Exam 3: Consolidationssubsequent to the Date of Acquisition

Exam 1: The Equity Method of Accounting for Investments119 Questions

Exam 2: Consolidation of Financial Information118 Questions

Exam 3: Consolidationssubsequent to the Date of Acquisition122 Questions

Exam 4: Consolidated Financial Statements and Outside Ownership115 Questions

Exam 5: Consolidated Financial Statementsintra-Entity Asset Transactions127 Questions

Exam 6: Variable Interest Entities, Intra-Entity Debt, Consolidated Cash Flows, and Other Issues115 Questions

Exam 7: Foreign Currency Transactions and Hedging Foreign Exchange Risk93 Questions

Exam 8: Translation of Foreign Currency Financial Statements97 Questions

Exam 9: Partnerships: Formation and Operation88 Questions

Exam 10: Partnerships: Termination and Liquidation69 Questions

Exam 11: Accounting for State and Local Governments Part 178 Questions

Exam 12: Accounting for State and Local Governments Part 251 Questions

Select questions type

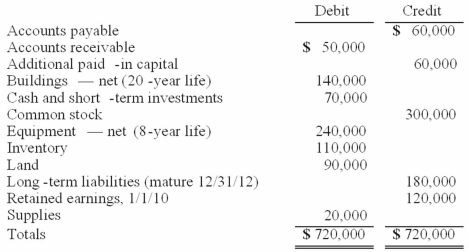

Matthews Co. acquired all of the common stock of Jackson Co. on January 1, 2010. As of that date, Jackson had the following trial balance:

During 2010, Jackson reported net income of $96,000 while paying dividends of $12,000. During 2011, Jackson reported net income of $132,000 while paying dividends of $36,000.

Assume that Matthews Co. acquired the common stock of Jackson Co. for $588,000 in cash. As of January 1, 2010, Jackson's land had a fair value of $102,000, its buildings were valued at $188,000, and its equipment was appraised at $216,000. Any excess of consideration transferred over fair value of assets and liabilities acquired is due to an unamortized patent to be amortized over 10 years.

Matthews decided to use the equity method for this investment.

Required:

(A.) Prepare consolidation worksheet entries for December 31, 2010.

(B.) Prepare consolidation worksheet entries for December 31, 2011.

During 2010, Jackson reported net income of $96,000 while paying dividends of $12,000. During 2011, Jackson reported net income of $132,000 while paying dividends of $36,000.

Assume that Matthews Co. acquired the common stock of Jackson Co. for $588,000 in cash. As of January 1, 2010, Jackson's land had a fair value of $102,000, its buildings were valued at $188,000, and its equipment was appraised at $216,000. Any excess of consideration transferred over fair value of assets and liabilities acquired is due to an unamortized patent to be amortized over 10 years.

Matthews decided to use the equity method for this investment.

Required:

(A.) Prepare consolidation worksheet entries for December 31, 2010.

(B.) Prepare consolidation worksheet entries for December 31, 2011.

(Essay)

4.9/5  (27)

(27)

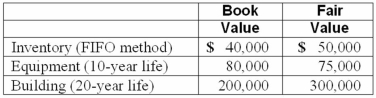

Watkins, Inc. acquires all of the outstanding stock of Glen Corporation on January 1, 2010. At that date, Glen owns only three assets and has no liabilities:

If Watkins pays $300,000 in cash for Glen, at what amount would the subsidiary's Building be represented in a January 2, 2010 consolidation?

If Watkins pays $300,000 in cash for Glen, at what amount would the subsidiary's Building be represented in a January 2, 2010 consolidation?

(Multiple Choice)

4.9/5  (31)

(31)

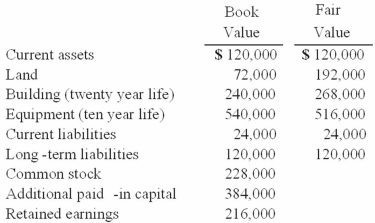

On January 1, 2010, Cale Corp. paid $1,020,000 to acquire Kaltop Co. Kaltop maintained separate incorporation. Cale used the equity method to account for the investment. The following information is available for Kaltop's assets, liabilities, and stockholders' equity accounts:

Kaltop earned net income for 2010 of $126,000 and paid dividends of $48,000 during the year.

