Exam 2: Corporations: Introduction and Operating Rules

Exam 1: Understanding and Working With the Federal Tax Law63 Questions

Exam 2: Corporations: Introduction and Operating Rules112 Questions

Exam 3: Corporations: Special Situations96 Questions

Exam 4: Corporations: Organization and Capital Structure93 Questions

Exam 5: Corporations: Earnings Profits and Dividend Distributions89 Questions

Exam 6: Corporations: Redemptions and Liquidations108 Questions

Exam 7: Corporations: Reorganizations98 Questions

Exam 8: Consolidated Tax Returns121 Questions

Exam 9: Taxation of International Transactions153 Questions

Exam 10: Partnerships: Formation, operation, and Basis98 Questions

Exam 11: Partnerships: Distributions, transfer of Interests, and Terminations97 Questions

Exam 12: S Corporations125 Questions

Exam 13: Comparative Forms of Doing Business131 Questions

Exam 14: Taxes on the Financial Statements81 Questions

Exam 15: Exempt Entities131 Questions

Exam 16: Multistate Corporate Taxation102 Questions

Exam 17: Tax Practice and Ethics112 Questions

Exam 18: The Federal Gift and Estate Taxes155 Questions

Exam 19: Family Tax Planning135 Questions

Exam 20: Income Taxation of Trusts and Estates122 Questions

Select questions type

Nancy is a 40% shareholder and president of Robin Corporation,a regular corporation.The board of directors of Robin has decided to pay Nancy a $100,000 bonus for the year based on her outstanding performance.The directors want to pay the $100,000 as salary,but Nancy would prefer to have it paid as a dividend.If both Robin Corporation and Nancy are in a 35% marginal tax bracket irrespective of the treatment of the bonus,discuss which form of payment would be most beneficial for each party.(Ignore any employment tax considerations. )

(Essay)

4.8/5  (40)

(40)

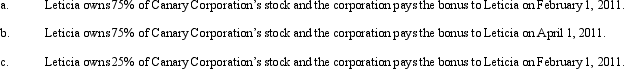

Canary Corporation,an accrual method C corporation,uses the calendar year for tax purposes.Leticia,a cash method taxpayer,is both a shareholder of Canary and the corporation's CFO.On December 31,2010,Canary has accrued a $100,000 bonus to Leticia.Describe the tax consequences of the bonus to Canary and to Leticia under the following independent situations.

(Essay)

4.9/5  (36)

(36)

Geneva,a sole proprietor,sold one of her business assets for a $5,000 long-term capital gain.Geneva's marginal tax rate is 25%.Gulf,a C corporation,sold one of its assets for a $5,000 long-term capital gain.Gulf's marginal tax rate is 25%.What tax rates are applicable to these capital gains?

(Multiple Choice)

4.8/5  (38)

(38)

Donald owns a 40% interest in a partnership that earned $140,000 in the current year.He also owns 40% of the stock in a C corporation that earned $140,000 during the year.Donald received $30,000 in distributions from each of the two entities during the year.With respect to this information,Donald must report $60,000 of income on his individual income tax return for the year.

(True/False)

4.9/5  (38)

(38)

Olga's proprietorship earned a net profit of $95,000 during the year and she withdrew $70,000 of this profit.Olga must report $70,000 net income from the proprietorship on her individual income tax return (Form 1040).

(True/False)

5.0/5  (36)

(36)

A corporation with $10 million or more in assets must file Schedule M-3 (instead of Schedule M-1).

(True/False)

4.9/5  (33)

(33)

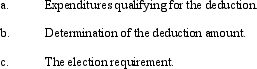

In connection with the deduction of organizational expenditures under § 248,comment on the following:

(Essay)

4.9/5  (46)

(46)

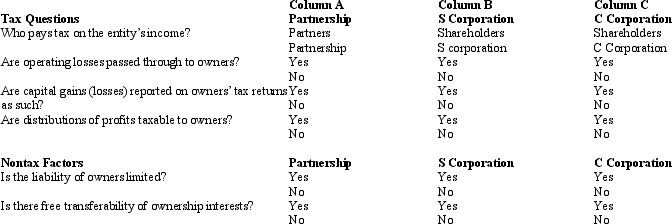

Compare the basic tax and nontax factors of doing business as a partnership,an S corporation,and a C corporation.Circle the correct answers.

