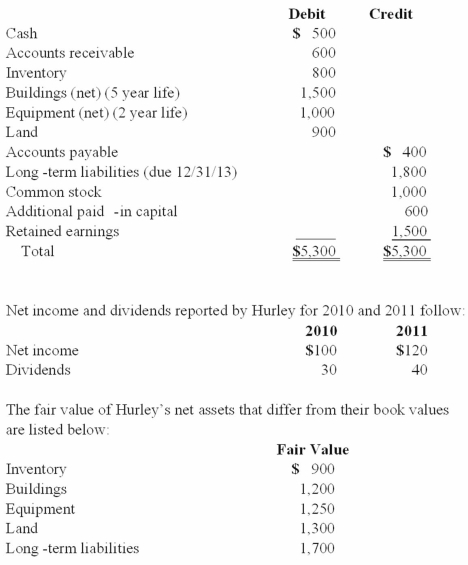

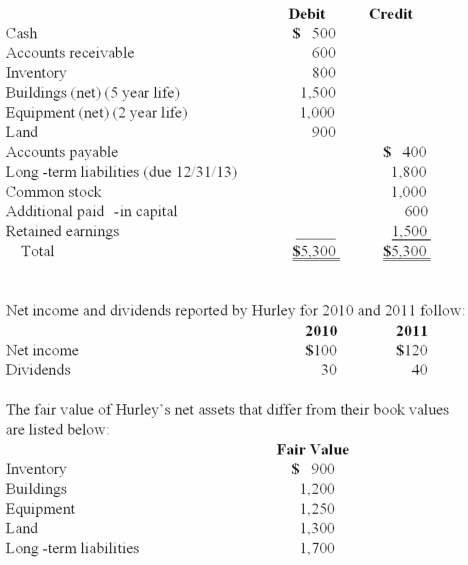

Perry Company acquires 100% of the stock of Hurley Corporation on January 1, 2010, for $3,800 cash. As of that date Hurley has the following trial balance;

Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life. FIFO inventory valuation method is used.

Compute the amount of Hurley's long-term liabilities that would be reported in a December 31, 2010, consolidated balance sheet.

Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life. FIFO inventory valuation method is used.

Compute the amount of Hurley's long-term liabilities that would be reported in a December 31, 2010, consolidated balance sheet.

(Multiple Choice)

4.8/5  (39)

(39)

Carnes Co. decided to use the partial equity method to account for its investment in Domino Corp. An unamortized trademark associated with the acquisition was $30,000, and Carnes decided to amortize the trademark over ten years. For 2011, Carnes' Equity in Subsidiary Earnings was $78,000.

Required:

What balance would have been in the Equity in Subsidiary Earnings account if Carnes had used the equity method?

(Essay)

4.8/5  (43)

(43)

Jansen Inc. acquired all of the outstanding common stock of Merriam Co. on January 1, 2010, for $257,000. Annual amortization of $19,000 resulted from this acquisition. Jansen reported net income of $70,000 in 2010 and $50,000 in 2011 and paid $22,000 in dividends each year. Merriam reported net income of $40,000 in 2010 and $47,000 in 2011 and paid $10,000 in dividends each year. What is the Investment in Merriam Co. balance on Jansen's books as of December 31, 2011, if the equity method has been applied?

(Multiple Choice)

4.7/5  (40)

(40)

On January 1, 2010, Franel Co. acquired all of the common stock of Hurlem Corp. For 2010, Hurlem earned net income of $360,000 and paid dividends of $190,000. Amortization of the patent allocation that was included in the acquisition was $6,000.

How much difference would there have been in Franel's income with regard to the effect of the investment, between using the equity method or using the partial equity method of internal recordkeeping?

(Multiple Choice)

5.0/5  (34)

(34)

On 4/1/09, Sey Mold Corporation acquired 100% of DotDot.Com for $2,000,000 cash. On the date of acquisition, DotDot's net book value was $900,000. DotDot's assets included land that was undervalued by $300,000, a building that was undervalued by $400,000, and equipment that was overvalued by $50,000. The building had a remaining useful life of 8 years and the equipment had a remaining useful life of 4 years. Any excess fair value over consideration transferred is allocated to an undervalued patent and is amortized over 5 years.

Determine the amortization expense related to the combination at the year-end date of 12/31/09.

(Essay)

4.9/5  (35)

(35)

Jaynes Inc. acquired all of Aaron Co.'s common stock on January 1, 2010, by issuing 11,000 shares of $1 par value common stock. Jaynes' shares had a $17 per share fair value. On that date, Aaron reported a net book value of $120,000. However, its equipment (with a five-year remaining life) was undervalued by $6,000 in the company's accounting records. Any excess of consideration transferred over fair value of assets and liabilities is assigned to an unrecorded patent to be amortized over ten years.

What was consolidated net income for the year ended December 31, 2011?

What was consolidated net income for the year ended December 31, 2011?