What is the balance in Cale's investment in subsidiary account at the end of 2010?

Kaltop earned net income for 2010 of $126,000 and paid dividends of $48,000 during the year.

What is the balance in Cale's investment in subsidiary account at the end of 2010?

(Multiple Choice)

4.7/5  (30)

(30)

Red Co. acquired 100% of Green, Inc. on January 1, 2010. On that date, Green had inventory with a book value of $42,000 and a fair value of $52,000. This inventory had not yet been sold at December 31, 2010. Also, on the date of acquisition, Green had a building with a book value of $200,000 and a fair value of $390,000. Green had equipment with a book value of $350,000 and a fair value of $280,000. The building had a 10-year remaining useful life and the equipment had a 5-year remaining useful life. How much total expense will be in the consolidated financial statements for the year ended December 31, 2010 related to the acquisition allocations of Green?

(Multiple Choice)

4.9/5  (40)

(40)

Beatty, Inc. acquires 100% of the voting stock of Gataux Company on January 1, 2010 for $500,000 cash. A contingent payment of $12,000 will be paid on April 1, 2011 if Gataux generates cash flows from operations of $26,500 or more in the next year. Beatty estimates that there is a 30% probability that Gataux will generate at least $26,500 next year, and uses an interest rate of 4% to incorporate the time value of money. The fair value of $12,000 at 4%, using a probability weighted approach, is $3,461.

What will Beatty record as its Investment in Gataux on January 1, 2010?

(Multiple Choice)

4.7/5  (36)

(36)

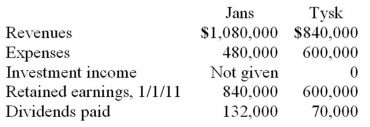

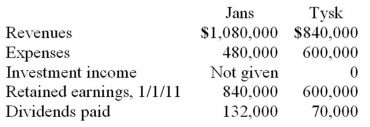

Jans Inc. acquired all of the outstanding common stock of Tysk Corp. on January 1, 2009, for $372,000. Equipment with a ten-year life was undervalued on Tysk's financial records by $46,000. Tysk also owned an unrecorded customer list with an assessed fair value of $67,000 and an estimated remaining life of five years.

Tysk earned reported net income of $180,000 in 2009 and $216,000 in 2010. Dividends of $70,000 were paid in each of these two years. Selected account balances as of December 31, 2011, for the two companies follow.

If the equity method had been applied, what would be the Investment in Tysk Corp. account balance within the records of Jans at the end of 2011?

If the equity method had been applied, what would be the Investment in Tysk Corp. account balance within the records of Jans at the end of 2011?

(Multiple Choice)

4.8/5  (39)

(39)

Dutch Co. has loaned $90,000 to its subsidiary, Hans Corp., which retains separate incorporation. How would this loan be treated on a consolidated balance sheet?

(Essay)

4.8/5  (46)

(46)

Beatty, Inc. acquires 100% of the voting stock of Gataux Company on January 1, 2010 for $500,000 cash. A contingent payment of $12,000 will be paid on April 1, 2011 if Gataux generates cash flows from operations of $26,500 or more in the next year. Beatty estimates that there is a 30% probability that Gataux will generate at least $26,500 next year, and uses an interest rate of 4% to incorporate the time value of money. The fair value of $12,000 at 4%, using a probability weighted approach, is $3,461.

Assuming Gataux generates cash flow from operations of $27,200 in 2010, how will Beatty record the $12,000 payment of cash on April 1, 2011 in satisfaction of its contingent obligation?

(Multiple Choice)

4.7/5  (42)

(42)

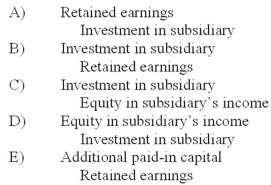

When a company applies the initial method in accounting for its investment in a subsidiary and the subsidiary reports income in excess of dividends paid, what entry would be made for a consolidation worksheet?