(Essay)

4.9/5  (31)

(31)

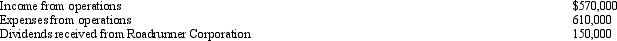

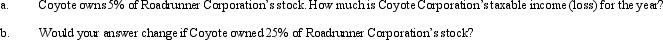

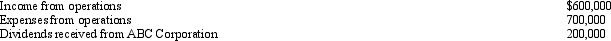

During the current year,Coyote Corporation (a calendar year C corporation)has the following transactions:

(Essay)

4.8/5  (34)

(34)

Nicole owns and operates a sole proprietorship.She is considering incorporating the business as a C corporation and has asked you to explain how a corporate tax return differs from the return for a sole proprietorship.In addition,she has asked you to explain the nontax factors that she should consider in deciding whether to incorporate her business.

(Essay)

4.9/5  (32)

(32)

Patrick,an attorney,is the sole shareholder of Gander Corporation.Gander is a personal service corporation with a fiscal year ending September 30.The corporation paid Patrick a salary of $294,000 during its fiscal year ending September 30,2010.How much salary must Gander pay Patrick during the period October 1 through December 31,2010,to permit the corporation to continue to use its fiscal year without negative tax effects?

(Multiple Choice)

4.8/5  (35)

(35)

Glen and Michael are equal partners in Trout Enterprises,a calendar year partnership.During the year,Trout Enterprises had gross income of $400,000 and operating expenses of $220,000.In addition,the partnership sold land that had been held for investment purposes for a long-term capital gain of $100,000.During the year,Glen withdrew $60,000 from the partnership,and Michael withdrew $60,000.Discuss the impact of this information on the taxable income of Trout,Glen,and Michael.

(Multiple Choice)

4.8/5  (42)

(42)

During the current year,Quartz Corporation (a calendar year C corporation)has the following transactions:

Quartz owns 25% of ABC Corporation's stock.How much is Quartz Corporation's taxable income (loss)for the year?

Quartz owns 25% of ABC Corporation's stock.How much is Quartz Corporation's taxable income (loss)for the year?

(Essay)

4.8/5  (40)

(40)

Vireo Corporation,a calendar year C corporation,has taxable income of $1.3 million and $3 million for 2009 and 2010,respectively.The minimum 2010 estimated tax installment payments for Vireo are:

(Multiple Choice)

4.8/5  (44)

(44)

Norma formed Hyacinth Enterprises,a proprietorship,in 2010.In its first year,Hyacinth had operating income of $200,000 and operating expenses of $100,000.In addition,Hyacinth had a long-term capital loss of $9,000.Norma,the proprietor of Hyacinth Enterprises,withdrew $50,000 from Hyacinth during the year.Assuming Norma has no other capital gains or losses,how does this information affect her taxable income for 2010?

(Multiple Choice)

4.9/5  (28)

(28)

Schedule M-1 is used to reconcile unappropriated retained earnings at the beginning of the year with unappropriated retained earnings at the end of the year.

(True/False)

4.7/5  (39)

(39)

Almond Corporation,a calendar year C corporation,had taxable income of $900,000,$1.1 million,and $790,000 for 2007,2008,and 2009,respectively.Almond's taxable income is $1.5 million for 2010.Compute the minimum estimated tax payments for 2010 for Almond Corporation.

(Essay)

4.7/5  (40)

(40)

Copper Corporation owns stock in Bronze Corporation and has net operating income of $900,000 for the year.Bronze Corporation pays Copper a dividend of $150,000.What amount of dividends received deduction may Copper claim if it owns 65% of Bronze stock (assuming Copper's dividends received deduction is not limited by its taxable income)?

(Multiple Choice)

4.9/5  (35)

(35)

Emma,the sole shareholder of Quail Corporation (a C corporation),has the corporation pay her a salary of $300,000 in 2010.The Tax Court has held that $80,000 represents unreasonable compensation.Assuming Emma is in the 35% bracket in 2010,the Tax Court's holding will increase total tax she pays in 2010.

(True/False)

4.8/5  (42)

(42)

For purposes of the estimated tax payment rules,a "large corporation" is defined as a corporation that had an average taxable income of $1 million or more over the preceding three-year period.

(True/False)

4.7/5  (31)

(31)

Showing 61 - 80 of 112

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)