Exam 2: Corporations: Introduction and Operating Rules

Exam 1: Understanding and Working With the Federal Tax Law63 Questions

Exam 2: Corporations: Introduction and Operating Rules112 Questions

Exam 3: Corporations: Special Situations96 Questions

Exam 4: Corporations: Organization and Capital Structure93 Questions

Exam 5: Corporations: Earnings Profits and Dividend Distributions89 Questions

Exam 6: Corporations: Redemptions and Liquidations108 Questions

Exam 7: Corporations: Reorganizations98 Questions

Exam 8: Consolidated Tax Returns121 Questions

Exam 9: Taxation of International Transactions153 Questions

Exam 10: Partnerships: Formation, operation, and Basis98 Questions

Exam 11: Partnerships: Distributions, transfer of Interests, and Terminations97 Questions

Exam 12: S Corporations125 Questions

Exam 13: Comparative Forms of Doing Business131 Questions

Exam 14: Taxes on the Financial Statements81 Questions

Exam 15: Exempt Entities131 Questions

Exam 16: Multistate Corporate Taxation102 Questions

Exam 17: Tax Practice and Ethics112 Questions

Exam 18: The Federal Gift and Estate Taxes155 Questions

Exam 19: Family Tax Planning135 Questions

Exam 20: Income Taxation of Trusts and Estates122 Questions

Select questions type

Red Corporation,which owns stock in Blue Corporation,had net operating income of $200,000 for the year.Blue pays Red a dividend of $40,000.Red takes a dividends received deduction of $28,000.Which of the following statements is correct?

(Multiple Choice)

4.9/5  (38)

(38)

Albatross,a C corporation,had $125,000 net income from operations and a $10,000 short-term capital loss in 2010.Albatross Corporation's taxable income is $115,000.

(True/False)

4.8/5  (38)

(38)

Maize Corporation had $200,000 operating income and $90,000 operating expenses during the year.In addition,Maize had a $25,000 long-term capital gain and a $16,000 short-term capital loss.Compute Maize's taxable income for the year.

(Multiple Choice)

4.9/5  (40)

(40)

Elk,a C corporation,has $500,000 operating income and $350,000 operating expenses during the year.In addition,Elk has a $20,000 long-term capital gain and a $52,000 short-term capital loss.Elk's taxable income is:

(Multiple Choice)

4.8/5  (35)

(35)

Flycatcher Corporation,a C corporation,has two equal individual shareholders,Nancy and Pasqual.In the current year,Flycatcher earned $200,000 net profit and paid a dividend of $40,000 to each shareholder.Regardless of any tax consequences resulting from their interests in Flycatcher,Nancy is in the 28% marginal tax bracket and Pasqual is in the 35% marginal tax bracket.With respect to the current year,which of the following statements is incorrect?

(Multiple Choice)

4.9/5  (35)

(35)

Egret Corporation,a calendar year C corporation,had an excess charitable contribution for 2009 of $15,000.In 2010,it made a further charitable contribution of $20,000.Its 2010 deduction is limited to $25,000 (10% of taxable income).In applying the 10% limitation,the $15,000 carryover is used before the current year contribution.

(True/False)

4.7/5  (43)

(43)

Under the "check-the-box" Regulations,a single-member LLC that fails to elect to be to treated as a corporation will be taxed as a sole proprietorship.

(True/False)

4.8/5  (36)

(36)

Orange Corporation owns stock in White Corporation and has net operating income of $400,000 for the year.White Corporation pays Orange a dividend of $60,000.What amount of dividends received deduction may Orange claim if it owns 15% of White stock (assuming Orange's dividends received deduction is not limited by its taxable income)?

(Multiple Choice)

4.8/5  (35)

(35)

Briefly describe the accounting methods available for adoption by a C corporation.

(Essay)

4.8/5  (34)

(34)

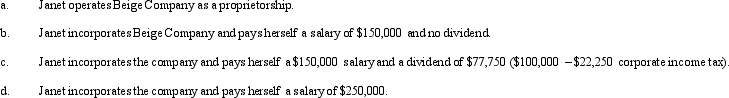

Beige Company has approximately $250,000 in net income in 2010 before deducting any compensation or other payment to its sole owner,Janet (who is single).Assume that Janet is in the 35% marginal tax bracket.Discuss the tax aspects of each of the following arrangements.(Ignore any employment tax considerations. )

(Essay)

4.9/5  (35)

(35)

For a corporation in 2010,the domestic production activities deduction is equal to 9% of the lower of (1)qualified production activities income or (2)taxable income.However,the deduction cannot exceed 50% of the W-2 wages related to qualified production activities income.

(True/False)

4.9/5  (41)

(41)

Schedule M-1 of Form 1120 is used to reconcile financial net income with taxable income reported on the corporation's income tax return as follows: net income per books + additions - subtractions = taxable income.Which of the following items is an addition on Schedule M-1?

(Multiple Choice)

4.8/5  (44)

(44)

Showing 101 - 112 of 112

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)