(Multiple Choice)

4.8/5  (44)

(44)

Jans Inc. acquired all of the outstanding common stock of Tysk Corp. on January 1, 2009, for $372,000. Equipment with a ten-year life was undervalued on Tysk's financial records by $46,000. Tysk also owned an unrecorded customer list with an assessed fair value of $67,000 and an estimated remaining life of five years.

Tysk earned reported net income of $180,000 in 2009 and $216,000 in 2010. Dividends of $70,000 were paid in each of these two years. Selected account balances as of December 31, 2011, for the two companies follow.

If the partial equity method had been applied, what was 2011 consolidated net income?

If the partial equity method had been applied, what was 2011 consolidated net income?

(Multiple Choice)

4.8/5  (38)

(38)

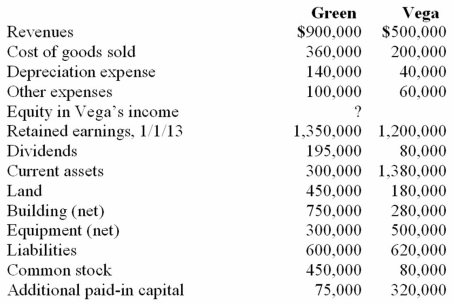

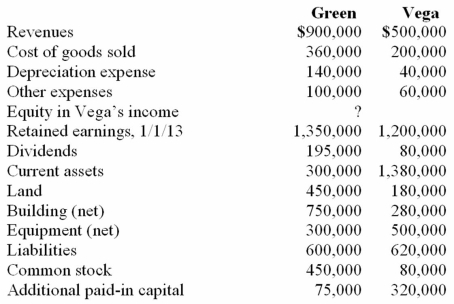

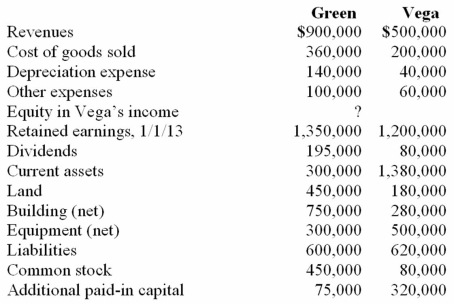

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2013. Several of Green's accounts have been omitted.

Green acquired 100% of Vega on January 1, 2009, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2009, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.

Compute the December 31, 2013, consolidated revenues.

Green acquired 100% of Vega on January 1, 2009, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2009, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.

Compute the December 31, 2013, consolidated revenues.

(Multiple Choice)

4.8/5  (43)

(43)

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2013. Several of Green's accounts have been omitted.

Green acquired 100% of Vega on January 1, 2009, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2009, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.

Compute the book value of Vega at January 1, 2009.

Green acquired 100% of Vega on January 1, 2009, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2009, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.

Compute the book value of Vega at January 1, 2009.

(Multiple Choice)

4.8/5  (32)

(32)

For an acquisition when the subsidiary maintains its incorporation, under the partial equity method, what adjustments are made to the balance of the investment account?

(Essay)

4.9/5  (29)

(29)

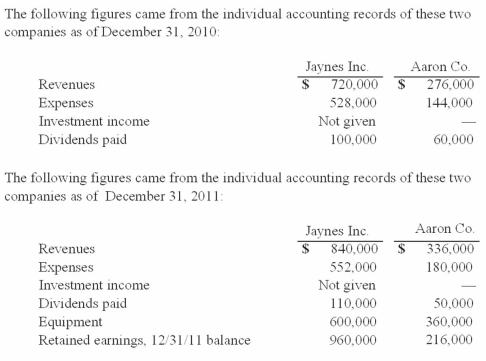

Jaynes Inc. acquired all of Aaron Co.'s common stock on January 1, 2010, by issuing 11,000 shares of $1 par value common stock. Jaynes' shares had a $17 per share fair value. On that date, Aaron reported a net book value of $120,000. However, its equipment (with a five-year remaining life) was undervalued by $6,000 in the company's accounting records. Any excess of consideration transferred over fair value of assets and liabilities is assigned to an unrecorded patent to be amortized over ten years.

