Exam 13: Comparative Forms of Doing Business

Exam 1: Understanding and Working With the Federal Tax Law63 Questions

Exam 2: Corporations: Introduction and Operating Rules112 Questions

Exam 3: Corporations: Special Situations96 Questions

Exam 4: Corporations: Organization and Capital Structure93 Questions

Exam 5: Corporations: Earnings Profits and Dividend Distributions89 Questions

Exam 6: Corporations: Redemptions and Liquidations108 Questions

Exam 7: Corporations: Reorganizations98 Questions

Exam 8: Consolidated Tax Returns121 Questions

Exam 9: Taxation of International Transactions153 Questions

Exam 10: Partnerships: Formation, operation, and Basis98 Questions

Exam 11: Partnerships: Distributions, transfer of Interests, and Terminations97 Questions

Exam 12: S Corporations125 Questions

Exam 13: Comparative Forms of Doing Business131 Questions

Exam 14: Taxes on the Financial Statements81 Questions

Exam 15: Exempt Entities131 Questions

Exam 16: Multistate Corporate Taxation102 Questions

Exam 17: Tax Practice and Ethics112 Questions

Exam 18: The Federal Gift and Estate Taxes155 Questions

Exam 19: Family Tax Planning135 Questions

Exam 20: Income Taxation of Trusts and Estates122 Questions

Select questions type

A C corporation offers greater flexibility in terms of the types of owners and capital structure than an S corporation.

(True/False)

4.9/5  (42)

(42)

A limited liability company (LLC)can elect under the check-the-box rules to be taxed as an S corporation.

(True/False)

4.9/5  (38)

(38)

An effective way for all C corporations to avoid double taxation is not to make dividend distributions.

(True/False)

4.8/5  (43)

(43)

Aaron purchases a building for $500,000 which is going to be used by his wholly-owned corporation.Which of the following statements are correct?

(Multiple Choice)

5.0/5  (45)

(45)

Do the § 465 at-risk rules apply to partnerships,LLCs,and S corporations?

(Essay)

4.9/5  (39)

(39)

The accumulated earnings tax rate in 2010 is the same as that for a C corporation that is classified as a personal service corporation.

(True/False)

5.0/5  (42)

(42)

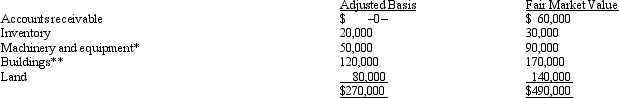

Kristine owns all of the stock of a C corporation which owns the following assets:

* Potential § 1245 recapture of $45,000.

** Straight-line depreciation was used.

Her adjusted basis for her stock is $270,000.Calculate Kristine's recognized gain or loss and classify it as capital or ordinary if she sells her stock for $500,000.

* Potential § 1245 recapture of $45,000.

** Straight-line depreciation was used.

Her adjusted basis for her stock is $270,000.Calculate Kristine's recognized gain or loss and classify it as capital or ordinary if she sells her stock for $500,000.

(Multiple Choice)

4.9/5  (38)

(38)

C corporations and S corporations can generate an AMT adjustment known as Adjusted Current Earnings (ACE).

(True/False)

4.8/5  (41)

(41)

From the perspective of the buyer of an unincorporated sole proprietorship whose assets have increased in value,the buyer is indifferent as to whether the transaction is the purchase of the business or a purchase of the individual assets.

(True/False)

4.7/5  (39)

(39)

Which of the following is correct regarding the form for filing the annual Federal income tax return?

Business entity form Tax form

(Multiple Choice)

4.9/5  (44)

(44)

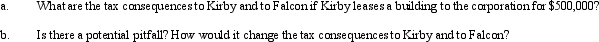

Kirby,the sole shareholder of Falcon,Inc. ,leases a building to the corporation.The taxable income of the corporation for 2010,before deducting the lease payments,is projected to be $500,000.

(Essay)

4.8/5  (37)

(37)

Candace,who is in the 33% tax bracket,is establishing a business which could have potential environmental liability problems.Therefore,she is trying to decide between the C corporation form and the S corporation form.She projects that the business will generate earnings of about $75,000 each year.Advise Candace on the tax consequences of each tax form.

(Essay)

4.9/5  (32)

(32)

The corporate tax rate for a business entity is always less than the tax rate that would apply if the business entity were not incorporated.

(True/False)

4.8/5  (32)

(32)

A major benefit of the S corporation election is the general avoidance of double taxation.

(True/False)

4.9/5  (48)

(48)

Personal service corporations can offset passive activity losses against active income,but not against portfolio income.

(True/False)

4.8/5  (41)

(41)

A limited partner in a limited partnership has limited liability whereas a general partner in a limited partnership has unlimited liability unless the limited partners agree that the general partner will have limited liability.

(True/False)

4.8/5  (42)

(42)

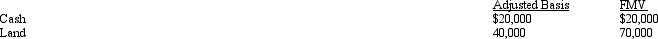

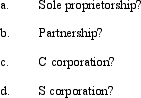

Julie is going to contribute the following assets to a business entity in exchange for an ownership interest.

What are the tax consequences of the contribution to Julie if the business entity is a(n):

What are the tax consequences of the contribution to Julie if the business entity is a(n):

(Essay)

4.8/5  (43)

(43)

Showing 61 - 80 of 131

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)