Exam 3: The Adjusting Process

Exam 1: Introduction to Accounting and Business191 Questions

Exam 2: Analyzing Transactions226 Questions

Exam 3: The Adjusting Process180 Questions

Exam 4: Completing the Accounting Cycle195 Questions

Exam 5: Accounting Systems160 Questions

Exam 6: Accounting for Merchandising Businesses218 Questions

Exam 7: Inventories169 Questions

Exam 8: Sarbanes-Oxley, Internal Control, and Cash177 Questions

Exam 9: Receivables151 Questions

Exam 10: Fixed Assets and Intangible Assets172 Questions

Exam 11: Current Liabilities and Payroll171 Questions

Exam 12: Accounting for Partnerships and Limited Liability Companies192 Questions

Exam 13: Corporations: Organization, Stock Transactions, and Dividends171 Questions

Exam 14: Long-Term Liabilities: Bonds and Notes188 Questions

Exam 15: Investments and Fair Value Accounting133 Questions

Exam 16: Statement of Cash Flows165 Questions

Exam 17: Financial Statement Analysis186 Questions

Select questions type

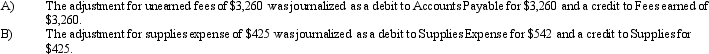

For each of the following errors, considered individually, indicate whether the error would cause the adjusted trial balance totals to be unequal. If the error would cause the adjusted trial balance total to be unequal, indicate whether the debit or credit total is higher and by how much.

(Essay)

4.7/5  (29)

(29)

A one-year insurance policy was purchased on October 1, 2011 for $4,200. The adjusting entry on December 31, 2010 would be:

(Essay)

4.8/5  (33)

(33)

Under the accrual basis, some accounts in the ledger require updating. Discuss the three main reasons for this updating and give an example of each.

(Essay)

4.7/5  (38)

(38)

At the end of the fiscal year, the usual adjusting entry for accrued salaries owed to employees was omitted. Which of the following statements is true?

(Multiple Choice)

5.0/5  (43)

(43)

Which of the accounting steps in the accounting process below would be completed last?

(Multiple Choice)

4.9/5  (41)

(41)

The financial statements are prepared from the unadjusted trial balance.

(True/False)

4.8/5  (37)

(37)

The adjustment for accrued fees was debited to Accounts Payable instead of Accounts Receivable. This error will be detected when the Adjusted Trial Balance is prepared.

(True/False)

4.9/5  (31)

(31)

As time passes, fixed assets other than land lose their capacity to provide useful services. To account for this decrease in usefulness, the cost of fixed assets is systematically allocated to expense through a process called

(Multiple Choice)

4.7/5  (33)

(33)

Classify the following items as: (1) prepaid expense, (2) unearned revenue, (3) accrued expense, or (4) accrued revenue.

Correct Answer:

Premises:

Responses:

(Matching)

4.8/5  (31)

(31)

Generally accepted accounting principles require accrual-basis accounting.

(True/False)

4.8/5  (40)

(40)

Protonix Corp has a payroll of $8,000 for a five-day workweek. Its employees are paid each Friday for the five-day workweek. The adjusting entry on December 31, 2015 assuming the year ends on Thursday would be:

(Essay)

4.8/5  (39)

(39)

On January 1st, Power House Co. prepays the year's rent, $10,140 to its landlord. Prepare the journal entry by recording the prepayment to an asset account.

(Essay)

4.8/5  (43)

(43)

Explain the difference between accrual basis accounting and cash basis accounting.

(Essay)

4.8/5  (41)

(41)

At the end of the fiscal year, the usual adjusting entry to Prepaid Insurance to record expired insurance was omitted. Which of the following statements is true?

(Multiple Choice)

4.9/5  (37)

(37)

A company pays an employee $3,000 for a five day work week, Monday - Friday. The adjusting entry on December 31, which is a Wednesday, is debit Wages Expense, $1,800 and credit Wages Payable, $1,800.

(True/False)

4.7/5  (38)

(38)

Which of the following is the proper adjusting entry, based on a prepaid insurance account balance before adjustment of $14,000 and unexpired insurance of $3,000, for the fiscal year ending on April 30?

(Multiple Choice)

4.8/5  (32)

(32)

The estimated amount of depreciation on equipment for the current year is $5,300. Journalize the adjusting entry to record the depreciation.

(Essay)

4.7/5  (33)

(33)

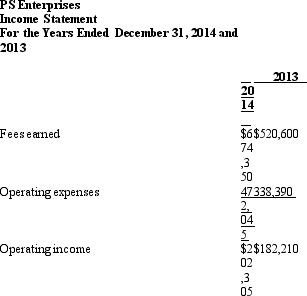

Two income statements for PS Enterprises are shown below:  Prepare a vertical analysis of PS Enterprises' income statements. Has operating income increased or decreased as a percentage of revenue?

Prepare a vertical analysis of PS Enterprises' income statements. Has operating income increased or decreased as a percentage of revenue?

(Multiple Choice)

4.9/5  (30)

(30)

A business pays weekly salaries of $25,000 on Friday for a five-day week ending on that day. The adjusting entry necessary at the end of the fiscal period ending on Tuesday is

(Multiple Choice)

4.8/5  (31)

(31)

Showing 41 - 60 of 180

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)