What was consolidated equipment as of December 31, 2011?

What was consolidated equipment as of December 31, 2011?

(Essay)

4.9/5  (37)

(37)

An acquisition transaction results in $90,000 of goodwill. Several years later a worksheet is being produced to consolidate the two companies. Describe in words at what amount goodwill will be reported at this date.

(Essay)

4.8/5  (39)

(39)

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2013. Several of Green's accounts have been omitted.

Green acquired 100% of Vega on January 1, 2009, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2009, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.

Compute the December 31, 2013, consolidated common stock.

Green acquired 100% of Vega on January 1, 2009, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2009, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.

Compute the December 31, 2013, consolidated common stock.

(Multiple Choice)

4.9/5  (38)

(38)

Which one of the following varies between the equity, initial value, and partial equity methods of accounting for an investment?

(Multiple Choice)

4.9/5  (44)

(44)

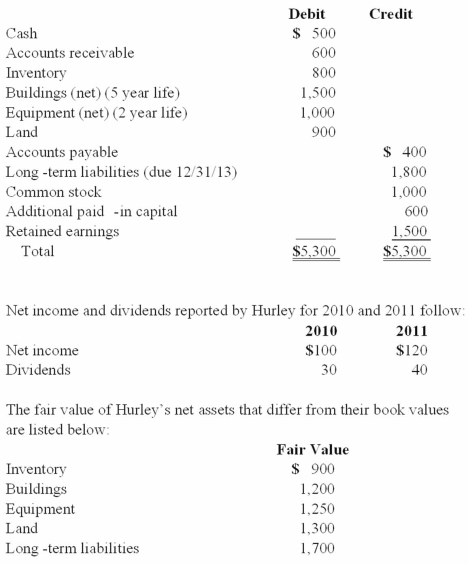

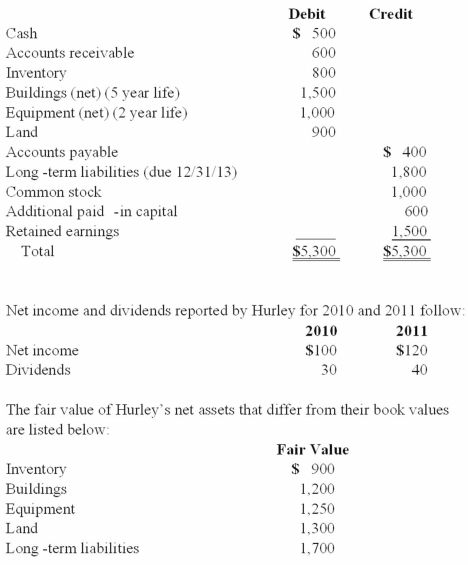

Perry Company acquires 100% of the stock of Hurley Corporation on January 1, 2010, for $3,800 cash. As of that date Hurley has the following trial balance;

Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life. FIFO inventory valuation method is used.

Compute the amount of Hurley's buildings that would be reported in a December 31, 2010, consolidated balance sheet.

Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life. FIFO inventory valuation method is used.

Compute the amount of Hurley's buildings that would be reported in a December 31, 2010, consolidated balance sheet.

(Multiple Choice)

5.0/5  (36)

(36)

Which of the following is false regarding contingent consideration in business combinations?

(Multiple Choice)

4.9/5  (34)

(34)

Perry Company acquires 100% of the stock of Hurley Corporation on January 1, 2010, for $3,800 cash. As of that date Hurley has the following trial balance;

Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life. FIFO inventory valuation method is used.

Compute the consideration transferred in excess of book value acquired at January 1, 2010.

Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life. FIFO inventory valuation method is used.

Compute the consideration transferred in excess of book value acquired at January 1, 2010.

(Multiple Choice)

4.9/5  (36)

(36)

Showing 21 - 40 of 122

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)