Exam 13: Comparative Forms of Doing Business

Exam 1: Understanding and Working With the Federal Tax Law63 Questions

Exam 2: Corporations: Introduction and Operating Rules112 Questions

Exam 3: Corporations: Special Situations96 Questions

Exam 4: Corporations: Organization and Capital Structure93 Questions

Exam 5: Corporations: Earnings Profits and Dividend Distributions89 Questions

Exam 6: Corporations: Redemptions and Liquidations108 Questions

Exam 7: Corporations: Reorganizations98 Questions

Exam 8: Consolidated Tax Returns121 Questions

Exam 9: Taxation of International Transactions153 Questions

Exam 10: Partnerships: Formation, operation, and Basis98 Questions

Exam 11: Partnerships: Distributions, transfer of Interests, and Terminations97 Questions

Exam 12: S Corporations125 Questions

Exam 13: Comparative Forms of Doing Business131 Questions

Exam 14: Taxes on the Financial Statements81 Questions

Exam 15: Exempt Entities131 Questions

Exam 16: Multistate Corporate Taxation102 Questions

Exam 17: Tax Practice and Ethics112 Questions

Exam 18: The Federal Gift and Estate Taxes155 Questions

Exam 19: Family Tax Planning135 Questions

Exam 20: Income Taxation of Trusts and Estates122 Questions

Select questions type

The profits of a business owned by Taylor (60%)and Maggie (40%)for the current tax year are $100,000.If the business is a C corporation,there is no effect on Taylor's basis in her stock.If the business is a partnership or an S corporation,Taylor's basis in her partnership interest or basis in her stock is increased by $60,000.

(True/False)

4.8/5  (42)

(42)

If a C corporation has earnings and profits at least equal to the amount of a distribution,the tax consequences to the shareholders are the same,regardless of whether the distribution is classified as a dividend or as a stock redemption.

(True/False)

4.8/5  (32)

(32)

Colin and Reed formed a business entity several years ago.At that date,Colin's basis for his ownership interest was $40,000 and Reed's basis for his ownership interest was $50,000.Colin's profit and loss percentage is 40% and Reed's profit and loss percentage is 60%.During the intervening period,the entity has reported profits of $200,000.At the beginning of the current year,the entity had liabilities (all recourse)of $50,000.At the end of the current year,the liabilities (all recourse)had increased to $70,000.Determine Colin and Reed's basis for their ownership interest if the entity is:

(Essay)

4.8/5  (39)

(39)

Factors that should be considered in making the S corporation election for the current tax year include the following:

(Multiple Choice)

4.7/5  (31)

(31)

The ACE adjustment associated with the C corporation AMT can be positive or negative.

(True/False)

4.9/5  (42)

(42)

Kirk is establishing a business in 2010 which could have potential environmental liability problems.Therefore,he is trying to decide between the C corporation form and the S corporation form.He projects that the business will generate losses of approximately $100,000 each year for the first 3 years and then will generate profits of at least $200,000 each year thereafter.All profits will be reinvested in the growth of the business.Kirk projects he will be in the 35% bracket in 2010 and thereafter.Advise Kirk on which tax form he should select.

(Essay)

4.8/5  (35)

(35)

An S corporation has the same degree of limited liability as a C corporation.

(True/False)

4.8/5  (30)

(30)

Beige,Inc. ,has 3,000 shares of stock authorized and 1,000 shares outstanding.The shares are owned by Sam (600 shares)and Lois (400 shares).Sam's adjusted basis for his stock is $60,000 and Lois' adjusted basis for her stock is $40,000.Beige's earnings and profits are $300,000.Beige redeems 200 of Lois' shares for $100,000.Determine the amount of Lois' recognized gain (1)if she is Sam's mother and (2)if they are unrelated.

(Multiple Choice)

4.9/5  (32)

(32)

Carol is a 60% owner of a business entity and has an adjusted basis in such interest of $60,000.For the current tax year,the entity has profits of $50,000.If the entity is a C corporation,the corporate profits have no effect on Carol's basis in her stock.However,if the entity is an S corporation,Carol's basis increases to $90,000 [$60,000 + (60% ´ $50,000)].

(True/False)

4.7/5  (37)

(37)

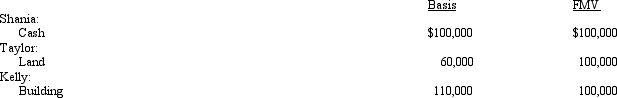

Shania,Taylor,and Kelly form a corporation with the following contributions.

(Multiple Choice)

4.8/5  (44)

(44)

The § 465 at-risk provision and the § 469 passive activity loss provision have decreased the tax attractiveness of investments in real estate for partnerships and for limited liability companies.

(True/False)

4.8/5  (41)

(41)

Rose,an S corporation,distributes land to Walter,its only shareholder.Rose's adjusted basis for the land is $100,000,and the fair market value is $225,000.Rose has a recognized gain of $125,000 ($225,000 - $100,000)on the distribution.Walter's adjusted basis for the land is the fair market value of $225,000.

(True/False)

4.9/5  (34)

(34)

Agnes is going to invest $90,000 in a business entity.She will manage the business entity.Her projected share of the loss for the first year is $36,000.Agnes' marginal tax rate is 33%.Determine the cash flow benefit of the loss to Agnes if the business form is:

(Essay)

4.9/5  (31)

(31)

Under what circumstances,if any,do the § 469 passive activity loss rules apply to C corporations?

(Essay)

4.8/5  (54)

(54)

List the various ways to minimize or avoid double taxation for a corporate taxpayer.

(Essay)

4.8/5  (41)

(41)

The "check-the-box" Regulations enable certain entities which have corporate characteristics to be taxed as S corporations.

(True/False)

4.8/5  (29)

(29)

Barb and Chuck each own one-half of the stock of Wren,Inc. ,a C corporation.Each shareholder has a stock basis of $100,000.Wren has accumulated E & P of $500,000.Wren's taxable income for the current year is $80,000,and it distributes $50,000 to each shareholder.Barb's stock basis at the end of the year is:

(Multiple Choice)

4.8/5  (34)

(34)

What tax rates apply for the AMT for an individual taxpayer and for a C corporation?

(Essay)

4.7/5  (47)

(47)

What special adjustment is required in calculating the AMT of a C corporation that does not apply in calculating the AMT of an individual taxpayer?

(Essay)

4.9/5  (41)

(41)

Showing 81 - 100 of 131

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)