(Essay)

4.9/5  (48)

(48)

Cashen Co. paid $2,400,000 to acquire all of the common stock of Janex Corp. on January 1, 2010. Janex's reported earnings for 2010 totaled $432,000, and it paid $120,000 in dividends during the year. The amortization of allocations related to the investment was $24,000. Cashen's net income, not including the investment, was $3,180,000, and it paid dividends of $900,000.

On the consolidated financial statements for 2010, what amount should have been shown for Equity in Subsidiary Earnings?

(Multiple Choice)

4.9/5  (34)

(34)

Yules Co. acquired Noel Co. in an acquisition transaction. Yules decided to use the partial equity method to account for the investment. The current balance in the investment account is $416,000. Describe in words how this balance was derived.

(Essay)

4.9/5  (43)

(43)

For each of the following situations, select the best answer that applies to consolidating financial information subsequent to the acquisition date:

(A) Initial value method.

(B) Partial equity method.

(C) Equity method.

(D) Initial value method and partial equity method but not equity method.

(E) Partial equity method and equity method but not initial value method.

(F) Initial value method, partial equity method, and equity method.

_____1. Method(s) available to the parent for internal record-keeping.

_____2. Easiest internal record-keeping method to apply.

_____3. Income of the subsidiary is recorded by the parent when earned.

_____4. Designed to create a parallel between the parent's investment accounts and changes in the underlying equity of the acquired company.

_____5. For years subsequent to acquisition, requires the *C entry.

_____6. Uses the cash basis for income recognition.

_____7. Investment account remains at initially recorded amount.

_____8. Dividends received by the parent from the subsidiary reduce the parent's investment account.

_____9. Often referred to in accounting as a single-line consolidation.

_____10. Increases the investment account for subsidiary earnings, but does not decrease the subsidiary account for equity adjustments such as amortizations.

(Essay)

4.7/5  (39)

(39)

Perry Company acquires 100% of the stock of Hurley Corporation on January 1, 2010, for $3,800 cash. As of that date Hurley has the following trial balance;

Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life. FIFO inventory valuation method is used.

Compute the amount of Hurley's equipment that would be reported in a December 31, 2010, consolidated balance sheet.

Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life. FIFO inventory valuation method is used.

Compute the amount of Hurley's equipment that would be reported in a December 31, 2010, consolidated balance sheet.

(Multiple Choice)

5.0/5  (24)

(24)

Watkins, Inc. acquires all of the outstanding stock of Glen Corporation on January 1, 2010. At that date, Glen owns only three assets and has no liabilities:

If Watkins pays $450,000 in cash for Glen, what amount would be represented as the subsidiary's Equipment in a consolidation at December 31, 2012, assuming the book value of the equipment at that date is still $80,000?

If Watkins pays $450,000 in cash for Glen, what amount would be represented as the subsidiary's Equipment in a consolidation at December 31, 2012, assuming the book value of the equipment at that date is still $80,000?

(Multiple Choice)

4.8/5  (36)

(36)

Prince Company acquires Duchess, Inc. on January 1, 2009. The consideration transferred exceeds the fair value of Duchess' net assets. On that date, Prince has a building with a book value of $1,200,000 and a fair value of $1,500,000. Duchess has a building with a book value of $400,000 and fair value of $500,000.

If push-down accounting is used, what amounts in the Building account appear in Duchess' separate balance sheet and in the consolidated balance sheet immediately after acquisition?

(Multiple Choice)

4.8/5  (23)

(23)

On January 1, 2010, Cale Corp. paid $1,020,000 to acquire Kaltop Co. Kaltop maintained separate incorporation. Cale used the equity method to account for the investment. The following information is available for Kaltop's assets, liabilities, and stockholders' equity accounts:

Kaltop earned net income for 2010 of $126,000 and paid dividends of $48,000 during the year.

If Cale Corp. had net income of $444,000 in 2010, exclusive of the investment, what is the amount of consolidated net income?

Kaltop earned net income for 2010 of $126,000 and paid dividends of $48,000 during the year.

If Cale Corp. had net income of $444,000 in 2010, exclusive of the investment, what is the amount of consolidated net income?

(Multiple Choice)

4.7/5  (34)

(34)

Consolidated net income using the equity method for an acquisition combination is computed as follows:

(Multiple Choice)

4.8/5  (34)

(34)

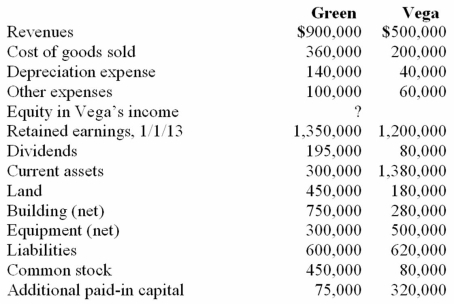

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2013. Several of Green's accounts have been omitted.

Green acquired 100% of Vega on January 1, 2009, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2009, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.

Compute the December 31, 2013, consolidated equipment.

Green acquired 100% of Vega on January 1, 2009, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2009, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.

Compute the December 31, 2013, consolidated equipment.

(Multiple Choice)

4.8/5  (35)

(35)

Showing 81 - 100 of 122

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)